Trading continues to be relatively subdued in the forex markets. US Treasury Janet Yellen’s comments prompted selloff in stocks overnight. But reactions in currencies were just mild, with most pairs and crosses range bound. Strong job data from New Zealand is giving the Kiwi a lift, while Aussie is supported by strong construction data. Yen and Dollar turn a bit softer.

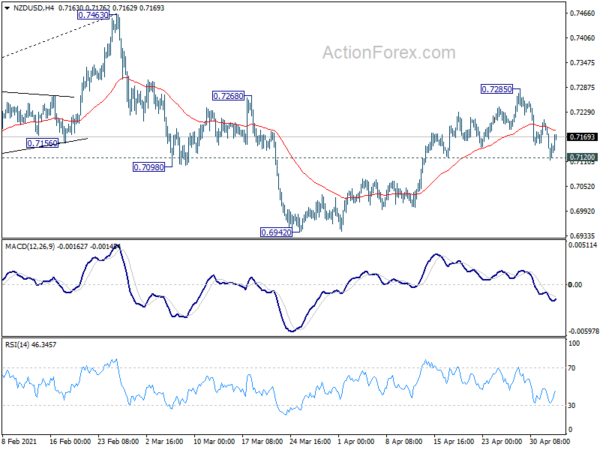

Technically, NZD/USD recovered notably after drawing support from 0.7120. Near term bullishness is somewhat retained. Break of 0.7285 will resume the rebound from 0.6942 back to retest 0.7463 high. That could be accompanied by break of 0.7815 in AUD/USD towards 0.8006 high. However, both pairs could also take out 0.7120 and 0.7676 support respectively, to target 0.6942 and 0.7530 support levels.

In Asia, at the time of writing, Hong Kong HSI is up 0.01%. Singapore Strait Times is down -0.85%. Japan and China are still on holiday. Overnight, DOW rose 0.06%. S&P 500 dropped -0.67%. NASDAQ dropped -1.88%. 10-year yield dropped -0.015 to 1.592.

NASDAQ tumbled on Yellen’s rate remarks

US closed mixed overnight, but notable decline was seen in NASDAQ. The selloff came after Treasury Secretary, former Fed chair, Janet Yellen said that “it may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat, even though the additional spending is relatively small relative to the size of the economy”.

Nevertheless, later in the day, she clarified that she was neither predicting nor recommending a rate hike. “If anybody appreciates the independence of the Fed, I think that person is me,” she said. “I don’t think there’s going to be an inflationary problem. But if there is the Fed will be counted on to address them.”

NASDAQ’s strong break of 13698.66 support should confirm rejection by 14175.11. The index should now be in the third leg of the consolidation pattern from 14175.11. Deeper fall is likely back towards 12397.05 support for the near term. Still, there is no risk to the medium term up trend yet, as long as 12397.05 holds.

Fed Kaplan: Make sense to at least start discussing adjusting asset purchases

Dallas Fed President Robert Kaplan “a lot has changed since December” in the US, with strong fiscal stimulus, fast vaccinations and eased restrictions. Hence, “it will make sense to at least start discussing how we would go about adjusting these purchases and start having those discussions sooner rather than later.”

On the other hand, San Francisco Fed President Mary Daly said the right time to start tapering is “when we are much closer to achieving our dual mandate goals than we are now… We have an optimistic outlook, a long way to go, and we are not out of the woods yet… we have only had a couple of months of really good data.”

Minneapolis Fed President Neel Kashkari said Fed should “not cut off the recovery prematurely.” “Today, roughly eight million Americans are out of work who were working before the pandemic. I assume that those folks want to work again,” he said. “How long is it going to take to bring all of those folks back into the labor market and really achieve full employment? We’ll see. It may take a few years.”

New Zealand employment grew 0.6% in Q1, unemployment rate dropped to 4.7%

New Zealand employment grew 0.6% in Q1, above expectation of 0.3% qoq. Unemployment rate dropped to 4.7%, down from 4.9%, better than expectation of 4.9%. Labor force participation rate rose 0.1% to 70.4%. Labor cost index rose 0.4% qoq, above expectation of 0.3% qoq.

