Yen’s continued weakness persists in today’s subdued market, despite growing expectations for a BoJ rate hike in the upcoming Asian session—a move anticipated to conclude its longstanding negative rates policy. Although the anticipated adjustment from -0.10% to 0.00% may seem minor, its symbolic significance for the Japanese economy is profound, as it heralds a new era of monetary policy.

Recent reports underscore the momentum building towards this policy shift. A Reuters article highlighted a source’s comments on the robust wage increases by large enterprises, setting a positive precedent for smaller companies. Recent wages increase is seen as a catalyst for boosting consumption, stimulating demand and prices, suggesting BoJ might not need to defer action until April.

Conversations with CEOs, as reported by Bloomberg TV, reveal a readiness for an interest rate hike, regardless of whether it occurs in March or April, signifying a widespread acceptance of the impending policy change. Retailers also anticipate benefits from a stronger Yen, viewing it as a vital step towards normalizing inflation and the broader economy.

Yet, predicting BoJ’s moves remains challenging, with the central bank known for its unpredictability. Thus, any surprises in the upcoming announcement would align with its historical pattern of unexpected decisions.

In the broader currency markets, Australian Dollar is the relatively stronger performer of the day, with New Zealand Dollar and Euro also showing mild strength. Dollar lags behind, positioned just ahead of Yen, followed closely by Swiss Franc. Sterling and the Canadian Dollar find themselves in a middle ground.

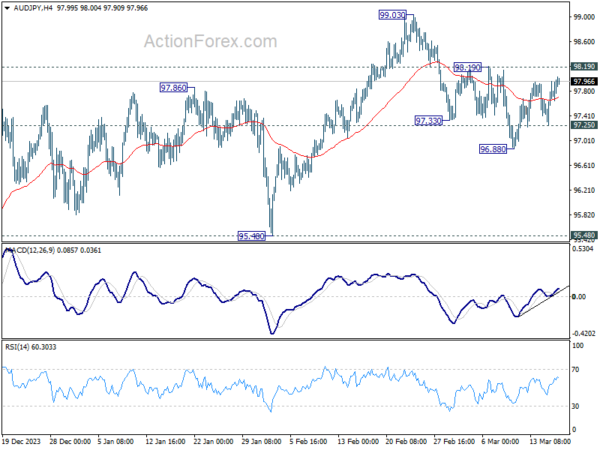

Technically, a main question is whether AUD/JPY’s correction from 99.03 has completed with three waves down to 96.88 already. Decisive break of 98.19 will affirm this bullish case, and target 99.03 high next. However, break of 97.25 will indicate that fall from 99.03 is resuming through 96.88, towards 95.48 key support level. With BoJ and RBA poised to announce their rate decisions shortly, clarity on this technical query is imminent.

In Europe, at the time of writing, FTSE is up 0.19%. DAX is up 0.14%. CAC is up 0.05%. UK 10-year yield is down -0.0025 at 4.200. Germany 10-year yield is up 0.029 at 2.472. Earlier in Asia, Nikkei rose 2.67%. Hong Kong HSI rose 0.10%. China Shanghai SSE rose 0.99%. Singapore Strait Times fell -0.03%. Japan 10-year JGB yield fell -0.030 to 0.763.

Eurozone CPI finalized at 2.6% in Feb, core CPI at 3.1%

Eurozone CPI was finalized at 2.6% yoy in February, down from 2.8% yoy in January. CPI core (excluding energy, food, alcohol & tobacco) was finalized at 3.1% yoy, down from prior month’s 3.3% yoy.

The highest contribution to the annual Eurozone inflation rate came from services (+1.73 percentage points, pp), followed by food, alcohol & tobacco (+0.79 pp), non-energy industrial goods (+0.42 pp) and energy (-0.36 pp).

EU CPI was finalized at 2.8% yoy. The lowest annual rates were registered in Latvia, Denmark (both 0.6%) and Italy (0.8%). The highest annual rates were recorded in Romania (7.1%), Croatia (4.8%) and Estonia (4.4%). Compared with January, annual inflation fell in twenty Member States, remained stable in five and rose in two.

NZ BNZ services rises to 53.0, signs of early and strong growth emerge

New Zealand’s BusinessNZ Performance of Services Index climbed from 52.2 to 53.0 in February, marking its highest point since March 2023.

A closer examination of the index’s components reveals a generally positive picture. Activity and sales maintained steady pace, inching slightly up from 53.0 to 53.1. Employment saw modest increase, moving closer to the expansionary threshold by rising from 48.3 to 49.1. Notably, new orders and business surged significantly from 52.4 to 56.0, the highest level recorded since December 2022.

The feedback from businesses highlighted persistent concerns, with the proportion of negative comments standing at 57.3% in February, a slight improvement from December’s 58.7% but an increase from January’s 53.0%. Businesses continue to identify the cost of living as the primary factor influencing activity, alongside the difficulties posed by the overall economic conditions.

