Euro drops broadly today after slightly weaker than expected German sentiment. Bundesbank also warned of significantly lower growth in Germany in Q4. Swiss France is following as second weakest. Yen is also soft following rally in major global treasury yields. On the other hand, Aussie is currently the strongest for today, followed by Dollar.

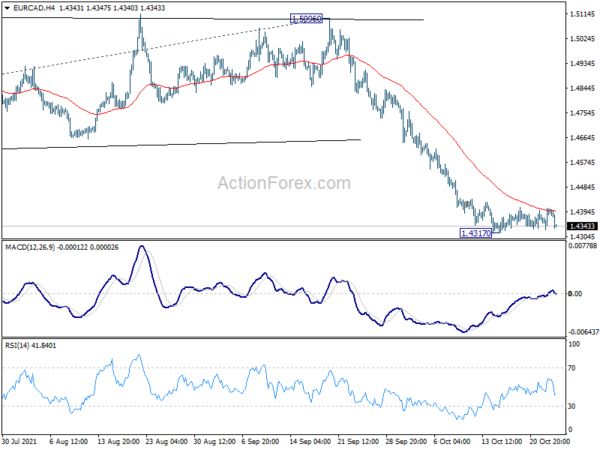

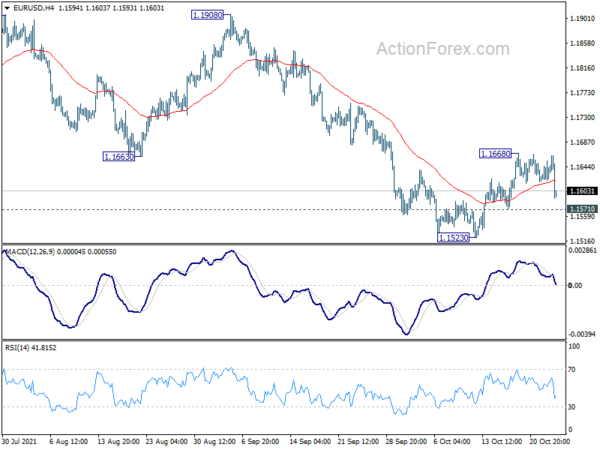

Technically, attention is now on whether Euro’s selloff would result in broad based decline resumption. In particular, levels to watch include temporary lows in EUR/GBP at 0.8420, in EUR/AUD at 1.5456, and in EUR/CAD in 1.4317. Meanwhile, break of 1.1571 minor support in EUR/USD and 0.9251 minor resistance in USD/CHF could be signs of come back in Dollar. But that’s still a bit far for now.

In Europe, at the time of writing, FTSE is up 0.32%. DAC is up 0.32%. CAC is down -0.16%. Germany 10-year yield is up 0.0124 at -0.088. Earlier in Asia, Nikkei dropped -0.71%. Hong Kong HSI rose 0.02%. China Shanghai SSE rose 0.76%. Singapore Strait Times dropped -0.10%. Japan 10-year JGB yield rose 0.0030 to 0.101.

Bundesbank: German economy to growth significantly weaker in Q4

Bundesbank said in the monthly report that inflation in Germany “continue to rise before it gradually declines in the coming year.” Industrial products prices continued to increase. Energy prices have risen mainly due to higher oil prices. “On the other hand, the considerably higher spot market prices for natural gas will probably only have an impact on consumer prices after the turn of the year.”

The economy is expected to “growth significantly weaker” in Q4. Strong momentum in service sector is “likely to subside considerably” too. Manufacturing is likely to “continue to suffer from delivery problems. Output will probably “still fall short of its pre-crisis level of the final quarter of 2019 in Autumn. For 2021, GDP growth is likely to be “significantly less than was expected in the Bundesbank’s June projection.

Germany Ifo dropped to 97.7, sand in the wheels hampering recovery

Germany Ifo Business Climate dropped slightly to 97.7 in October, down from 98.8, missed expectation of 97.8. Current Assessment dropped to 100.1, down from 100.4, above expectation of 99.3. Expectations index dropped to 95.4, down from 97.3, below expectation of 96.1.

By sector manufacturing dropped from 20.0 to 17.2. Service dropped from 191. to 16.5. Trade dropped notably from 9.0 to 3.7. Construction rose from 11.1 to 12.9.

Ifo said: “Supply problems are giving businesses headaches. Capacity utilization in manufacturing is falling. Sand in the wheels of the German economy is hampering recovery.”

ECB de Cos: High commodity prices have transitory nature, but may persist

ECB Governing Council member Pablo Hernandez de Cos warned that supply chain problems and rising raw material prices affected the pace of economic recovery negatively. “Recent developments anticipate a significant downward economic outlook revision for 2021.”

“We’ll keep observing relatively high inflation rates in coming months,” he added. “High commodity prices have transitory nature, though we cannot rule out price hike will persist over coming months.” In particular, “high energy prices may persist through winter as oil and gas storage is relatively low.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1625; (P) 1.1640; (R1) 1.1660; More…

EUR/USD drops sharply today but stays above 1.1571 minor support. Intraday bias remains neutral at this point. On the upside, break of 1.1668 will target 55 day EMA (now at 1.1705). Sustained break there will be a sign that larger correction from 1.2348 has completed. Stronger rally would be seen to 1.1908 resistance for confirmation. On the downside, though, break of 1.1571 minor support will turn bias back to the downside for 1.1523 support instead. Break there will resume larger fall from 1.2348.

In the bigger picture, price actions from 1.2348 should at least be a correction to rise from 1.0635 (2020 low). As long as 1.1908 resistance holds, deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289. Nevertheless break of 1.1908 resistance will revive medium term bullishness and turn focus back to 1.2348 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 8:00 | EUR | Germany IFO Business Climate Oct | 97.7 | 97.8 | 98.8 | |

| 8:00 | EUR | Germany IFO Current Assessment Oct | 100.1 | 99.3 | 100.4 | |

| 8:00 | EUR | Germany IFO Expectations Oct | 95.4 | 96.1 | 97.3 |