Sterling drops notably today after BoE delivered no hawkish surprise. While it sounded upbeat on the outlook, the MPC, except chief economist Andy Haldane, would prefer to wait until August to take any policy actions. Dollar is also soft after weaker than expected jobless claims and durable goods orders. On other other hand, New Zealand Dollar is currently the strongest, followed by Yen and than Euro. US futures are currently pointing to higher open and we’d see if markets would extend risk-on rally, and pressure Dollar and Yen again.

Technically, GBP/USD appears to be rejected by 4 hour 55 EMA, but that’s more likely due to selling in Sterling that buying in Dollar. Eyes will be on 0.8600 resistance in EUR/GBP and break will suggest completion of the choppy decline form 0.8718. That could add to the case of more downside for the Pound. On the other hand, rejection by 4 hour 55 EMA in EUR/USD could argue that Dollar has completed a general corrective retreat.

In Europe, at the time of writing, FTSE is up 0.43%. DAX is up 0.68%. CAC is up 0.96%. Germany 10-year JGB yield is down -0.0051 at -0.178. Earlier in Asia, Nikkei rose 0.00%. Hong Kong HSI rose 0.23%. China Shanghai SSE rose 0.01%. Singapore Strait Times rose 0.03%. Japan 10-year JGB yield dropped -0.0015 at 0.054.

US initial jobless claims dropped to 411k, durable goods orders rose 2.3%, ex-transport orders up 0.3%

US initial jobless claims dropped -7k to 411k in the week ending June 18, above expectation of 380k. Four-week moving average of initial claims rose 1.5k to 398k. Continuing claims dropped -144k to 3390k in the week ending June 12, lowest since March 21, 2020. Four-week moving average of continuing claims dropped -55k to 3553k.

Durable goods orders rose 2.3% mom to USD 253.3B in May, below expectation of 2.9% mom. Ex-transport orders rose 0.3% mom, below expectation of 0.8% mom. Ex-defense orders rose 1.7% mom. Transportation equipment rose USD 5.2B or 7.6% mom to USD 74.2B.

Goods trade deficit widened to USD -88.1B in May, versus expectation of USD -87.8B. Q1 GDP was finalized at 6.4% annualized in Q1.

BoE stands pat, Haldane voted to taper again

BoE left Bank Rate unchanged at 0.10% by unanimous vote. Though, it voted 8-1 to keep asset purchases target at GBP 895B. Chief economist Andrew Haldane voted to again to lower the target to GBP 845B. BoE said that the “existing stance of monetary policy remained appropriate” to meet the 2% inflation target and to sustain growth and employment.

Bank staff have “revised up” Q2 GDP growth expectation by 1.50% since the May MPR, as restrictions on economic activity have eased. June output is expected to be around -2.50% below pre-Covid 2019 Q4 level. Labor market slack remained “higher than implied” by the 4.7% unemployment rate in the three months to April.

CPI inflation is expected to “pick up further above the target” and is “likely to exceed 3% for a temporary period”. The “central expectation” is that after a strong period, “growth and inflation will fall back”. But there are “two-sided risks around this central path”. “Inflation expectations remain well anchored”.

The Committee will continue to monitor the situation closely and will have the opportunity to assess the economic outlook “more fully” in the August MPR and projections.

Germany Ifo business climate rose to 101.8, shaking off coronavirus crisis

Germany Ifo business climate rose to 101.8 in June, up from 99.2, above expectation of 100.4. That’s also the highest level since end of 2018. Current assessment index rose to 99.6, up from 95.7, above expectation of 97.8. Expectations index rose to 104.0, up from 102.9, above expectation of 103.5.

Looking at some more details, manufacturing index rose from 25.7 to 28.5, highest since April 2018. Services sector index rose from 13.7 to 22.4. Trade index rose from 8.5 to 17.8. Construction index rose from 3.0 to 4.2.

Ifo said: “Companies assessed their current business situation as much better. Optimism regarding the second half of the year also grew. The German economy is shaking off the coronavirus crisis.”

