As the market transitions into early US session, Yen remains the best performer of the day, riding on Japan’s stronger-than-anticipated CPI data. Despite the positive undercurrent, Yen has yet to find decisive buying momentum, suggesting that most traders are still on the sideline. Meanwhile, Australian Dollar trails as the second strongest for now, followed by Swiss Franc and Canadian Dollar.

Conversely, New Zealand Dollar finds itself at the bottom, with market participants on edge as they anticipate the upcoming RBNZ rate decision. While most economists lean towards a rate hold as the likely outcome, the potential for a surprise hike keeps traders on their toes. Kiwi’s response could be notably volatile in either case. Sterling and Euro are also underperforming. Dollar is also soft, despite showing minimal reaction to disappointing durable goods orders data.

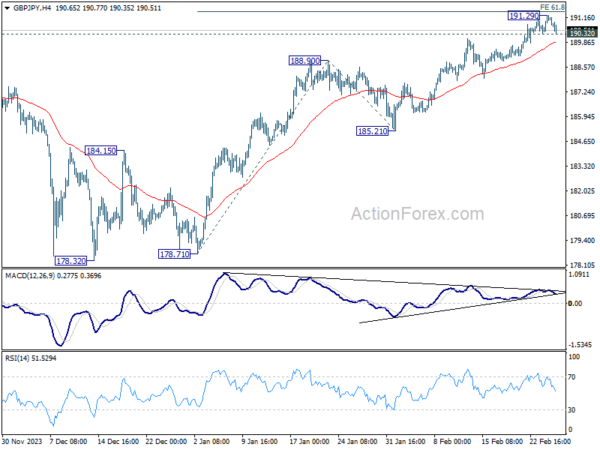

Technically, break of 190.32 minor support in GBP/JPY will argue that a short term top was formed at 191.29, just ahead of 61.8% projection of 178.71 to 188.90 from 185.21 at 191.50. Considering bearish divergence condition too, that could also mark the completion of a five-wave impulsive rally from 178.32. Further break of 55 4H EMA (now at 189.87) could open up deeper correction back to 185.21/188.90 support zone.

In Europe, at the time of writing, FTSE is down -0.14%. DAX is up 0.41%. CAC is down -0.05%. UK 10-year yield is up 0.0091 at 4.103. Germany 10-year yield is down -0.015 at 2.432. Nikkei rose 0.01%. Hong Kong HSI rose 0.94%. China Shanghai SSE rose 1.29%. Singapore Strait Times fell -0.44%. Japan 10-year JGB yield rose 0.0048 to 0.95.

US durable goods orders down -6.1% mom, ex-transport orders fall -0.3% mom

US durable goods orders fell -6.1% mom to USD 276.7B in January, worse than expectation of -4.4% mom. Ex-transport orders fell -0.3% mom to USD 186.9B, below expectation of 0.3% mom rise. Ex-defense orders fell -7.3% mom to USD 260.2B. Transportation equipment orders were down -16.2% mom to USD 89.8B, down three of the last four months, led the overall decline.

Germany’s Gfk consumer sentiment rises slightly to -29

Germany Gfk Consumer Sentiment for March ticked up from -29.6 to -29.0, matched expectations. In February, economic expectations rose from -6.6 to -6.4. Income expectations improved notably from-20.0 to -4.8. Willingness to buy fell from -14.8 to -15.0. Willingness to save jumped from 14.0 to 17.4.

Rolf Bürkl, a consumer expert, highlighted the prevailing uncertainty among consumers, driven by persistently high prices and dimming economic projections for Germany. German government’s downgrade of its growth forecast for 2024 from an initial 1.3% down to a mere 0.2% underscores the challenges ahead.

Core inflation in Japan eases to 2%, but surpasses expectations

Japan’s CPI core (all items ex food) slowed from 2.3% yoy to 2.0% yoy, above expectation of 1.9% yoy. This marks the third consecutive month of decline, reaching the lowest level in 22 months and aligning precisely with BoJ’s inflation target of 2%.

The headline CPI also saw a decrease, moving from 2.6% to 2.2% yoy. Nevertheless, CPI core-core (ex-food and energy) showed only modest improvement, edging down from 3.7% to 3.5% yoy.

