Sterling surges to a 10-month high against Dollar today, as comments from a lone dove on the Bank of England’s Monetary Policy Committee seem to have little impact. Pound’s strength against Euro and Swiss Franc suggests a one-sided movement. Meanwhile, Australian Dollar remains the weakest performer following RBA’s decision to hold interest rates steady. With Yen and Kiwi also weak, risk sentiment appears directionless. Dollar’s performance is mixed, with the market awaiting tomorrow’s ISM services report and Friday’s non-farm payroll employment data for further inspiration.

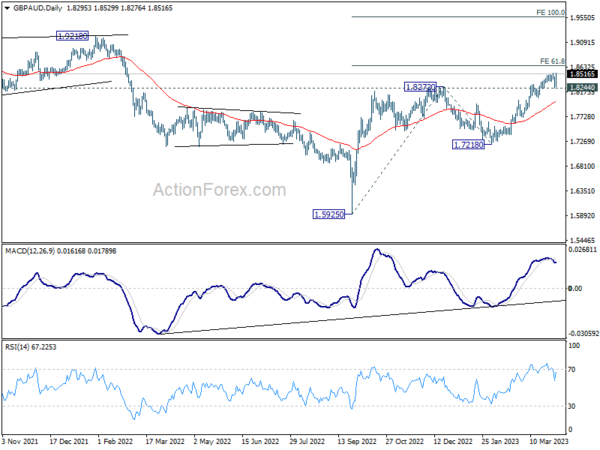

Technically, GBP/AUD appears poised to resume its uptrend from 1.5925, passing last week’s high at 1.8532. However, the near-term upside momentum has not been too convincing, as evidenced by daily MACD readings. A significant obstacle lies at the 61.8% projection of 1.5925 to 1.8272 from 1.7218 at 1.8668. Rejection from this level, followed by a break of 1.8244 support, could signal a deeper pullback towards the 55 day EMA (now at 1.7984). On the other hand, a decisive break of 1.8668 might trigger sharper upside acceleration, targeting 1.9218 resistance and above. The market is likely to see a clearer picture on the cross within April.

In Europe, at the time of writing, FTSE is up 0.08%. DAX is up 0.85%. CAC is up 0.57%. Germany 10-year yield is up 0.078 at 2.332. Earlier in Asia, Nikkei rose 0.35%. Hong Kong HSI dropped -0.66%. China Shanghai SSE rose 0.49%. Singapore Strait Times rose 0.92%. Japan 10-year JGB yield rose 0.0453 to 0.416.

BoE’s Tenreyro foresees need for looser monetary policy

BoE Monetary Policy Committee member Silvana Tenreyro, a known dove, remarked in a speech that the data sinve November has evolved most like her downside scenario, noting a sharp decline in high-frequency private-sector regular pay growth.

She explained that with the Bank Rate at 4.25%, the restrictive policy is likely to “drag demand well below its potential, loosening the labour market and pulling down on inflation.” As a result, she believes that “inflation is likely to fall well below target.”

Tenreyro voted for no change in the Bank Rate in recent months, instead of further tightening, as she believes a looser stance is necessary to achieve the inflation target in the medium term.

She expressed her expectation that the current high level of the Bank Rate “will require an earlier and faster reversal, to avoid a significant inflation undershoot.”

ECB survey: Moderating inflation expectations, improved growth outlook

ECB has released its Consumer Expectations Survey results for February 2023, which demonstrate a continuing moderating inflation expectations and uptick in growth outlook. The results suggest that consumers may be regaining some confidence in the Eurozone’s economic recovery prospects.

Median inflation expectations for the coming year dropped from 4.9% in January to 4.6%, compared to 5.0% in December. In addition, expectations for inflation three years ahead also saw a slight decrease, from 2.5% to 2.4%, in contrast to December’s 3.0%.

On a positive note, mean economic growth expectations for the next 12 months experienced an improvement. The figure rose from January’s 1.2% to -0.9%, a better outcome when compared to December’s -1.5%.

Eurozone PPI at -0.5% mom, 13.2% yoy in Feb

Eurozone PPI came in at -0.5% mom, 13.2% yoy in February below expectation of -0.3% mom, 13.2% yoy. For the month, industrial producer prices decreased by -1.6% in the energy sector and by 0.1% for intermediate goods, while prices increased by 0.3% for capital goods, by 0.4% for durable consumer goods and by 0.6% for non-durable consumer goods. Prices in total industry excluding energy increased by 0.2%.

EU PPI stood at -0.6% mom, 14.5% yoy. The largest monthly decreases in industrial producer prices were recorded in Bulgaria (-7.9%), Greece (-3.3%) and Belgium (-3.2%), while the highest increases were observed in Slovakia (+11.5%), Slovenia (+2.7%) and Portugal (+2.5%).

