Sterling rises strongly today, and overpowers Australia and New Zealand Dollar. On the other hand, Yen’s selloff continues while Dollar is following closely behind. Despite strong investor confidence data, Euro is indeed under heavy selling pressure against the Pound and Aussie. Comments from ECB chief economist Philip Lane suggests that the central bank is still open to increase the asset purchase pace in next quarter, depending on market situations.

Technically, EUR/AUD’s break of 1.5423 support suggests that it’s on the way to retest 1.5250 low. Similarly, EUR/GBP’s break of 0.8622 support now puts 0.8578 support in focus, and break will pave the way to retest 0.8470 low. We’ll keep an eye on whether weakness of Euro would spread over to other pairs. At the same time, GBP/JPY’s break of 153.39 high indicates up trend resumption. Focus will be on when GBP/USD will break through 1.4240 high to follow.

In Europe, at the time of writing, FTSE is up 0.05%. DAX is down -0.14%. CAC is down -0.24%. Germany 10-year yield is up 0.0023 at -0.210. Earlier in Asia, Nikkei rose 0.55%. Hong Kong HSI dropped -0.05%. China Shanghai SSE rose 0.27%. Singapore Strait Times dropped -0.56%. Japan 10-year JGB yield dropped -0.0002 to 0.085.

ECB Lane: We can increase or decrease our asset purchases after June

In an interview by Le Monde, ECB chief economist Philip Lane said that “from now on, the economy will be growing quickly, but from a subdued level”. Eurozone will only get back to its 2019 GDP level “around this time next year”. Unemployment rate will only fall back to 2019 levels “in 2023”. Hence, “it’s a long journey”, which still requires “sustained” fiscal and monetary efforts.

Lane also said that despite the increases in some Eurozone bond yields, they “remain relatively low and anchored”. He reiterated ECB’s commitment to “maintain favorable financing conditions”. The “significantly” higher level of asset purchases announced in March will continue over the coming weeks. The pace of purchases will be reviewed at the June meeting. He added, “we can increase or decrease our purchases depending on what is necessary to keep financing conditions favorable.”

Eurozone Sentix investor confidence rose to 21.0, but there are increasing signs of being overstimulated

Eurozone Sentix Investor Confidence rose sharply to 21.0 in May, up from 13.1, well above expectation of 14.0. That’s also the highest level since March 2018. Current situation index turned positive from -6.5 to 6.3, highest since May 2019. Expectations index rose from 34.8 to 36.8, hitting another record high.

Sentix said: ‘This is very unusual and underlines that the very expansive monetary and fiscal policy that has been in place for a year has not failed to have an effect on the real economy.” Though it also warned, “there are increasing signs that the economy is being overstimulated. This is evident in individual sectors that report shortages of materials. However, the strong global economy is having an even stronger impact on commodity prices and thus on inflation.”

Germany overall index rose from 20.0 to 26.1, highest since March 2018. Current situation index rose form 4.5 to 15.3, highest since May 2019. Expectations rose from 36.8 to 37.5, record high.

Australia NAB business confidence and condition rose to new records

Australia NAB business confidence jumped from 17 to 26 in April, a new survey high. Business conditions rose from 24 to 32, also a record high. The condition sub-component were also at record high. Trading condition rose from 35 to 40. Profitability rose from 25 to 33. Employment condition also rose from 15 to 22.

NAB said: “The April survey result is simply stunning – with many variables reaching survey highs. Conditions reset last month’s high, driven by further gains across trading conditions, profitability and employment. Confidence has also set a new high – pointing to ongoing strength in conditions in the near term.

“It looks like we have moved past the rebound phase of the recovery and are now seeing healthy growth in most of the economy. After lagging in the rebound phase, the services sectors are now showing strength. Retail continues to see healthy conditions but does have slightly softer confidence than the other industries suggesting less improvement from the already high level in conditions”.

Australia retail sales rose 1.3% mom in march, Victoria and WA led

Australia retail sales rose 1.3% mom in March, slightly below the preliminary results of 1.4% mom. Comparing with March 2020, sales rose 2.2% yoy. Ben James, Director of Quarterly Economy Wide Surveys said: “Victoria (3.5 per cent) and Western Australia (5.5 per cent) led rises at the state and territory level, following falls in February associated with local coronavirus lockdowns. Queensland (-0.5 per cent), which saw a short lockdown at the end of March, partially offset these increases.”

