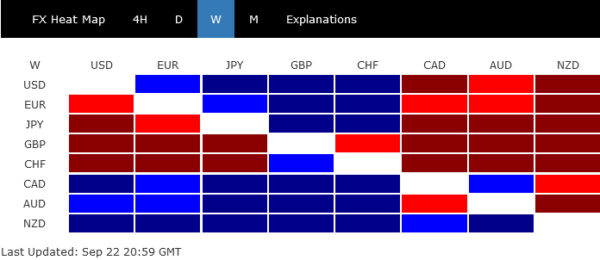

Despite a confluence of favorable conditions that are typically Dollar bullish — a decidedly hawkish Federal Reserve, plummeting stocks, and soaring yields — the greenback’s response was unexpectedly tepid last week. While it managed to gain ground against European majors and Yen, it faltered when squared against the robust commodity currencies. Dollar Index, a measure of the currency against a basket of other major currencies, also recorded only a modest uptick. With the quarter’s end on the horizon, it’s plausible that a sense of caution may have restrained Dollar’s potential surge. Alternatively, traders might possibly be awaiting further developments to validate a one-sided bullish shift.

The week was notably tough for Sterling and Swiss Franc. Both currencies took a hit after their respective central banks, BoE and SNB, caught market participants off-guard with decisions to maintain their interest rates unchanged. There’s mounting speculation that both these institutions might have hit the ceiling of their tightening cycles. Euro, despite facing its own challenges, found some reprieve from the buying against these two European rivals, which in turn, acted as a buffer against surging Dollar.

Meanwhile, Japanese Yen emerged as the week’s third most lackluster performer, following Pound and Franc. BoJ’s decision to remain tight-lipped about potential policy adjustments did the currency no favors. However, fears surrounding potential intervention are lending some support to Yen, anchoring it securely above 150 mark against Dollar.

In a surprising twist, commodity currencies stood out as the week’s top performers. Their rise can be dissected into several catalysts. Market bets are tilting towards BoC potentially breaking its pause for a second time, particularly in light of Canada’s robust inflation figures. The narrative surrounding RBA remains more ambivalent, with market consensus yet to crystallize on the possibility of another rate hike within the fourth quarter, potentially in November. However, the primary tailwind for commodity currencies appears to be the revitalized Chinese stock markets, endowing them with substantial impetus.

Dollar bulls remain wary despite hawkish Fed, surging yields, and falling stocks

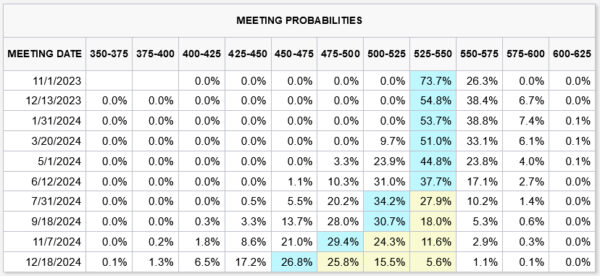

The US markets faced a turbulent last week after Fed’s hawkish hold at 5.25-5.00%. While Fed’s messages were clear that interest rates are going to stay “higher for longer”, overall developments argue that investors are much less convinced on the “higher” part than the “longer”.

S&P 500 and NASDAQ experiencing notable drops of -2.9% and -3.6% respectively, marking both indexes’ most dismal weekly performance since March and their third consecutive week in the red. 10-year Treasury yield reached its highest point since 2007, while 2-year rate recorded its apex since 2006. Despite the risk aversion sentiment and elevated yields, Dollar index only nudged up by a mere 0.002%. Dollar would probably need to be convinced about the “higher” part before having another substantial break on the upside.

To recap, Fed’s messages were unequivocal – another rate hike this year is in the offing. Out of 19 policymakers, 12 have projected another 25bps rate hike to 5.50-5.75% by the year’s end. Interest rates will remain elevated for a protracted period. By the conclusion of 2024, rate is anticipated to drop backs slightly to 5.10%.

However, market sentiment doesn’t seem wholly aligned with Fed’s projections. Current indications from Fed fund futures underscore only a 26.3% likelihood of a hike in November, and 46.3% in December. On the other hand, here’s a whopping 90% chance that by 2024-end, interest rates will have reverted to 5.00-5.25% or even lower.

On the technical side, S&P 500’s fall from 4607.07 resumed last week by breaking through 4335.31 support. Next target is the support zone between 55 W EMA (now at 4228.09) and 38.2% retracement of 3491.58 to 4607.07 at 4180.95. Strong rebound from there level will maintain near term bullishness for extending the whole rise from 3491.58 at a later stage. However, sustained break of 4180.95 will argue that SPX is already in a medium term down trend, as the third leg of the corrective pattern from 4818.62 (2021 high). In any case, risk will stay on the downside as long as 55D EMA (now at 4430.30) holds.

10-year yield surged sharply to as high as 4.490 (in regular hours), before closing at 4.438. Near term outlook will stay bullish as long as 4.223 support holds. Daily MACD suggests upside re-acceleration while W MACD doesn’t indicate loss of momentum. Current rally might target 61.8% projection of 1.343 to 4.333 from 4.253 at 5.100, which is above 5% handle.

Dollar index edged higher to close at 105.58 but failed to break through 105.88 resistance. But upside momentum is unconvincing as seen in D MACD. It’s still unsure if rise from 99.57 is just correcting the down trend from 114.77 (2022 high), or reversing it. DXY is now at a juncture.