RBA holds cash rate steady, maintains tightening bias

RBA has decided to keep the cash rate target unchanged at 3.60% amid ongoing uncertainty, but maintained its tightening bias. The central bank stated that some further tightening might be necessary, depending on developments in the global economy, household spending, inflation, and the labor market outlook.

In the official statement, RBA noted, “The Board expects that some further tightening of monetary policy may well be needed to ensure that inflation returns to target.”

RBA’s central forecast anticipates inflation to decline over the next couple of years, reaching around 3% by mid-2025. The statement highlighted that “medium-term inflation expectations remain well anchored, and it is important that this remains the case.”

Despite the slowing growth in the Australian economy, labor market remains very tight. However, as economic growth slows, RBA expects unemployment to increase. The Board remains alert to the risk of a “price-wages spiral”, given the limited spare capacity in the economy and the historically low rate of unemployment.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2320; (P) 1.2372; (R1) 1.2470; More…

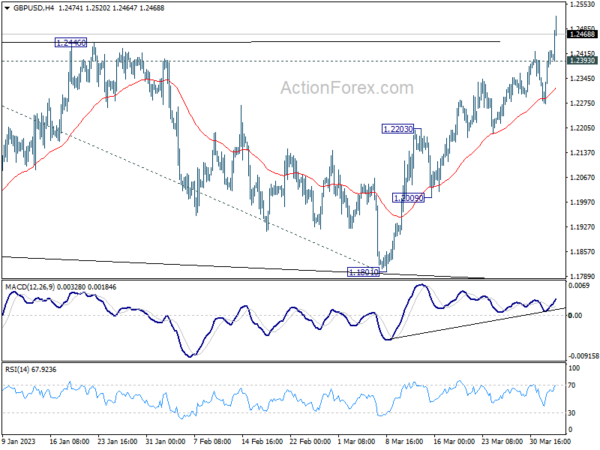

Intraday bias in GBP/USD remains on the upside for the moment. Up trend from 1.0351 is resuming and further rise should be seen to 1.2759 fibonacci level. Firm break there will target 61.8% projection of 1.0351 to 1.2445 from 1.1801 at 1.3095. On the downside, below 1.2393 minor support will turn intraday bias neutral first. But retreat should be contained above 1.2203 resistance turned support to bring another rally.

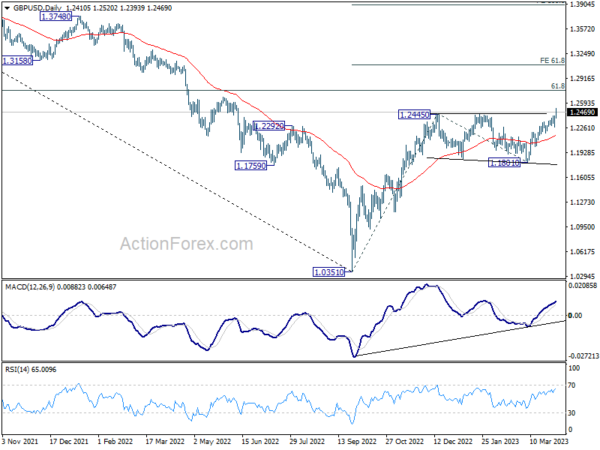

In the bigger picture, the rise from 1.0351 medium term term bottom (2022 low) is in progress for 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759. Sustained break there will add to the case of long term bullish trend reversal. Further break of 61.8% projection of 1.0351 to 1.2445 from 1.1801 at 1.3095 could prompt upside acceleration to 100% projection at 1.3895. For now, this will remain the favored case as long as 1.1801 support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | NZD | NZIER Business Confidence Q1 | -66 | -70 | ||

| 23:50 | JPY | Monetary Base Y/Y Mar | -1.00% | 2.00% | -1.60% | |

| 04:30 | AUD | RBA Interest Rate Decision | 3.60% | 3.60% | 3.60% | |

| 06:00 | EUR | Germany Trade Balance (EUR) Feb | 16.0B | 16.9B | 16.7B | |

| 09:00 | EUR | Eurozone PPI M/M Feb | -0.50% | -0.30% | -2.80% | |

| 09:00 | EUR | Eurozone PPI Y/Y Feb | 13.20% | 13.50% | 15.00% | 15.10% |

| 12:30 | CAD | Building Permits M/M Feb | 8.60% | 2.20% | -4.00% | -3.70% |

| 14:00 | USD | Factory Orders M/M Feb | -0.30% | -1.60% |