The financial markets have been more influenced by speculations than by concrete economic data, as anticipation builds ahead of Fed’s interest rate decision on September 18. Recent US economic indicators, including the latest CPI report and the prior week’s non-farm payrolls, pointed toward a cautious and modest 25bps rate cut. However, traders and investors chose to focus on media reports hinting that Fed’s decision remains a close call, with the possibility of a larger50 bps cut still on the table.

Whether these reports are based on legitimate leaks or speculation, the mere possibility of a larger cut has caused significant reactions across financial markets. Dollar and Treasury yields declined notably in the latter part of the week. Equity markets, on the other hand, rallied strongly, with DOW on the verge of making new historical highs. Gold prices shot to record, benefiting from expectations of looser monetary policy.

Overall in the currency markets, Yen ended as the strongest performer last week, supported by expectations that BoJ will maintain its gradual tightening path. While the pace of future rate hikes remains uncertain, the narrowing interest rate differential between Japan and other major economies continues to lend support to Yen.

Australian Dollar followed suit, buoyed by data showing resilient consumer confidence and inflation expectations, suggesting that the economic sthe pressure on lowdown has been measured. This has urgency for RBA to pull ahead the rate cut plan. Sterling ended as the third, as expectations solidify that BoE will skip a rate cut this month.

On the weaker side, Swiss Franc posted the worst performance of the week, but likely just consolidating after its recent rally. New Zealand Dollar and Canadian Dollar also struggled, rounding out the weakest currencies for the week. Euro ended the week mixed, grappling with ECB’s decision to cut rates while offering little forward guidance on its next steps.

DOW Near Record High as 50bps Fed Cut Remains on the Table, Dollar and Yields Falter

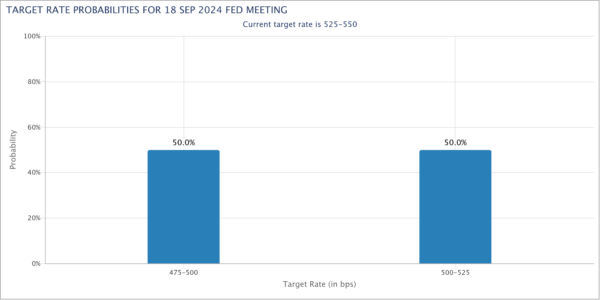

As another week passes, the central question remains: Will Fed kick start its rate-cut cycle with a 25bps or 50bps reduction at its September 18 meeting? Initially, the August CPI report, which revealed a slightly higher-than-expected core inflation reading, seemed to rule out the possibility of a larger 50bps cut. However, speculation has resurfaced after media reports suggested that the decision remains tightly balanced. Market odds for a 50bps cut, as reflected in fed fund futures, bounced back to 50% after dipping below 20%, making it a true coin toss.

Both sides of the debate present valid arguments, but ultimately, the Fed must decide what message it wishes to send to the markets. Does a 50bps cut suggest that the central bank is deeply concerned about a severe economic downturn? Or is it so confident that inflation is under control and won’t re-emerge? Moreover, would such a move signal that Fed could implement additional 50bps cuts in subsequent meetings? The implications are significant, and Fed officials must carefully consider how their decision will be interpreted.

Traditionally, uncertainty is not welcomed by stock investors, but in this case, markets have rallied despite the ambiguity. S&P 500 rose 4%, while NASDAQ gained 5.9%, marking the best week of 2024 for both indexes. DOW advanced 2.6% as well.

Technically, DOW is now indeed just inch below record high at 41585.21. The strong bounce from rising 55 D EMA is a clear bullish signal. Firm break of 41585.21 will extend the larger up trend towards 61.8% projection from 32327.20 to 39889.05 from 38000.96 at 42674.18 next.

Also, the up trend from 28660.94 remains healthy as DOW stays comfortably above rising 55 W EMA. Bearish divergence in W RSI might be a concern, but momentum appears to be picking up again as seen in W MACD. Outlook will remain bullish as long as 55 W EMA (now at 38185.23) holds. Next medium term target is 100% projection of 18213.65 to 36952.65 from 28660.94 at 47399.94.

