Trading activity leans mildly toward risk aversion as US jobless claims data underscores concerns over a slowdown in the job market. Stock futures and treasury yields are trading modestly lower, but overall market movements remain limited, suggesting many traders may already be in a holiday mindset. Canadian Dollar also appears unfazed by better-than-expected employment figures.

For the week, Aussie stands as the weakest performer, followed by Dollar, which is experiencing a slight recovery today. New Zealand Dollar, currently the third weakest, has reversed most gains following RBNZ rate hike. European majors exhibit mixed performance, with Sterling holding a marginal advantage.

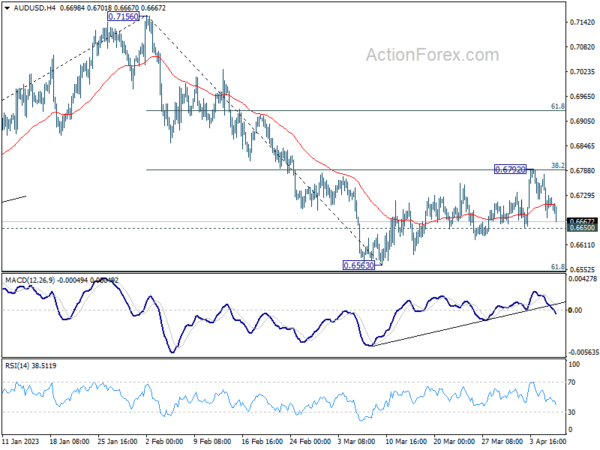

As the trading session progresses, it remains to be seen whether the risk-off sentiment will intensify and push AUD/USD below the 0.6650 minor support level. Such a development would suggest that the corrective recovery from 0.6563 has concluded and that the broader downtrend from 0.7156 is set to resume, potentially breaking the 0.6563 low.

In Europe, at the time of writing, FTSE is up 0.91%. DAX is up 0.33%. CAC is up 0.24%. Germany 10-year yield is down -0.0019 at 2.166. Earlier in Asia, Nikkei dropped -1.22%. Hong Kong HSI rose 0.28%. China Shanghai SSE rose 0.00%. Singapore Strait Times dropped -0.55%. Japan 10-year JGB yield rose 0.0013 to 0.471.

US initial jobless claims rose to 228k, continuing claims highest since late 2021

US initial jobless claims dropped -18k to 228k in the week ending April 1, above expectation of 200k. Four-week moving average of continuing claims dropped -4k to 238k.

Continuing claims rose 6k to 1823k in the week ending March 25, highest level since December 11, 2021. Four-week moving average continuing claims rose 10.5k to 1804k, highest since November 13, 2021.

Canada employment grew 34.7k in Mar, unemployment rate unchanged at 5%

Canada employment grew 34.7k in March, well above expectation of 10.2k. Employment gains in March were concentrated among private sector employees (+35,000; +0.3%). There was little change in the number of public sector employees and self-employed workers.

Unemployment rate was unchanged at 5.0%, better than expectation of 5.1%. That’s just above the record low of 4.9% recorded in June and July of 2022. Total hours worked rose 0.4% mom, 1.6% yoy. Average hourly wages rose 4.% yoy.

ECB Lane: Appropriate to hike further if baseline holds up

In an interview with Cyprus News Agency, ECB Chief Economist Philip Lane stressed the importance of being data-dependent and scientific in deciding on a potential interest rate hike at the May meeting. He explained, “if the baseline we developed before the banking stress holds up, it will be appropriate to have a further increase in May. However, we need to be data-dependent about the assessment of whether that baseline still holds true at the time of our May meeting.”

Lane highlighted three factors that will influence the May decision: the inflation outlook, assessing the underlying dynamic of inflation, and the speed at which interest rate increases are restricting the economy and bringing down inflation. He urged focusing on understanding every data point instead of predicting the decision, stating, “rather than asking me what the next interest rate decision will be, the focus should be on understanding every data point that comes in.”

Responding to a question regarding OPEC’s production, the ECB Chief Economist note that the movement in oil prices should be weighed against the context of a large drop in recent months and a significant ongoing reduction in gas prices. Lane emphasized the importance of monitoring how the rest of the economy responds to the energy dynamic and analyzing the incoming data until the day of the May meeting.

UK PMI construction dropped to 50.7, mixed fortunes in the sector

UK PMI Construction dropped from 54.6 to 50.7 in March, below expectation of 53.6, indicating a mixed picture for the industry.

Tim Moore, Economics Director at S&P Global Market Intelligence, explained that civil engineering and commercial projects saw a sustained rebound in output levels and improved tender opportunities, leading to the strongest rate of job creation in five months.

