Japanese Yen continues its decline in today’s subdued trading environment. This selloff gained momentum following the release of disappointing wages growth data, which has tempered expectations for an imminent monetary policy adjustment by BoJ in January. Despite this, April is still considered a more probable time for interest rate hike, heavily dependent on the outcomes of the upcoming Spring wage negotiations. BoJ Governor Kazuo Ueda has underscored the importance of widespread wage increases across businesses of all sizes as a critical factor in the central bank’s decision-making process. There is still significant progress to be made before the central bank can shift its policy direction.

Meanwhile, Australian Dollar emerges as the strongest performer of the day, although its gains are relatively modest, surpassing yesterday’s highs against Yen and Swiss Franc only. This suggests that the current strength of Aussie is just a temporary phase within near-term market consolidations, subject to change at any moment. Euro and British Pound are following as the next strongest currencies, while New Zealand Dollar and Swiss Franc are weaker, with Yen being the worst. Dollar and Canadian are showing mixed performances.

Technically, Nikkei’s strong break of 33853.46 resistance this week confirms resumption of long term up trend. Current rally should target 100% projection of 30538.28 to 33853.46 from 32205.38 at 35571.17. Decisive break there could prompt upside acceleration to 161.8% projection at 37651.22 next. Market reactions to today’s wages data suggest that investors might continue to bolster Japanese stocks if they perceive a reduced likelihood of BoJ interest rate hike in the near term.

In Europe, at the time of writing, FTSE is down -0.23%. DAX is up 0.02%. CAC is down -0.08%. Germany 10-year yield s down -0.014 at 2.174. UK 10-year yield is down -0.0138 at 3.767. Earlier in Asia, Japan 10-year yield fell -0.0006 to 0.587. Nikkei rose 2.01%. Hong Kong HSI fell -0.57%. China Shanghai SSE fell -0.54%. Singapore Strait Times fell -0.56%.

ECB’s de Guindos foresees slower disinflation and economic challenges in 2024

Luis de Guindos, Vice-President of ECB, in speech today, indicated that the “rapid pace of disinflation” observed in 2023 is likely to “slow down” in the coming year, with a “pause” early in the year, mirroring the pattern seen in December 2023.

De Guindos also pointed out that “soft indicators” suggest an economic “contraction” in December, hinting at the likelihood of a “technical recession” in the latter half of 2023. This downturn is expected to have broad impacts across various sectors, with “construction and manufacturing” being particularly hit. “Services” sector is also anticipated to “soften in the coming months as a result of weaker activity in the rest of the economy.”

Regarding the ECB’s monetary policy, de Guindos expressed that the “current level of interest rates,” if maintained, would substantially aid in returning inflation to the ECB’s target. He underscored that the “key ECB interest rates” remain the central instrument for monetary policy, emphasizing that future decisions will be “data-dependent,” focusing on the “appropriate level and duration of restriction.”

Japan’s labor cash earnings rises only 0.2% yoy, real wages down for 20th month

Japan’s labor market showed a notable slowdown in nominal cash earnings growth in November, increasing by only 0.2% yoy, which was significantly below market expectation of 1.5% yoy. This rate marks the slowest growth in nearly two years and represents a considerable decrease compared to 1.5% yoy growth in October.

A closer look at the components of earnings reveals mixed trends. Regular or base salaries saw modest increase of 1.2% yoy, slightly down from previous month’s 1.3% yoy. Overtime pay, which had been declining, showed a positive shift with 0.9% yoy increase, marking the first rise in three months. However, special payments, such as bonuses, experienced a significant drop of -13.2% yoy.

More concerning that real wages fell sharply by -3.0% yoy in November, exceeding expectations of -2.0% yoy decline. This drop marks the 20th consecutive month of contraction.

Australia’s monthly CPI eases to 4.3% yoy, lowest since Jan 2022

Australia’s monthly CPI saw notable deceleration in November, dropping from 4.9% yoy to 4.3% yoy, which was below expectation of 4.5% yoy. This represents the lowest reading since January 2022, as easing of the inflationary pressures continued

CPI excluding volatile items and holiday travel also slowed from 5.1% yoy to 4.8% yoy. Additionally, Trimmed Mean CPI, which removes the most volatile components to provide a clearer picture of underlying inflation trends, decelerated from 5.3% yoy to 4.6% yoy.

The primary drivers of the annual increase in November were in housing , which witnessed a significant rise of 6.6. Food and non-alcoholic beverages also saw a notable increase of 4.6%, Insurance and financial services recorded an 8.8% increase, and Alcohol and tobacco category experienced a 6.4% rise.

GBP/JPY Mid-Day Outlook

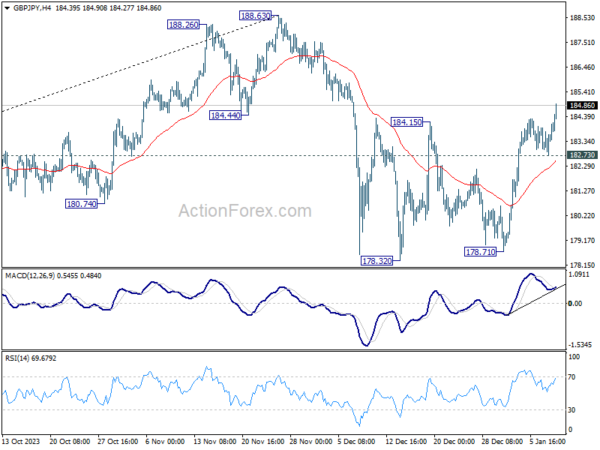

Daily Pivots: (S1) 182.94; (P) 183.45; (R1) 184.15; More…

GBP/JPY’s strong rally today confirms resumption of rise from 178.32. More importantly, the decisive break of 184.15 resistance indicates that correction from 188.63 has completed already. Intraday bias is back on the upside for retesting 188.63 next. On the downside, break of 182.73 support is needed to indicate completion of the rebound. Otherwise, further rally will remain in favor in case of retreat.

In the bigger picture, price actions from 188.63 medium term top are seen as a correction to the up trend from 148.93 (2022 low) only. As long as 172.11 resistance turned support holds, larger up trend from 123.94 (2020 low) is still in favor to resume through 188.63 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Nov | 0.20% | 1.50% | 1.50% | |

| 00:30 | AUD | Monthly CPI Y/Y Nov | 4.30% | 4.50% | 4.90% | |

| 07:45 | EUR | France Industrial Output M/M Nov | 0.50% | 0.00% | -0.30% | |

| 15:00 | USD | Wholesale Inventories Nov F | -0.20% | -0.20% | ||

| 15:30 | USD | Crude Oil Inventories | -0.2M | -5.5M |