10-year yield continued the down trend from 4.737 and 4.997 last week. Near term outlook will stay bearish as long as 3.923 resistance holds. Next target is 100% projection of 4.997 to 3.785 from 4.737 at 3.525.

The critical question is whether 3.525 will provide sufficient support to stabilize yields. If not, TNX could dive further to 3.253 cluster support (38.2% retracement of 0.398 to 4.997 at at 3.240) before bottoming.

While Dollar was pressured in the latter part of the week, it has indeed ended mixed only. Notably, the greenback remained within the prior week’s range against most major rivals, except for Yen.

Dollar Index’s price action from 100.51 are clearly corrective looking, which suggests that fall from 106.13 is not over. Outlook will stay bearish as long as 102.16 resistance holds. Firm break of 100.51 will target 99.57 key support level next (2023 low).

The important question for Dollar Index is whether, with consolidation pattern from 99.57 completed at 106.13, and the down trend from 114.77 (2022 high) is ready to resume.

A more bearish scenario would unfold if Fed opts for a larger 50bps rate cut and signals faster easing ahead. That could shoot DOW through to new record with strong momentum and hammers 10-year yield. This scenario would be a double whammy for Dollar. In this case, Dollar Index could be heading to 61.8% projection of 114.77 to 99.57 from 106.13 at 96.73.

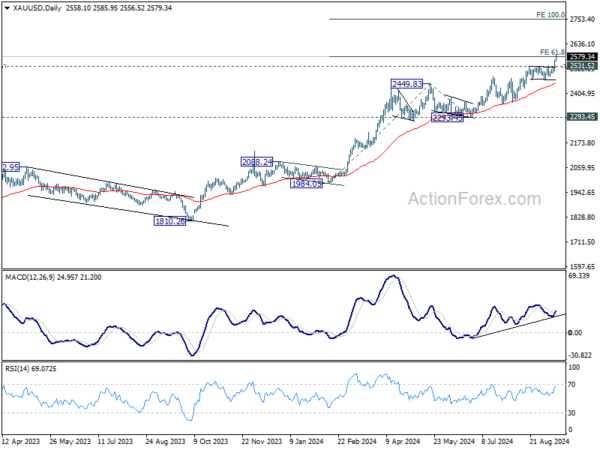

Gold Sets New Record as Silver Climbs Sharply Alongside

Gold and Silver also saw significant gains as speculation around Fed’s aggressive rate cuts fueled a bullish push in precious metals. Gold, in particular, has already been riding a strong uptrend, supported by central bank purchases and haven demand due to ongoing geopolitical tensions in the Middle East and Ukraine. Now, with growing bets on Fed easing, Gold has broken out of its month-long consolidation, and traders are increasingly bullish, as lower interest rates tend to boost non-yielding assets like gold.

Technically, outlook in Gold will stay bullish as long as 2531.52 resistance turned support holds. Sustained trading above 61.8% projection of 1984.05 to 2449.83 from 2293.45 at 2581.30 could prompt further upside accelerations to 100% projection at 2759.23.

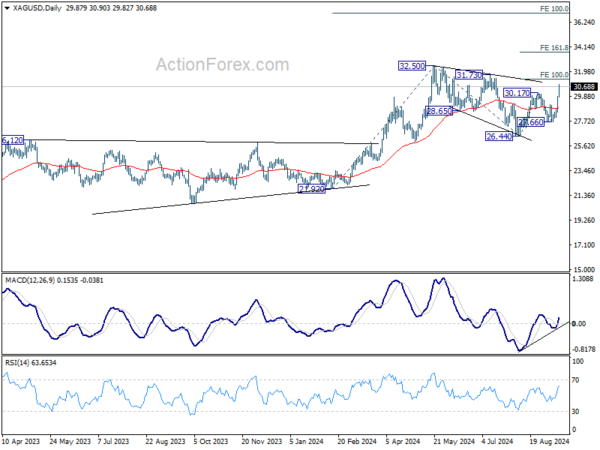

Silver’s rise from 26.44 also resumed by breaking through 30.17 resistance. Next target is 100% projection of 26.44 to 30.17 from 27.66 at 29.96. Decisive break there will further solidify the case that whole correction from 32.50 has completed with three waves down to 26.44. In this bullish case, there could be upside acceleration through 32.50 high to 161.8% projection at 33.69.

Euro Wraps Up Week Mixed as ECB Remains Noncommittal After Rate Cut

Euro ended the week with mixed performance after ECB delivered another 25bps rate cut, but offered no clear guidance on future moves. This left markets with little clarity on the ECB’s direction, though the general expectation remains that the central bank will continue at a measured pace of one 25bps cut per quarter. ECB looks comfortable with that.

ECB lowered the deposit rate to 3.50%, with President Christine Lagarde avoiding any commitments on when the next reduction might occur. Nevertheless, the accompanying economic projections saw only minor revisions, indicating that despite signs of economic softening, the broader outlook remains relatively stable. Additionally, Lagarde expressed optimism that recovery will strengthen over time as real incomes rise and the effects of tight monetary policy gradually ease.

On inflation, ECB acknowledged that domestic pressures remain high, with wages continuing to climb at elevated rates. However, Lagarde noted that labor cost pressures are starting to moderate, and corporate profits are helping to cushion the inflationary effects of wage growth, reducing the overall impact on prices.

EUR/GBP extended the consolidation pattern from 0.8399 last week, without any attempt to breakout from range. Outlook will remain bearish as long as 38.2% retracement of 0.8624 to 0.8399 at 0.8485. Break of 0.8399 will bring retest of 0.8382 low. Firm break there will resume larger down trend from 0.9267 (2022 high).

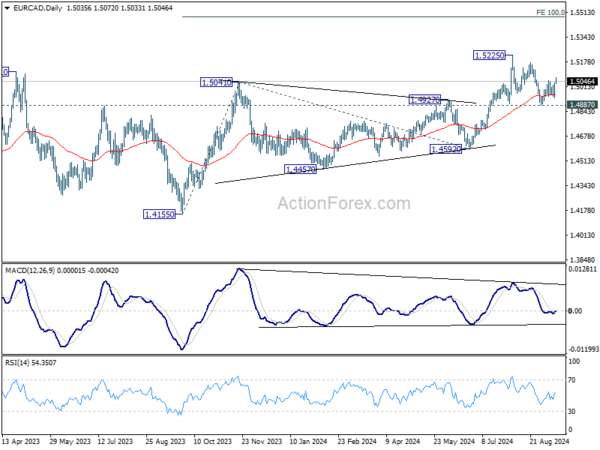

EUR/CAD was also bounded in range below 1.5225 last week. But the support from 55 D EMA is a bullish sign. Also, further rally is expected as long as 1.4887 support holds. Firm break of 1.5225 resistance will resume larger rise to 100% projection of 1.4155 to 1.5041 from 1.4592 at 1.5478.

USD/JPY Weekly Outlook

USD/JPY’s fall from 161.94 resumed by breaking through 141.67 support last week. Initial bias stays on the downside this week for 139.26 fibonacci level. Decisive break there would carry larger bearish implications. On the upside, above 143.03 resistance will turn intraday bias neutral first. But outlook will remain bearish as long as 147.20 resistance holds, in case of recovery.

In the bigger picture, fall from 161.94 medium term top is seen as correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. Strong support could be seen there to bring rebound. But in any case, risk will stay on the downside as long as 149.35 resistance holds. Sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.

In the long term picture, it’s still early to conclude that up trend from 75.56 (2011 low) has completed. However, a medium term corrective phase should have commenced, with risk of deep correction towards 55 M EMA (now at 133.19).