Sterling is currently the weakest performer in today’s trading, though selling pressure remains somewhat contained for now. Weaker-than-expected inflation data from the UK further strengthened the case for BoE to cut interest rates in November. More critically, markets are now pricing in a higher probability of another back-to-back rate cut in December. Interest rate futures reflect a 90% chance of two 25bps cuts by the end of the year, aligning with BoE Governor Andrew Bailey’s remarks about taking a “more activist” approach to monetary easing.

In the broader forex market, Australian Dollar and New Zealand Dollar are following Sterling’s weakness. Both currencies are anticipating impacts from tomorrow’s joint press conference featuring China’s Housing Ministry, Finance Minister, People’s Bank of China, and National Financial Regulatory Administration. Speculation is building that the Chinese government would announce new support measures to aid the struggling housing market.

On the other side, Euro has risen to the strongest position today, largely due to buying against the Pound. While ECB is widely expected to announce another interest rate cut tomorrow, much of this has already been priced in by the market. Investors will focus on whether ECB signals another follow up rate cuts in December. Dollar and Swiss Franc are also performing well, while Canadian Dollar and Japanese Yen are trading in middle positions.

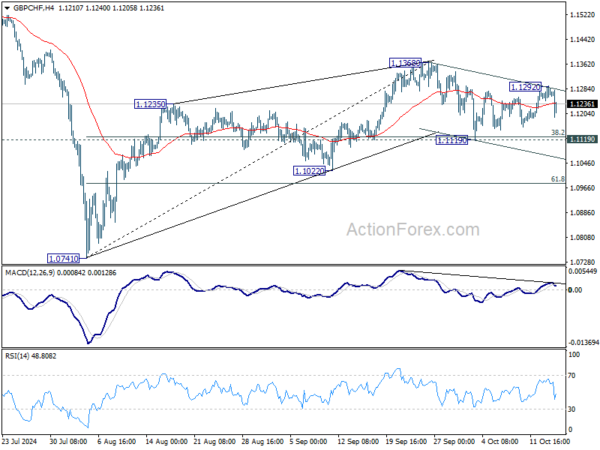

Technically, GBP/CHF will be monitored to see if Sterling’s decline is taking off. So far, it’s holding well above 1.1119 cluster support (38.2% retracement of 1.0741 to 1.1368 at 1.1220). Rise from 1.0741 is still in favor to resume through 1.1368 at a later stage. However, decisive break of 1.1119 will indicate near term reversal and target 61.8% retracement at 1.0981 and below.

In Europe, at the time of writing, FTSE is up 0.87%. DAX is down -0.19%. CAC is down -0.55%. UK 10-year yield is down -0.087 at 4.082. Germany 10-year yield is down -0.034 at 2.194. Earlier in Asian, Nikkei fell -1..83%. Hong Kong HSI fell -0.16%. China Shanghai SSE rose 0.05%. Singapore Strait Times fell -0.13%. Japan 10-year JGB yield fell -0.0211 to 0.955.

Canada’s manufacturing sales falls -1.3% mom to lowest level since Jan 2022

Canada’s manufacturing sales fell -1.3% mom to CAD 69.4B in August, better than expectation of -1.5% mom decline, but marked the lowest level since January 2022.

The decline was mainly driven by lower sales in the primary metal (-6.4%) and petroleum and coal product (-3.7%) subsectors. Meanwhile, production of aerospace products and parts (+7.3%) and sales of wood products (+3.8%) increased the most.

With the decrease in August, monthly sales were down -4.4% on a year-over-year basis.

UK CPI falls to 1.7% in Sep, core CPI down to 3.2%

UK CPI slowed more than expected from 2.2% yoy to 1.7% yoy in September, below expectation of 1.9% yoy. Core CPI (excluding energy, food, alcohol and tobacco) slowed from 3.6% yoy to 3.2% yoy, below expectation of 3.4% yoy. CPI goods fell from -0.9% yoy to -1.4% yoy. CPI services also slowed from 5.6% yoy to 4.9% yoy.

ONS Chief Economist Grant Fitzner said: “Inflation eased in September to its lowest annual rate in over three years. Lower airfares and petrol prices were the biggest driver for this month’s fall. These were partially offset by increases for food and non-alcoholic drinks, the first time that food price inflation has strengthened since early last year. “Meanwhile the cost of raw materials for businesses fell again, driven by lower crude oil prices.”

NZ CPI falls to 2.2% in Q3, back in RBNZ’s target band

New Zealand’s CPI rose 0.6% qoq in Q3, slightly below market expectations of 0.7% qoq. Annually, inflation slowed sharply from 3.3% yoy to 2.2% yoy, in line with forecasts.

This marks the first time since March 2021 that annual inflation has returned within RBNZ’s target range of 1 to 3%. The result was also softer than RBNZ’s own forecast of 0.8% quarterly and 2.3% annual inflation.

Rent prices were the largest contributor to the annual inflation figure, rising by 4.5%. Nearly 20% of the overall inflation increase came from rent.

On the other hand, lower fuel costs, with petrol prices dropping -8.0%, helped balance rising costs, alongside a notable -17.9% drop in vegetable prices following last year’s spike in potato, kūmara, and onion prices.

RBA’s Hunter: Monitoring China’s stimulus and inflation expectations closely

RBA Assistant Governor Sarah Hunter emphasized today the importance of China’s economic stimulus measures for Australia, noting that the central bank is actively assessing their local implications.