A significant factor contributing to the overall CPI’s decline a -12.1% yoy drop in energy prices, resulting from government interventions to mitigate utility bills through subsidies for oil wholesalers. In contrast, food prices saw 5.9% yoy increase, while accommodation fees surged by 26.9% yoy.

The latest inflation data should fortify the argument for BoJ to terminate its negative interest rate policy soon. However, the decisive factor for the exact timing—be it March or April—hinges on the forthcoming wage negotiations between large enterprises and unions scheduled for March 13.

NZIER forecasts no further RBNZ hike, eyes mid-2025 cuts

In its latest Quarterly Predictions, NZIER noted there are “signs of further easing in inflation pressures” in New Zealand. But the pivotal question for RBNZ is whether this easing is “occurring at a fast enough pace” to bring inflation back to target band of 1-3%.

“Based on the balance of risks, we expect “no further OCR increases in this cycle,” NZIER said.

Highlighting the New Zealand economy’s “resilience,” NZIER acknowledges the potential for inflation to persist above RBNZ’s target, suggesting a “cautious approach” from the central bank, gearing towards understanding the “lag effects of the monetary policy tightening” already implemented.

Meanwhile, NZIER forecasts RBNZ OCR cuts to start mid-2025, “once it is confident it has reined in inflation sufficiently to keep it around the 2 percent inflation target mid-point over the coming year.”

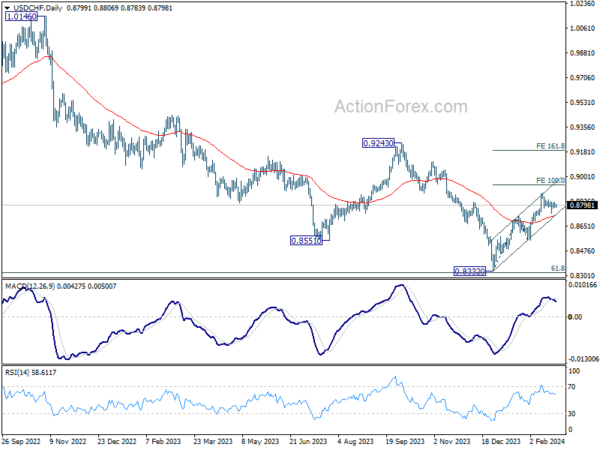

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8785; (P) 0.8803; (R1) 0.8819; More….

Intraday bias in USD/CHF remains neutral as consolidation from 0.8884 is still in progress. With 0.8727 resistance turned support intact, further rally is expected. On the upside, above 0.8884 will resume the rally from 0.8332 to 100% projection of 0.8332 to 0.8727 from 0.8550 at 0.8954. However, sustained break of 0.8727 will dampen this bullish view, and turn bias back to the downside for 0.8550 support instead.

In the bigger picture, a medium term bottom should be formed at 0.8332, on bullish convergence condition in W MACD, just ahead of 0.8317 long term fibonacci support. It’s still early to decide if the larger down trend from 1.0146 (2022 high) is reversing. But further rise should be seen to 0.9243 resistance even as a correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Y/Y Jan | 2.20% | 2.60% | ||

| 23:30 | JPY | National CPI ex Fresh Food Y/Y Jan | 2.00% | 1.90% | 2.30% | |

| 23:30 | JPY | National CPI ex Food & Energy Y/Y Jan | 3.50% | 3.70% | ||

| 00:01 | GBP | BRC Shop Price Index Y/Y Jan | 2.50% | 2.90% | ||

| 07:00 | EUR | Germany Gfk Consumer Confidence Mar | -29 | -29 | -29.7 | -29.6 |

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Jan | 0.10% | 0.20% | 0.10% | |

| 13:30 | USD | Durable Goods Orders Jan | -6.10% | -4.40% | 0.00% | |

| 13:30 | USD | Durable Goods Orders ex Transport Jan | -0.30% | 0.30% | 0.50% | |

| 14:00 | USD | S&P/CS Composite-20 HPI y/y Dec | 6.10% | 6.00% | 5.40% | |

| 14:00 | USD | Housing Price Index M/M Dec | 0.10% | 0.10% | 0.30% | |

| 15:00 | USD | Consumer Confidence Feb | 114.9 | 114.8 |