Yen’s selloff is the main theme today with USD/JPY hitting the highest level in 24 years, above 140 handle. Australian Dollar quickly turns softer after RBA delivered an expected rate hike. On the other hand, Sterling is getting a lift after Liz Truss is set to become the next UK Prime Minister while Euro remains soft. Dollar is mixed for now, awaiting more guidance from overall risk sentiment.

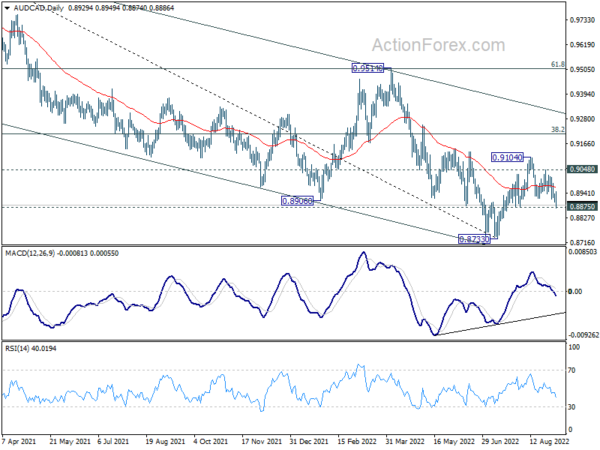

Technically, AUD/CAD is staying within our radar. Now that RBA risk is cleared, the next is tomorrow’s BoC rate decision, where a 75bps hike is expected. On the downside, break of 0.8875 support will argue that rebound from 0.8733 has completed, and larger down trend is ready to resume through 0.8733. Let’s see if that will happen.

In Europe, at the time of writing, FTSE is up 0.20%. DAX is up 0.94%. CAC is up 0.42%. Germany 10-year yield is down -0.005 at 1.558. Earlier in Asia, Nikkei rose 0.02%. Hong Kong HSI dropped -0.12%. China Shanghai SSE rose 1.36%. Singapore Strait Times rose 0.27%. Japan 10-year JGB yield rose 0.0061 to 0.241.

UK PMI construction recovered to 49.2, but further weakness ahead

UK PMI Construction recovered from 48.9 to 49.2 in August, above expectation of 48.0. S&P Global noted that activity was down for the second month running. New orders and employment had softer rises. But supply-chain disruption and inflationary pressures eased.

Andrew Harker, Economics Director at S&P Global Market Intelligence, said: “The UK construction sector looks set to be in for a challenging period, according to the latest PMI data. Not only did construction activity fall for the second month running, but a range of indicators from the survey pointed to further weakness ahead.”

RBA hikes 50bps to 2.35%, more over the months ahead

RBA raises cash rate target by 50bps to 2.35% as widely expected. The Board “expects to increase interest rates further over the months ahead”, but it’s “not on a pre-set path”. The size and timing of future hikes will be “guided by the income data and the Board’s assessment of the outlook for inflation and the labour market.”

Regarding inflation, RBA expects it to peak “later this year”. The central forecasts is for CPI to be around 7.75% over 2022, a little above 4% over 2023, and then around 3% over 2024.

The economy is “continuing to grow solidly” as boosted by a “record level of the terms of trade”. Labor market is “very tight” while wages growth “has picked up”.

It maintained that an important source of uncertainty is household spending, which is facing pressure from higher inflation and higher interest rates.

CAD/JPY upside breakout, targets 108.52, then 109.93

CAD/JPY breaks through 107.62 high today on broad based Yen selloff. The break of near term channel resistance also indicates upside acceleration. Further rally is expected now as long as 106.55 minor support holds. Next near term targets are 161.8% projection of 101.39 to 105.07 from 102.57 at 108.52, and then 200% projection at 109.93.

Current development also indicates resumption of long term up trend from 73.80 (2020 low). Next medium term target is 161.8% projection of 73.80 to 91.16 from 84.65 at 112.73.

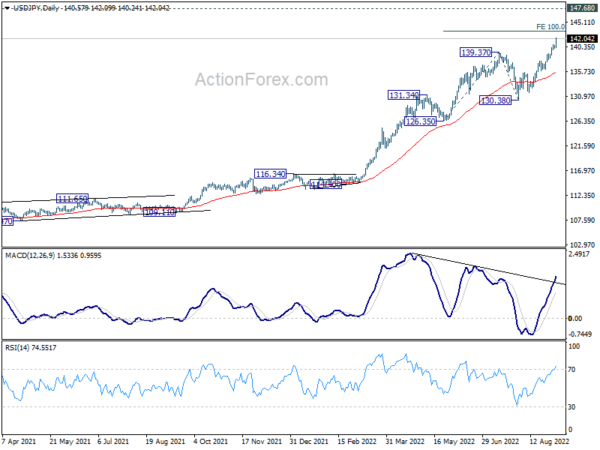

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 140.25; (P) 140.45; (R1) 140.79; More…

USD/JPY’s up trend continues today and hit as high as 142.00 so far. Intraday bias remains on the upside for 100% projection of 126.35 to 139.37 from 130.38 at 143.40. Sustained break there could bring upside acceleration of 147.68 long term resistance. On the downside, below 140.24 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

In the bigger picture, up trend from 101.18 is still in progress, as part of the whole up trend from 75.56 (2011 low). Further rise should be seen to 147.68 (1998 high). For now, break of 130.38 support is needed to be the first indication of medium term topping. Otherwise, outlook will stay bullish even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Aug | 0.50% | 1.60% | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Jul | 1.80% | 1.90% | 2.20% | |

| 23:30 | JPY | Overall Household Spending Y/Y Jul | 3.40% | 4.20% | 3.50% | |

| 01:30 | AUD | Current Account Balance (AUD) Q2 | 18.3B | 21.5B | 7.5B | |

| 04:30 | AUD | RBA Interest Rate Decision | 2.35% | 2.35% | 1.85% | |

| 06:00 | EUR | Germany Factory Orders M/M Jul | -1.10% | -0.20% | -0.40% | -0.30% |

| 08:30 | GBP | Construction PMI Aug | 49.2 | 48 | 48.9 | |

| 13:45 | USD | Services PMI Aug F | 44.1 | 44.1 | ||

| 14:00 | USD | ISM Services PMI Aug | 55.4 | 56.7 |