In a Bloomberg interview, Hunter explained, “We are factoring it into our forecasts going into November,” as China remains a key player in Australia’s economy. “China’s still very important, and we put a lot of our time and attention into thinking through what’s happening there and what it means for the economy here.”

In a separate speech, Hunter also addressed the importance of keeping inflation expectations anchored within RBA’s 2-3% target range.

She noted that “the fact that expectations feed into actual inflation outcomes means de-anchored expectations typically lead to greater inflation volatility.”

RBA remains vigilant to ensure inflation expectations remain steady, as de-anchoring could cause significant economic disruption. Hunter stressed the need to constantly track and understand how inflation expectations are evolving to mitigate any risks to the broader economy.

Australia’s Westpac leading index ticks up to -0.15%, growth outlook remains subdued

Australia’s Westpac Leading Index showed a slight improvement, rising from -0.26% to -0.15% in September. However, the index remains in negative territory, indicating “below-trend momentum” that is expected to carry into 2025.

Westpac maintains that while growth will improve next year, it will remain “relatively subdued,” with GDP growth forecasted to gradually rise from annualized 1% currently to 1.5% by the end of 2024, reaching 2.4% by the end of 2025—still below the long-term trend of slightly above 2.5%.

As for monetary policy, RBA is not expected to change its cash rate target at the upcoming meetings in November and December.

However, Westpac anticipates a shift in RBA’s messages, moving away from its 2024 focus on “inflation vigilance.”

Key data releases, including Q3 CPI on October 30 and national accounts on December 4, are likely to confirm a subdued growth environment and provide RBA with enough confidence to start considering less restrictive policies in 2025.

BoJ’s Adachi warns against premature rate hikes, urges most conservative approach

In a speech today, BoJ Board Member Seiji Adachi suggested that Japan’s economy has met the conditions for beginning to normalize its ultra-loose monetary policy. He pointed to the firm economic outlook and broadening price increases as positive signs.

However, Adachi emphasized the need for caution, stating that until underlying inflation sustainably reaches the 2% target, Japan must maintain an “accommodative” financial environment. He added that any interest rate increases should be at a “very moderate pace.”

Adachi also stressed the importance to “avoid raising rates prematurely”, suggesting that BoJ should use the “most conservative estimate” when considering policy adjustments.

“Given high uncertainty surrounding global developments, there is significant uncertainty over next year’s wage developments in Japan. We must carefully monitor the situation,” Adachi added.

GBP/USD Mid-Day Outlook

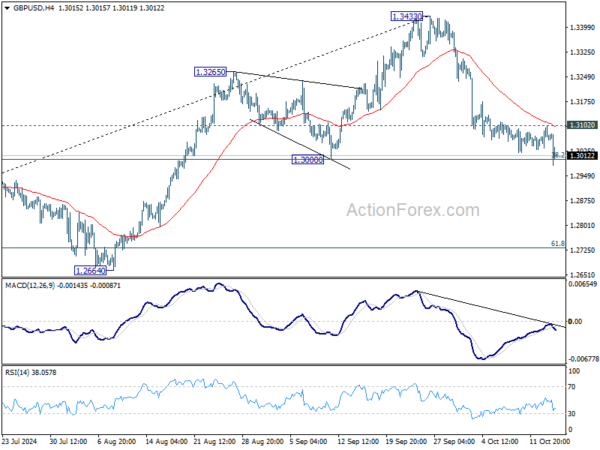

Daily Pivots: (S1) 1.3039; (P) 1.3071; (R1) 1.3106; More…

GBP/USD is still defending 1.3000 cluster support (38.2% retracement of 1.2298 to 1.3433 at 1.2999) for now. On the downside, decisive break of 1.2999/3000 will argue that whole rise from 1.2298 has complete,d and bring deeper fall to 61.8% retracement at 1.2732. Nevertheless, strong bounce from current level, followed by break of 1.3102 minor resistance, will turn bias back to the upside for stronger rebound towards 1.3433.

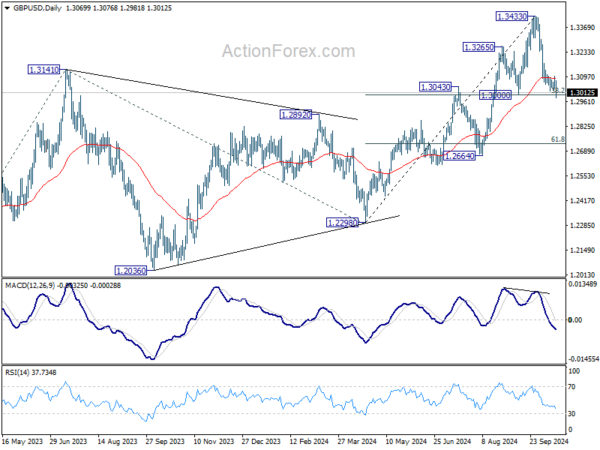

In the bigger picture, as long as 1.3000 support holds, the up trend from 1.0351 (2022 low) is still in progress. Next target is 61.8% projection of 1.0351 to 1.3141 from 1.2298 at 1.4022. However, considering mild bearish divergence condition in D MACD, decisive break of 1.3000 will argue that a medium term top is already in place, and bring deeper fall back to 1.2664 support next.