Overall, retail sales volume dropped -0.5% in March quarter. James said: “The quarterly volume fall was driven by households spending patterns gradually returning to those seen before COVID-19. Food retailing (-2.7 per cent) led the falls while household goods also fell (-1.6 per cent). The falls were partially offset by a rise in cafes, restaurants and takeaways (5.8 per cent), as eating out increased, while functions and events continued to return.”

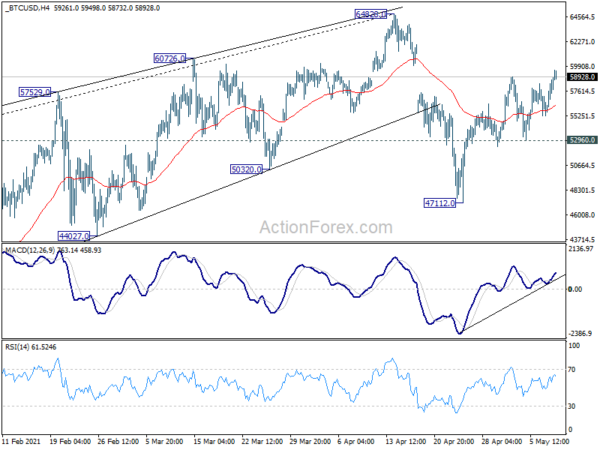

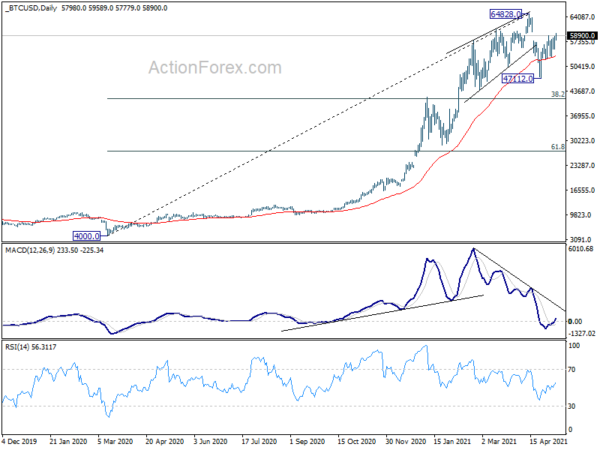

Bitcoin extending rebound, but near term upside potential limited

Bitcoin retreated to 52960 last week but set a base there. Rebound from 47112 resumes today and is now heading back to 60k handle or above. Still, we’d continue to view current rise as the second leg of the medium term corrective pattern from 64848 high only. Hence, bitcoin should start to feel heavy as it approaches this resistance, which shouldn’t be taken out decisively.

We’d expecting another falling leg and break of 52960 will target 47112 support and below. The corrective pattern might complete only after testing 38.2% retracement of 4000 to 64828 at 41591, which is close to the top of prior range of 20283/41964.

GBP/JPY Mid-Day Outlook

Daily Pivots: (S1) 151.43; (P) 151.77; (R1) 152.28; More…

GBP/JPY’s break of 153.39 resistance confirms resumption of whole up trend from1 23.94. Intraday bias stays on the upside for 156.69 long term resistance first. Firm break there will carry larger bullish implications. Next target will be 61.8% projection of 133.03 to 153.39 from 149.03 at 161.61. Also, outlook will remain bullish as long as 151.24 support holds, in case of retreat.

In the bigger picture, rise from 123.94 is seen as the third leg of the pattern from 122.75 (2016 low). Next target is 156.59 resistance (2018 high). Sustained break there should confirm long term bullish trend reversal. Next target is 61.8% retracement of 195.86 (2015 high) to 122.75 at 167.93. On the downside, break of 142.71 resistance turned support is needed to be the first sign of completion of the rise from 123.94. Otherwise, outlook will remain bullish even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Retail Sales M/M Mar | 1.30% | 1.40% | 1.40% | |

| 01:30 | AUD | NAB Business Conditions Apr | 32 | 25 | ||

| 01:30 | AUD | NAB Business Confidence Apr | 26 | 15 | ||

| 08:30 | EUR | Eurozone Sentix Investor Confidence May | 21.0 | 14 | 13.1 |