GBP/USD Mid-Day Outlook

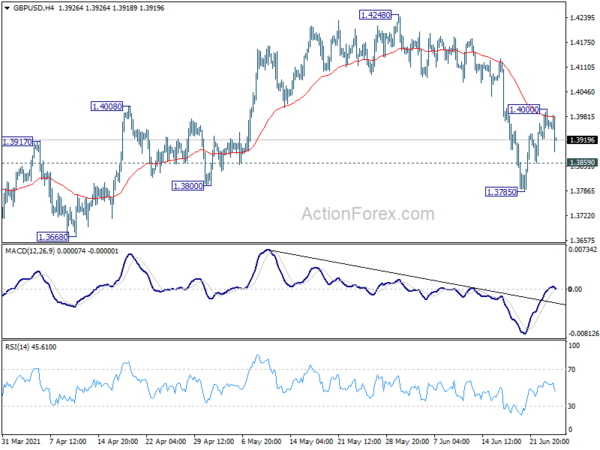

Daily Pivots: (S1) 1.3924; (P) 1.3963; (R1) 1.4001; More….

GBP/USD drops notably after failing to sustain above 4 hour 55 EMA (now at 1.3978), but stays above 1.3859 minor support. Intraday bias remains neutral first. On the downside, break of 1.3859 will resume the fall from 1.4248, as the third leg of the consolidation pattern from 1.4240, to 1.3668 support and possibly below. On the upside, sustained break of the 4 hour 55 EMA will turn bias back to the upside for retesting 1.4240/8 resistance zone instead.

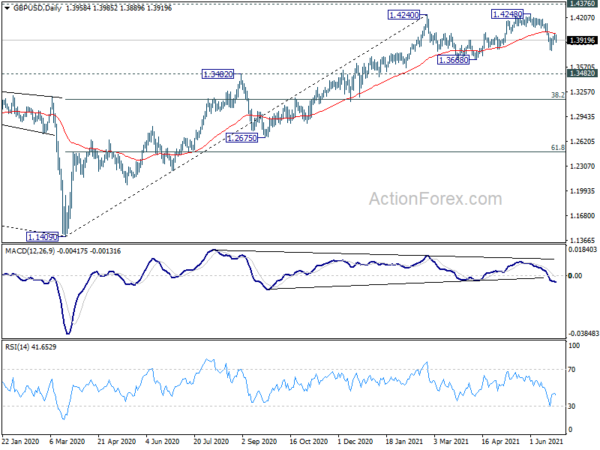

In the bigger picture, as long as 1.3482 resistance turned support holds, up trend from 1.1409 should still continue. Decisive break of 1.4376 resistance will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. However, firm break of 1.3482 support will argue that the rise from 1.1409 has completed and bring deeper fall to 1.2675 support and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y May | 1.50% | 1.40% | 1.00% | 1.10% |

| 08:00 | EUR | Germany IFO Business Climate Jun | 101.8 | 100.4 | 99.2 | |

| 08:00 | EUR | Germany IFO Expectations Jun | 104 | 103.5 | 102.9 | |

| 08:00 | EUR | Germany IFO Current Assessment Jun | 99.6 | 97.8 | 95.7 | |

| 08:00 | EUR | ECB Monthly Bulletin | ||||

| 11:00 | GBP | BoE Interest Rate Decision | 0.10% | 0.10% | 0.10% | |

| 11:00 | GBP | BoE Asset Purchase Facility | 895B | 895B | 895B | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–1–8 | 0–0–9 | 0–0–9 | |

| 12:30 | USD | Initial Jobless Claims (Jun 18) | 411K | 380K | 412K | 418K |

| 12:30 | USD | Durable Goods Orders May | 2.30% | 2.90% | -1.30% | |

| 12:30 | USD | Durable Goods Orders ex Transportation May | 0.30% | 0.80% | 1.00% | |

| 12:30 | USD | Wholesale Inventories May P | 1.10% | 0.90% | 0.80% | |

| 12:30 | USD | Goods Trade Balance (USD) May P | -88.1B | -87.8B | -85.2B | -85.7B |

| 12:30 | USD | GDP Annualized Q1 F | 6.40% | 6.40% | 6.40% | |

| 12:30 | USD | GDP Price Index Q1 F | 4.30% | 4.30% | 4.30% | |

| 14:30 | USD | Natural Gas Storage | 64B | 16B |