Following ECB’s decision to lower interest rates by 25 bps, a move that aligned with market expectations, Euro remained relatively steady within its near term trading range. ECB President Christine Lagarde, speaking at the post-meeting press conference, deliberately avoided providing explicit forward guidance, stating that ECB is not pre-committing to any particular rate path.

Lagarde also addressed the current inflation dynamics, acknowledging that price pressures are gradually subsiding, although wage inflation remains a concern. However, forward-looking indicators suggest that wage growth is likely to moderate over the course of the year. She projected that inflation would continue to hover around current levels for the remainder of this year and would begin to approach 2% target in the latter half of 2025.

In the broader forex markets, activity has been notably subdued, with most major currency pairs and crosses trading within the previous day’s range. New Zealand Dollar, Australian Dollar, and Japanese Yen are currently the weaker performers, while Swiss Franc stands out as the strongest, followed by Euro and Dollar. The British Pound and Canadian Dollar are positioned in the middle of the pack.

In Europe at the time of writing, FTSE is up 0.28%. DAX is up 0.40%. CAC is up 0.29%. UK 10-year yield is down -0.0007 at 4.184. Germany 10-year yield is up 0.004 at 2.556. Earlier in Asia, Nikkei rose 0.55%. Hong Kong HSI rose 0.28%. China Shanghai SSE fell -0.54%. Singapore Strait Times rose 0.02%. Japan 10-year JGB yield fell -0..0394 to 0.966.

US initial jobless claims rises to 229k vs exp 215k

US initial jobless claims rose 8k to 229k in the week ending May 25, above expectation of 215k. Four-week moving average of initial claims fell -750 to 222k.

Continuing claims rose 2k to 1792k in the week ending May 25. Four-week moving average of continuing claims rose 3k to 1789k.

ECB cuts 25bps, inflation seen below 2% in 2026

ECB has lowered interest rates by 25 basis points as widely expected. Following the reduction, the main refinancing rate is now 4.25%, the deposit rate is 3.75%, and the marginal lending rate is 4.50%.

In its latest forecasts, the ECB projects economic growth to pick up to 0.9% in 2024, 1.4% in 2025, and 1.6% in 2026.

Inflation is expected to average 2.5% in 2024, 2.2% in 2025, and 1.9% in 2026. Core inflation is forecasted to average 2.8% in 2024, 2.2% in 2025, and 2.0% in 2026.

Notably, both headline and core inflation forecasts have been revised upward for 2024 and 2025.

Eurozone retail sales down -0.5% mom in Apr, EU falls -0.6% mom

Eurozone retail sales volume fell -0.5% mom in April, worse than expectation of -0.2% mom. Sales volume decreased for food, drinks, tobacco by 0.5%, for non-food products (except automotive fuel) by 0.1%, and for automotive fuel in specialised stores by 2.2%.

EU retail sales fell -0.6% mom. Among Member States for which data are available, the largest monthly decreases in the total retail trade volume were recorded in Latvia (-3.3%), Cyprus (-3.1%) and Denmark (-2.7%). The highest increases were observed in Slovakia (+2.4%), Bulgaria and Austria (both +1.9%) and Portugal (+1.7%).

BoJ’s Nakamura warns of inflation risks, advocates maintaining current policy

BoJ board member Toyoaki Nakamura, known for his dovish stance, cautioned in a speech today that “inflation may not reach 2 per cent from fiscal 2025 onward” if households reduce spending, which would discourage companies from further price hikes.

Nakamura highlighted that domestic consumption has been sluggish recently. He also pointed to the uncertainty surrounding the sustainability of wage increases, noting that the impact of rising wages on prices has been weak too.

Given the current data, Nakamura stated that it is appropriate to keep monetary policy unchanged for the time being. He was the sole dissenter in the BoJ’s decision to end eight years of negative interest rates and bond yield control in March.