BNZ’s Head of Research Stephen Toplis said that “when we combine the PMI and PSI together to get an indicator of activity, there is a strong suggestion of growth returning later this year. The turnaround occurs a little stronger and earlier than we are forecasting but, whatever the case, it is a heartening sign”.

China’s industrial production expand 7% yoy, retail sales up 5.5% yoy

China’s industrial production grew 7.0% yoy in the January-February period, above expectation of 5.3% yoy. During the same period, retail sales rose 5.5% yoy, below expectation 5.6% yoy.

Fixed asset investment rose 4.2% yoy, above expectation of 3.2% yoy. Investment into real estate fell by -9% yoy. Investment in infrastructure rose by 6.3% yoy while that in manufacturing increased by 9.4% yoy.

“The economy kept rebounding and improving in January and February with various policies taking effect. But we also need to see that the external environment is increasingly complex, grim and uncertain, and the problem of insufficient domestic demand still remains. The foundation for the economy’s rebound needs to be further solidified,” NBS said.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 148.34; (P) 148.75; (R1) 149.47; More…

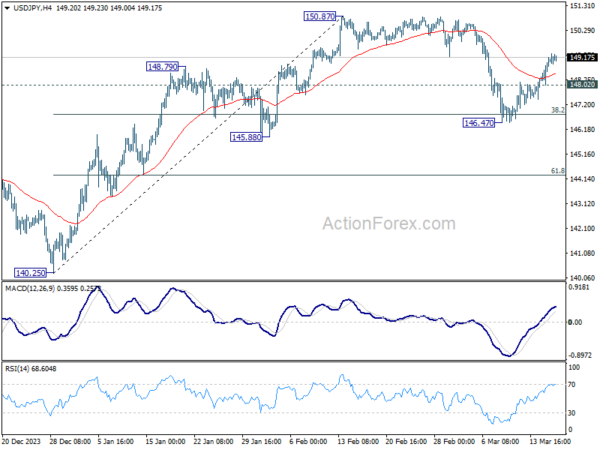

USD/JPY’s rebound from 146.47 is still in progress and intraday bias stays on the upside. Corrective fall from 150.87 should have completed at 146.47, after drawing support from 38.2% retracement of 140.25 to 150.87 at 146.81. Further rally should be seen to 150.87/89 key resistance zone. Nevertheless, on the downside, below 148.02 minor support will turn intraday bias neutral first.

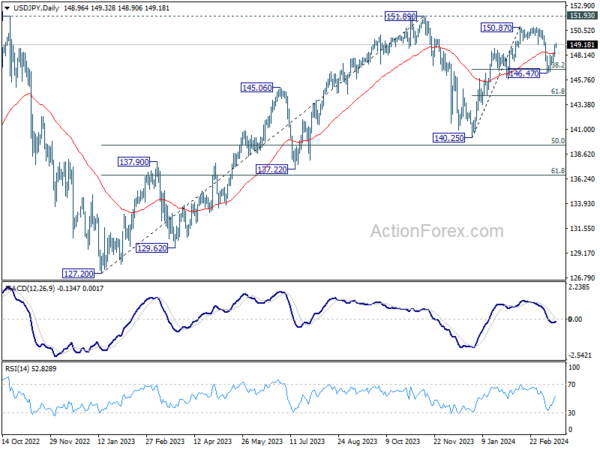

In the bigger picture, no change in the view that price action from 151.89 (2023 high) are correction to up trend from 127.20 (2023 low). The question is whether this correction has completed at 140.25, or extending with fall from 150.87 as the third leg. Sustained break of above mentioned 146.81 fibonacci level will favor the latter case. But even so, downside should be contained by 50% retracement of 127.20 to 151.89 at 139.54

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PSI Feb | 53 | 52.1 | 52.2 | |

| 23:50 | JPY | Machinery Orders M/M Jan | -1.70% | -0.70% | 2.70% | |

| 02:00 | CNY | Industrial Production Y/Y Feb | 7.00% | 5.30% | 6.80% | |

| 02:00 | CNY | Retail Sales Y/Y Feb | 5.50% | 5.60% | 7.40% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Feb | 4.20% | 3.20% | 3.00% | |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Jan | 14.2B | 13.0B | ||

| 10:00 | EUR | Eurozone CPI Y/Y Feb F | 2.60% | 2.60% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Feb F | 3.10% | 3.10% | ||

| 12:30 | CAD | Industrial Product Price M/M Feb | 0.00% | -0.10% | ||

| 12:30 | CAD | Raw Material Price Index Feb | 0.80% | 1.20% | ||

| 14:00 | USD | NAHB Housing Index Mar | 48 | 48 |