However, a sharp decline in house building raised concerns, as subdued demand and rising interest rates contributed to the steepest fall in housing activity in almost three years.

Despite these challenges, overall expectations for construction output in the coming year remain positive, with survey respondents citing improved availability of construction inputs and expectations for moderating purchasing price inflation.

China Caixin PMI services rose to 57.8, highest since Nov 2020

China’s Caixin PMI Services index exceeded expectations in March, rising from 55.0 to 57.8, marking the highest level since November 2020. The data revealed sharp increases in activity, sales, and employment, with the services sector showing stronger expansion compared to the manufacturing sector. Business confidence remained historically strong, while input price inflation reached a seven-month high. The PMI Composite also experienced a slight increase from 54.2 to 54.5, reaching its highest point since June 2022.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Production, demand and employment all grew, with the services sector showing a stronger expansion, whereas manufacturing activity turned comparatively sluggish. Input costs and prices charged remained stable, and businesses were highly optimistic.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0875; (P) 1.0923; (R1) 1.0954; More…

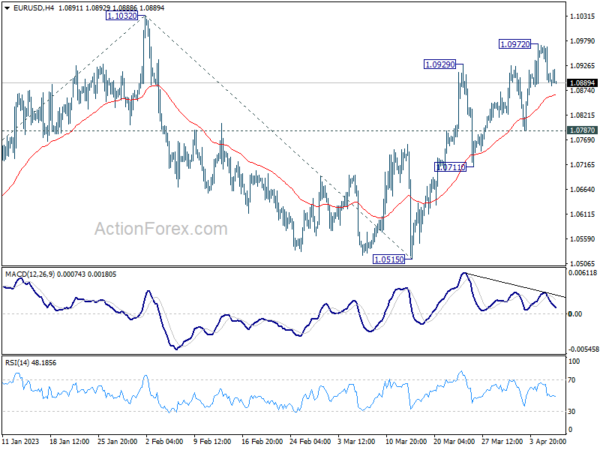

Intraday bias in EUR/USD remains neutral for consolidation below 1.0972 temporary low. Further rise is expected as long as 1.0787 support holds. Above 1.0972 will resume the rally from 1.0515 to retest 01.1032 high. Firm break there will resume larger up trend from 0.9534. However, break of 1.0787 will turn bias back to the downside for 1.0711 support instead.

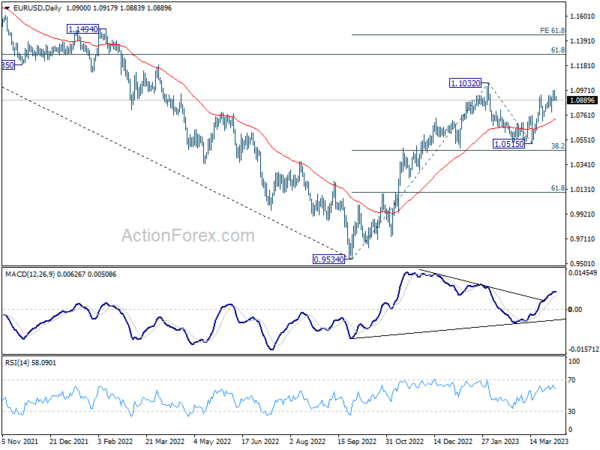

In the bigger picture, rise from 0.9534 (2022 low) is in progress with 38.2% retracement of 0.9534 to 1.1032 at 1.0460 intact. The strong support from 55 week EMA (now at 1.0625) was also a medium term bullish sign. Next target is 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) Feb | 13.87B | 11.12B | 11.69B | 11.27B |

| 01:45 | CNY | Caixin Services PMI Mar | 57.8 | 55 | 55 | |

| 05:45 | CHF | Unemployment Rate Mar | 1.90% | 1.90% | 1.90% | |

| 06:00 | EUR | Germany Industrial Production Feb | 2.00% | -0.40% | 3.50% | 3.70% |

| 07:00 | CHF | Foreign Currency Reserves (CHF) Mar | 743B | 771B | 770B | |

| 08:30 | GBP | Construction PMI Mar | 50.7 | 53.6 | 54.6 | |

| 11:30 | USD | Challenger Job Cuts Mar | 319.40% | 410.10% | ||

| 12:30 | USD | Initial Jobless Claims (Mar 31) | 228K | 200K | 198K | 246K |

| 12:30 | CAD | Net Change in Employment Mar | 34.7K | 10.2K | 21.8K | |

| 12:30 | CAD | Unemployment Rate Mar | 5.00% | 5.10% | 5.00% | |

| 14:00 | CAD | Ivey PMI Mar | 52 | 51.6 | ||

| 14:30 | USD | Natural Gas Storage | -20B | -47B |