EUR/USD Mid-Day Outlook

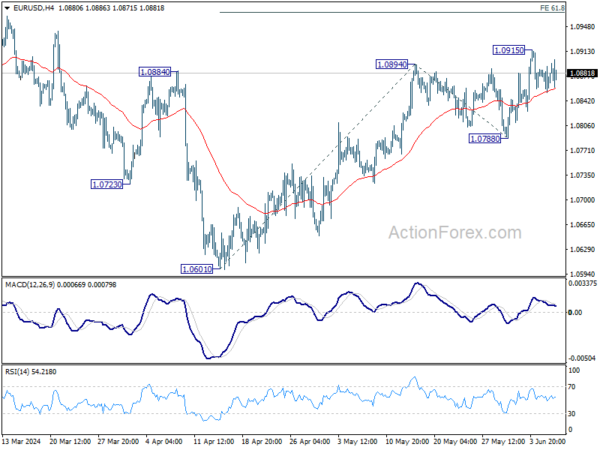

Daily Pivots: (S1) 1.0851; (P) 1.0872; (R1) 1.0889; More…

Intraday bias in EUR/USD remains neutral and outlook is unchanged. Further rally is expected as long as 1.0788 support holds. Break of 1.0915 will resume the rally from 1.0601 to 61.8% projection of 1.0601 to 1.0894 from 1.0788 at 1.0969. However, firm break of 1.0788 will turn bias back to the downside for deeper decline instead.

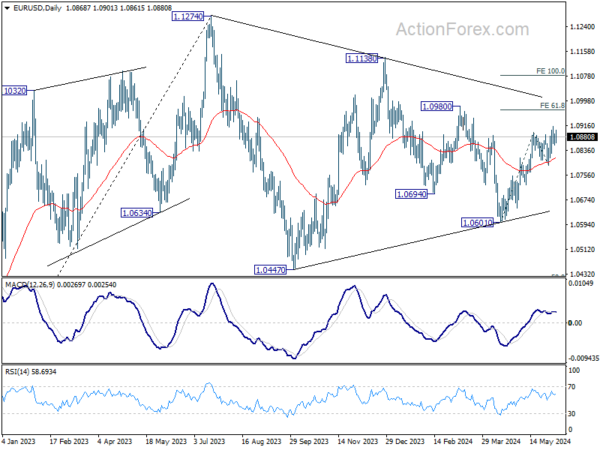

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern. Fall from 1.1138 is seen as the third leg and could have completed. Firm break of 1.1138 will argue that larger up trend from 0.9534 (2022 low) is ready to resume through 1.1274 high. On the downside, break of 1.0788 support will extend the corrective pattern instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) May | 6.55B | 5.50B | 5.02B | 4.84B |

| 05:45 | CHF | Unemployment Rate May | 2.40% | 2.30% | 2.30% | |

| 06:00 | EUR | Germany Factory Orders M/M Apr | -0.20% | 0.50% | -0.40% | |

| 08:00 | EUR | Italy Retail Sales M/M Apr | -0.10% | 0.30% | 0.00% | |

| 08:30 | GBP | Construction PMI May | 54.7 | 52.5 | 53 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Apr | -0.50% | -0.20% | 0.80% | 0.70% |

| 12:15 | EUR | ECB Rate On Deposit Facility | 3.75% | 3.75% | 4.00% | |

| 12:15 | EUR | ECB Main Refinancing Operations Rate | 4.25% | 4.25% | 4.50% | |

| 12:30 | USD | Trade Balance (USD) Apr | -74.6B | -69.8B | -69.4B | -68.6B |

| 12:30 | USD | Initial Jobless Claims (May 31) | 229K | 215K | 219K | |

| 12:30 | USD | Nonfarm Productivity Q1 | 0.20% | 0.30% | 0.30% | |

| 12:30 | USD | Unit Labor Costs Q1 | 4.00% | 4.70% | 4.70% | |

| 12:30 | CAD | Trade Balance (CAD) Apr | -1.05B | -2.2B | -2.3B | |

| 12:45 | EUR | ECB Press Conference | ||||

| 14:00 | CAD | Ivey PMI May | 65.2 | 63 | ||

| 14:30 | USD | Natural Gas Storage | 89B | 84B |