The market is betting on the FOMC sounding less hawkish than just a few weeks ago.

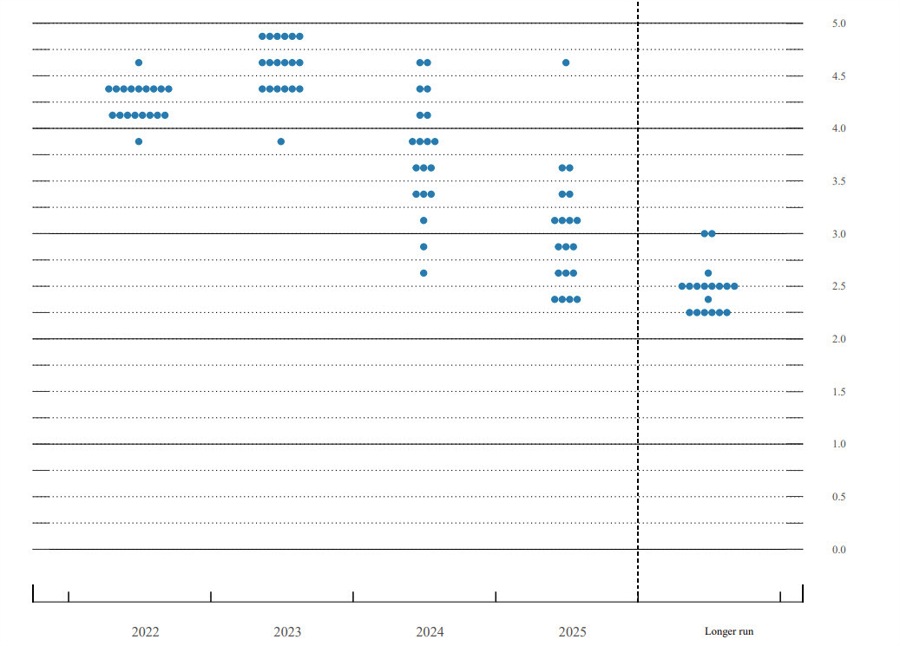

There’s been a consistent message from a number of top Federal Reserve policymakers that rates need to go higher than anticipated in the autumn when the dot plot looked like this:

Nearly all Fed members were between 4.50% and 5.00% then with the median at 4.60%. Officials had hinted at a rise above 5% but now market pricing puts 4.84% as the top, in light of back-to-back softening CPI reports.

That’s barely a nudge higher from the September dot plot and if confirmed would indicate a Fed that’s incrementally less-hawkish than a few weeks ago.

The alternative is that the Fed sticks to its guns, hikes by 50 bps and the median dot is just above 5%. Of course, the quirk here is that the dot doesn’t indicate the March top, it indicates 2023 year-end rates. That will leave the Fed some wiggle room (and the market some uncertainty) no matter what the dot plot says.

Instead, we may have to listen to message from Powell on where rates are headed but it would be no surprise for him to downgrade to some kind of meeting-by-meeting messaging and even to maintain that after they’ve reached a top.

Along with that will come a tight focus on messaging around inflation. It’s certain that the Fed and Powell will express some comfort in the falling pace of inflation but they will also be careful to avoid anything close to declaring victory.

Add all that up and I think there’s some room for the optimism to continue. Economists are showing a great deal of optimism today on the path of inflation, particularly on goods. At some point we may have to worry about a hard landing but we’re in the window right now where a soft landing certainly looks possible.