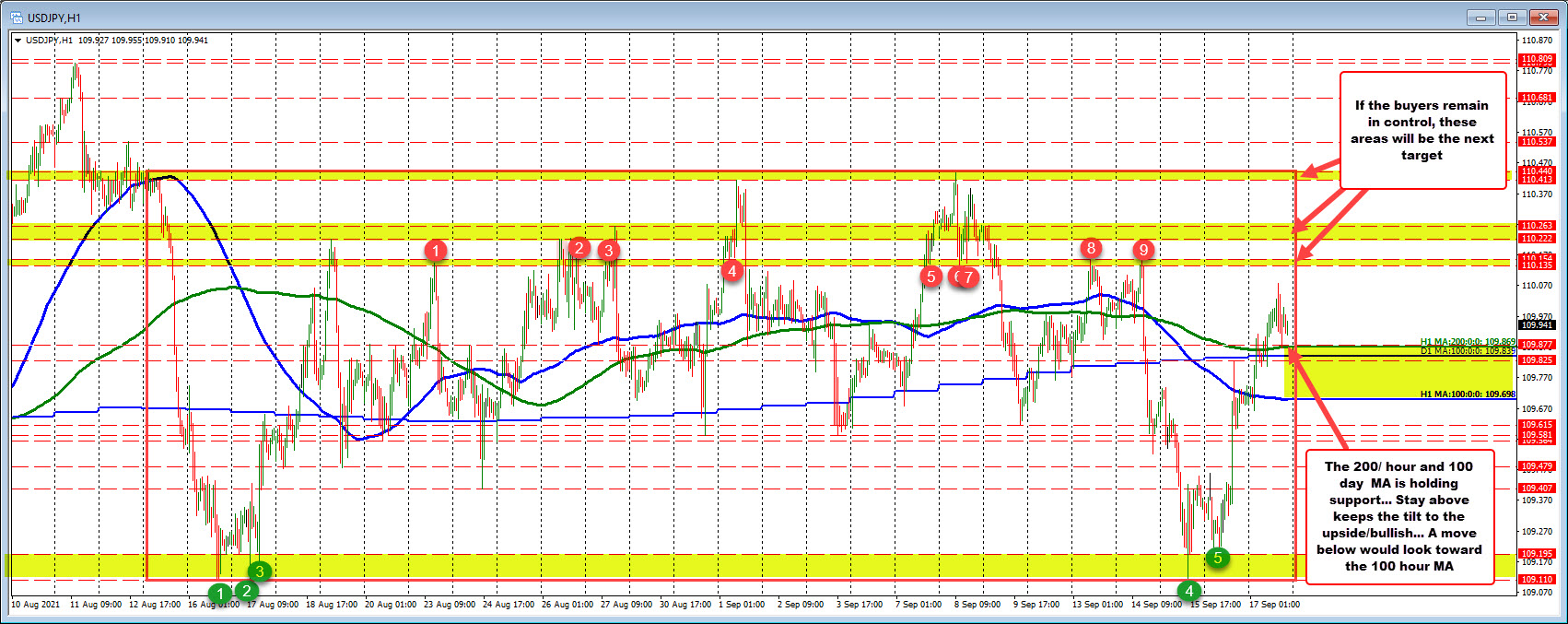

The 200 hour moving averages at 109.869

The USDJPY continued the run higher started on Wednesday when the price stall against the August 16 in August 17 lows near 109.11. The move to the upside yesterday cracked above the 100 hour moving average but stalled against the 100 day moving average and backed off.

Today, the price retried the move to the upside and ultimately was able to get above the 200 hour moving average (green line). The correction off the high came down to retest that 200 hour moving average at 109.868. The moving average line held support.

What now?

Going forward, the 200 hour moving average at 109.868 and the 100 day moving average at 109.839 will be the barometers for the buyers and sellers. Stay above is more bullish. Move below and the sellers are more in control with the 100 hour moving average at 109.697 as the next target.

On the topside, more upside momentum would initially target the highs from this week at 110.135 and 110.154. Above that and another swing area between 110.22 and 110.263 and the highest highs going back to August 13 between 110.413 and 110.440 would be targeted.

The price of the USDJPY has remained in a range between 109.110 and 110.44 (133 pips) over 26 trading days. That’s five weeks of trading. To give you an idea the lowest trading range for a one-month period was 130 pips from December 1 week of 2019. So at 133 pips for five trading weeks, the range is at historically low levels over an extended period time.

At some point, there will be a break and a run. For now, the barometer is tilted a little more to the upside above the moving average levels. But there still is work to do to get outside of the trading range.