Higher yields. Lower stocks. China growth slowdown. Fed Chair testifies.

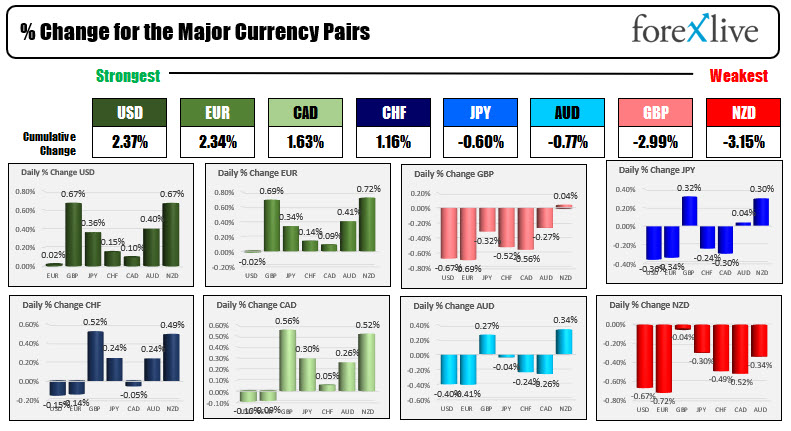

The USD is the strongest followed closely by the EUR, and the NZD is the weakest as the North American session begins. US stocks are down sharply and are heading for a September loss that is the biggest since October 2020. Natural gas prices are up 8.22%.. WTI crude oil futures are up 1.06%. That is helping to support bond yields which are up another 4.3 basis points for the 10 year yield to 1.5270%. The Senate GOP blocks bill to fund government and pushes closer to a potential government shutdown. Fed’s Powell is set to testify on Capitol Hill in the wake of two officials (Rosengren and Kaplan) resigning just yesterday on suspicions of unethical trading during the pandemic crisis (although Rosengren has health concerns as well and cited that for his resignation). Powell will also be in the crosshairs for his monetary policy stance in the face of rising inflation. There is not a lot of good news out there to start the day.

In other markets:

- Spot gold is down $-15 in the $0.19 or -0.87% at $1734.65

- Spot silver is down $0.42 -1.87% at $22.17

- WTI crude oil futures are up $0.80 or 1.08% at $76.24

- bitcoin is down $151 and $42,021

In the US stock market, the futures are implying sharply lower levels with the NASDAQ leading the way to the downside.

- Dow -115 points after yesterday’s 71.37 point gain

- S&P index -33 points after yesterday’s -12.37 point decline

- NASDAQ index -222 points after yesterday’s -77.73 point decline

in the European equity markets, the major indices are all trading in the red:

- German DAX, -1%

- France’s CAC, -1.4%

- UK’s FTSE 100 -0.2%

- Spain’s Ibex -1%

- Italy’s FTSE MIB -0.8%

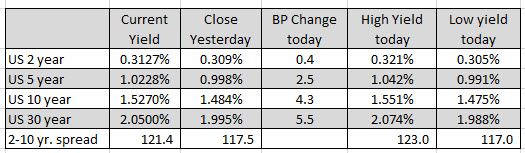

in the US debt market, the to – 10 year spread is higher by about four basis points to 121.4 basis points versus 117.5 basis points at the close yesterday. The 10 year yield is up 4.3 basis point the 30 year is up 5.5 basis point:

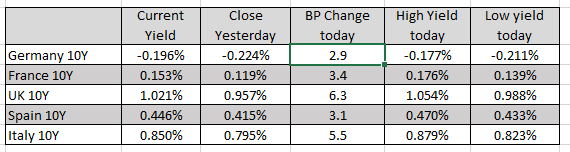

In the European debt market, the benchmark 10 year yields are also sharply higher with the UK 10 year up 6.3 basis points: