Major indices higher for the week/higher for the month

The major European indices have moved higher on the day and the week. With most European it’s open on Monday, there is still one more day of trading for the month. However, the major indices are all trading higher for the month as well.

A look at the provisional closes are showing:

- German DAX, +0.7%

- France’s CAC, +0.8%

- UK’s FTSE 100, +0.2%

- Spain’s Ibex +0.45%

- Italy’s FTSE MIB, +0.45%

For the week,

- German DAX, +0.97%

- Francis CAC, +1.55%

- UK’s FTSE 100, +0.1%

- Spain’s Ibex, +0.3%

- Italy’s FTSE MIB, +0.8%

For the month:

- German DAX, +2.5%

- France’s CAC, +3.4%

- UK’s FTSE 100, +0.8%

- Spain’s Ibex, +4.7%

- Italy’s FTSE MIB, +4.3%

in other markets as London/European traders look to exit:

- Spot gold is trading near unchanged at $1896.20

- .Spot silver is also near unchanged at $27.83.

- WTI crude oil futures are trading up six cents or 0.09% at $66.92

- Bitcoin is down $1700 or -4.37% at $36,810

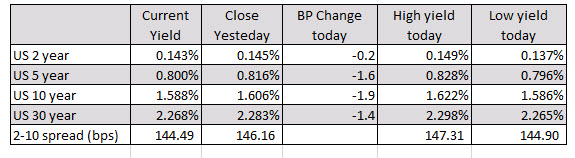

In the US debt market, yields are lower with the 10 year down 1.8 basis points leading the way: