British pound experienced some volatility following BoE’s rate decision, which revealed a dovish tilt in both the voting pattern and the language used. Sterling dipped initially, but then made a swift recovery, surviving as Governor Andrew Bailey dovish remarks in his follow-up press conference.

Bailey stressed it’s not time to cut interest yet. But for June, he’s open to the idea, depending on upcoming economic data. He took a non-committal stance and described a June cut as “neither ruled out nor a fait accompli.” However, with inflation projected to dip below target to 1.6% in three years, Bailey indicated the necessity for future rate cuts to make monetary policy less restrictive over the forecast period.

Meanwhile, Dollar saw a sharp decline in early US session following unexpectedly weak jobless claims data, fostering hopes that the labor market might be easing. This softening is seen as potentially paving the way for Fed to begin reducing interest rates by September, although this will depend heavily on forthcoming inflation data, particularly next week’s U.S. CPI release.

As for the day overall, Yen is currently the worst performer, followed by Dollar and then Euro. Aussie is the best, followed by Kiwi and Canadian. Sterling and Swiss Franc are positioning in the middle.

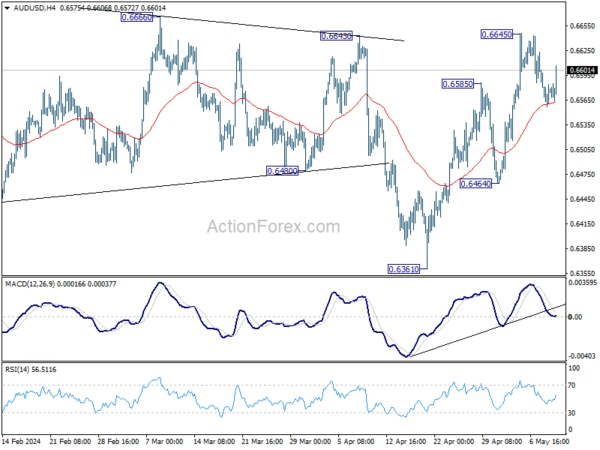

Technically, AUD/USD bounces after drawing support from 55 4H EMA and retains near term bullishness. Focus is back on 0.6645 resistance. Firm break there will resume whole rise from 0.6361. Further break of 0.6666 resistance will solidify the case of near term bullish reversal, and target 0.6870 resistance next.

In Europe, at the time of writing, FTSE is up 0.34%. DAX is up 0.93%. CAC is up 0.31%. UK 10-year yield is up 0.0061 at 4.149. Germany 10-year yield is up 0.018 at 2.484. Earlier in Asia, Nikkei fell -0.34%. Hong Kong HSI rose 1.22%. China Shanghai SSE rose 0.83%. Singapore Strait Times rose 0.04%. Japan 10-year JGB yield rose 0.0298 to 0.913.

US initial jobless claims rises to 231k, vs exp 210k

US initial jobless claims rose 22k to 231k in the week ending May 4, above expectation of 210k. That’s also the highest level since late August 2023. Four-week moving average on initial claims rose 4.75k to 215k. Four-week moving average on initial claims rose 4.75k to 215k. Continuing claims rose 17k to 1785k in the week ending April 27. Four-week moving average of continuing claims fell -6.25k to 1781k.

BoE holds rate at 5.25%, Ramsden joins dove camp

BoE maintained Bank Rate at 5.25%, as widely expected. The announcement revealed a subtle dovish shift as evidenced by the voting and adjustments in the accompanying statement. Although these changes are not strong enough to warrant an immediate rate cut in June, they suggest that the central bank is inching closer to easing monetary policy.

The meeting concluded with a 7-2 voting split, with Deputy Governor Dave Ramsden joining the typically dovish Swati Dhingra in advocating for a rate cut. Additionally, BoE has explicitly stated its intent to monitor incoming data to assess whether risks from “inflation persistence are receding”, to determine the duration for which current Bank Rate is maintained.

Furthermore, in its updated economic forecasts, BoE revised GDP growth projections upwards across the board and lowered CPI expectations for the coming years.

Four-quarter GDP growth is projected to be at 0.2% in Q2 2024 (revised up from 0.1%), 0.9% in Q2 2025 (up from 0.6%), 1.2% in Q2 2026 (up from 1%) , and then 1.6% in Q2 2027.

CPI inflation is projected to be at 2% in Q2 2024 (unchanged), 2.6% in Q2 2025 (down from 2.7%), 1.9% in Q2 2026 (down from 2.2%, and then 1.6) in Q2 2027.

BoJ meeting summary indicates hawkish shift

Summary of Opinions from BoJ’s April meeting revealed a notable hawkish tilt among its board members, with significant dialogue concerning further rate hikes. This development reflects a growing concern over inflationary pressures and the impact of a weaker yen, which could hasten monetary policy normalization.

One board member highlighted that if the economic activity and price forecasts from April are realized, future policy interest rates might be “higher than the path that is factored in by the market.”

Further discussions emphasized the necessity of managing transitions carefully to mitigate shocks from sudden and substantial policy changes once price stability target is achieved. One approach proposed involves “moderate policy interest rate hikes”.

Another critical point raised was the impact of a weakening yen on inflation. A board member warned that if underlying inflation continues to rise above the baseline scenario due to the currency’s depreciation, “it is quite possible that the pace of monetary policy normalization will increase”.

Japan’s real wages fall -2.5% yoy, declining for 24th consecutive month

In Japan, real wages fell notably by -2.5% yoy in March, marking a worsening trend from the previous month’s -1.8% yoy. It also extended the streak of declines to 24 consecutive months—the longest since such data was first recorded in 1991.

Nominal wages, which include total cash earnings, grew modestly by 0.6% yoy in March, a deceleration from February’s 1.4% yoy increase. Although regular pay saw a rise of 1.7% yoy , this was offset by -1.5% yoy decline in overtime pay, which has fallen for four consecutive months. Furthermore, special payments, which encompass bonuses and other benefits, saw a sharp decrease of -9.4% yoy.

The persistence of wage declines occurs despite a seemingly favorable outcome from Japan’s annual labor-management wage talks this spring, which were described as the most beneficial for workers at major companies in three decades.

However, a labor ministry official noted that the results of the “shunto” wage negotiations were not reflected in the March data. With these results expected to influence the figures from April onwards, there is a focus on whether real wages will show an improvement and turn positive for the first time in two years.

China’s exports rises 1.5% yoy in Apr, imports surges 8.% yoy

China’s trade figures for April showcased significant recovery, with exports increasing by 1.5% yoy to USD 292.5 B, exceeding the expected 1.0% yoy growth. This rebound is particularly noteworthy given the -7.5% yoy decline observed in March.

On the import side, there was a notable surge of 8.4% yoy to USD 210.1B, substantially higher than the forecasted 5.4% yoy. This rise marks a recovery from the -1.9% decline in March. The significant increase in imports, driven partly by a weaker comparison base from the previous year, also reflects an uptick in economic activity as domestic conditions improve.

Trade surplus for April stood at USD 72.4B, smaller than the expected USD 81.4B but still an improvement from USD 58.6B recorded in March.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2468; (P) 1.2497; (R1) 1.2525; More…

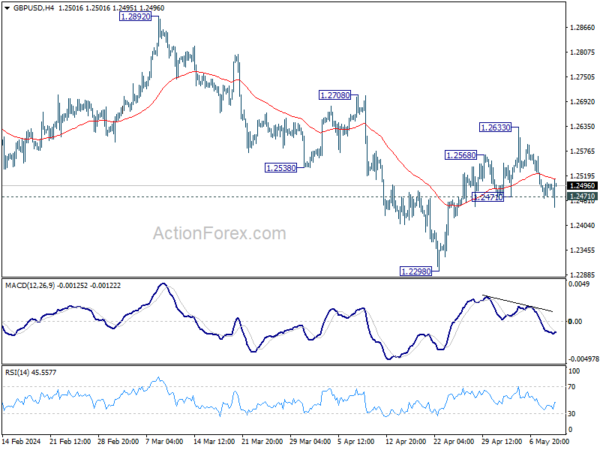

GBP/USD breached 1.2471 support briefly but quickly recovered. Intraday bias stays neutral first. Strong bounce from current level will retain near term bullishness. Further break of 1.2633 will resume the rebound from 1.2298 to 1.2708 resistance next. However, firm break of firm break of 1.2471 will indicate that this rebound has completed, and revive near term bearishness. Retest of 1.2298 should then be seen in this case.

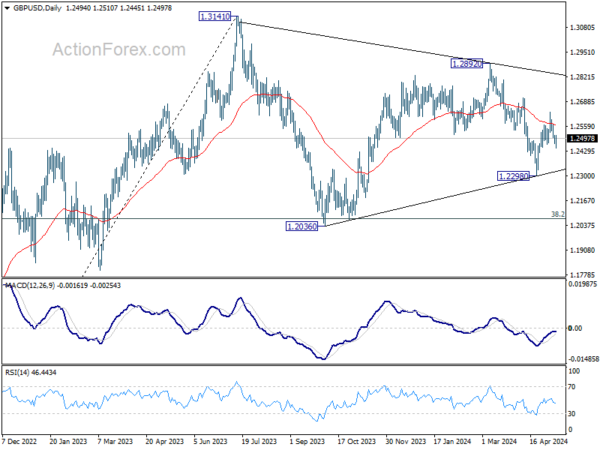

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern. Fall from 1.2892 is seen as the third leg which might have completed already. Break of 1.2892 resistance will argue that larger up trend from 1.0351(2022 low) is ready to resume through 1.3141. Meanwhile, break of 1.2298 support will extend the corrective pattern instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Apr | -5% | 4% | -4% | -5% |

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 03:00 | CNY | Trade Balance (USD) Apr | 72.4B | 81.4B | 58.6B | |

| 05:00 | JPY | Leading Economic Index Mar P | 111.4 | 111.3 | 111.8 | |

| 11:00 | GBP | BoE Interest Rate Decision | 5.25% | 5.25% | 5.25% | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–2–7 | 0–1–8 | 0–1–8 | |

| 12:30 | USD | Initial Jobless Claims (May 3) | 231K | 210K | 208K | 209K |

| 14:30 | USD | Natural Gas Storage | 87B | 59B |