“There have been some gains in labour market outcomes, especially for women, over the past two quarters. However, annual changes indicate the labour market still hasn’t returned to pre-COVID-19 levels for men or women,” work, wealth, and wellbeing statistics senior manager Sean Broughton said.

Australia AiG construction dropped -2.7, still continued to power ahead

Australia AiG Performance of Construction Index dropped -2.7 pts to 59.1 in April, but stayed in expansion. Also, all four components of activity expanded strongly, with the activity index reaching a record high of 62.8. Employment dropped -3.9 to 59.2. New orders dropped -7.7 to 57.0. Supplier deliveries dropped -6.1 to 56.0.

Ai Group Head of Policy, Peter Burn, said: “Australia’s construction sector continued to power ahead in April led by house building and engineering construction.”

Also released, building permits rose 17.4% mom in March, well above expectation of 3.0% mom.

Looking ahead

Swiss will release CPI. Eurozone will release PMI services finally and PPI. Later in the day, US will release ADP employment and ISM services.

USD/CAD Daily Outlook

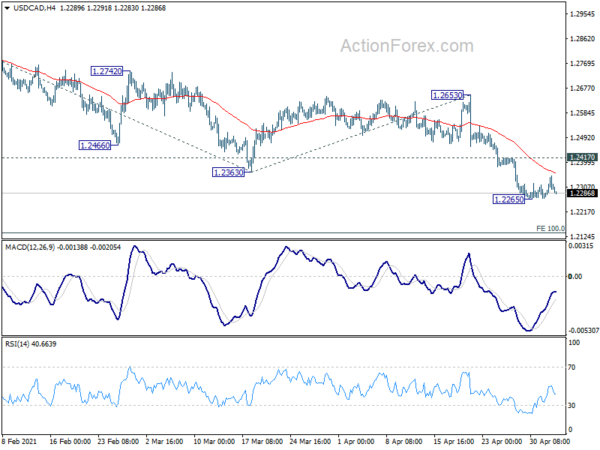

Daily Pivots: (S1) 1.2268; (P) 1.2310; (R1) 1.2344; More…

Intraday bias in USD/CAD remains neutral for the moment as consolidation continues above 1.2265 temporary low. In case of another recovery, upside should be limited by 1.2417 minor resistance to bring down trend resumption. On the downside, break of 1.2265 will target 100% projection of 1.2880 to 1.2363 from 1.2653 at 1.2136 next.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Further decline should be seen back to 1.2061 (2017 low). We’d look for strong support from there to bring rebound. Nevertheless, sustained break of 1.2653 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Apr | 59.1 | 61.8 | ||

| 22:45 | NZD | Employment Change Q1 | 0.60% | 0.30% | 0.60% | |

| 22:45 | NZD | Unemployment Rate Q1 | 4.70% | 4.90% | 4.90% | |

| 22:45 | NZD | Labour Cost Index Q/Q Q1 | 0.40% | 0.30% | 0.50% | |

| 01:30 | AUD | Building Permits M/M Mar | 17.40% | 3.00% | 21.60% | 20.10% |

| 06:30 | CHF | CPI M/M Apr | 0.40% | 0.30% | ||

| 06:30 | CHF | CPI Y/Y Apr | -0.20% | -0.20% | ||

| 07:45 | EUR | Italy Services PMI Apr | 50 | 48.6 | ||

| 07:50 | EUR | France Services PMI Apr F | 50.4 | 50.4 | ||

| 07:55 | EUR | Germany Services PMI Apr F | 50.1 | 50.1 | ||

| 08:00 | EUR | Eurozone Services PMI Apr F | 50.3 | 50.3 | ||

| 09:00 | EUR | Eurozone PPI M/M Mar | 0.90% | 0.50% | ||

| 09:00 | EUR | Eurozone PPI Y/Y Mar | 4.00% | 1.50% | ||

| 12:15 | USD | ADP Employment Change Apr | 808K | 517K | ||

| 13:45 | USD | Services PMI Apr F | 63.1 | 63.1 | ||

| 14:00 | USD | ISM Services PMI Apr | 64.3 | 63.7 | ||

| 14:30 | USD | Crude Oil Inventories | -1.9M | 0.1M |