Rejection by 105.88, followed by break of 104.42 support will affirm the former case, and bring deeper fall back to 55 D EMA (now at103.73). However, decisive break of 105.88 will affirm the latter case, and target 61.8% retracement of 114.77 to 99.57 at 108.96 next.

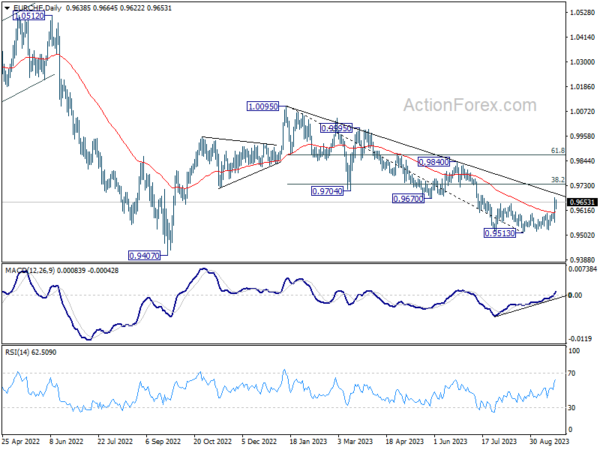

EUR/CHF and EUR/GBP in medium term rallies after BoE and SNB holds

Sterling ended as the weakest currency last week, following the shock move of BoE which kept interest rates steady. This decision became notably significant, given that key figures like Governor Andrew Bailey, Deputies Ben Broadbent and Dave Ramsden, and Chief Economist Huw Pill, in alignment with Swati Dhingra, edged out a close 5-4 vote.

In response, a slew of prominent global banks, including Barclays, BNP Paribas, Citigroup, Deutsche Bank, Goldman Sachs, JP Morgan, UBS, and HSBC, have revised their forecasts. Now, the prevalent expectation is that BoE’s current 5.25% rate might mark the peak of this cycle.

Swiss Franc followed closely behind Sterling’s tumble, ranking as the second-worst performer. This came after SNB chose to maintain status quo, defying market anticipations of a rate increase. Yen wasn’t far behind, securing the third spot, as BoJ refrained from providing any hints regarding potential monetary policy adjustments or an exit from negative rates.

On the technical front, EUR/CHF and EUR/GBP are gearing up for a potential medium-term rally as the aftermath of ECB’s recent rate hike combined with BoE’s and SNB’s inaction. However, given that all three central banks have reached their peak in tightening, the long-term trends will hinge on the intensity and span of the potential upcoming recessions in the region, as well as the implications on the timing for the inaugural rate cut. Still for the immediate future, the dynamics within EUR/CHF and EUR/GBP might alleviate some of the downward pressure on EUR/USD and subsequently limit upward momentum of Dollar Index.

Specifically, a medium term bottom is probably in place at 0.9513 in EUR/CHF, on bullish convergence condition in D MACD. Sustained break of 0.9670 support turned resistance will argue that whole decline from 1.095 has completed, and bring stronger rally to 61.8% retracement at 0.9873.

Similarly, for EUR/GBP, firm break of 0.8700 resistance should confirm medium term bottoming at 0.8491, on bullish convergence condition in D MACD. That would also argue that whole down trend from 0.9267 (2022 high) has completed with three waves down to 0.8491. Stronger rally would then be seen to 0.8874/8997 resistance zone.

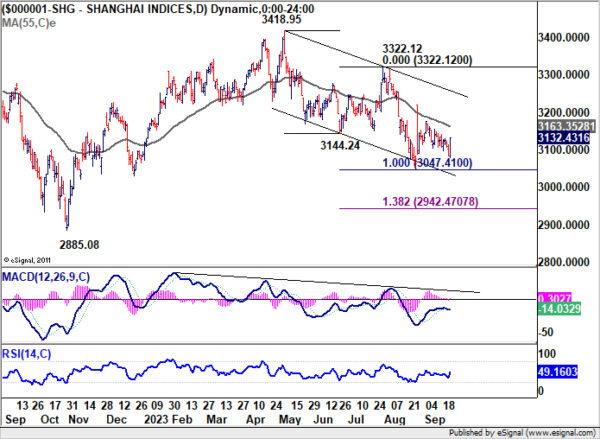

China’s move to relax capital controls bolsters commodity currencies

In a move that defied the prevailing risk aversion in US markets, commodity currencies took the lead as the week’s strongest performers. The uplift seems largely tethered to shifting sentiments in the Chinese financial arena.

A marked turnaround was observed in Chinese stocks on Friday, following the nation’s announcement of plans to liberalize capital controls in major cities, Beijing and Shanghai. This initiative would grant foreigners more flexibility to channel their funds into and out of the country.

China’s move, as articulated by the government, aims to entice overseas investors by paving the way for a more open economy. This could mark a seminal shift, given China’s traditionally stringent capital controls.

Technically speaking, there is no confirmation of trend reversal in China Shanghai SSE index for now, as sit’s still capped well below falling 55 D EMA (now at 3161.35). The decline from 3418.95 could still extend to 100% projection of 3418.95 to 3144.24 from 3322.12 at 3047.41, or even further to 138.2% projection at 2942.47.

Nonetheless, a continued stream of encouraging economic data, coupled with strategic government interventions, could provide the necessary momentum for the index to challenge the aforementioned EMA at least.

USD/CAD Weekly Outlook

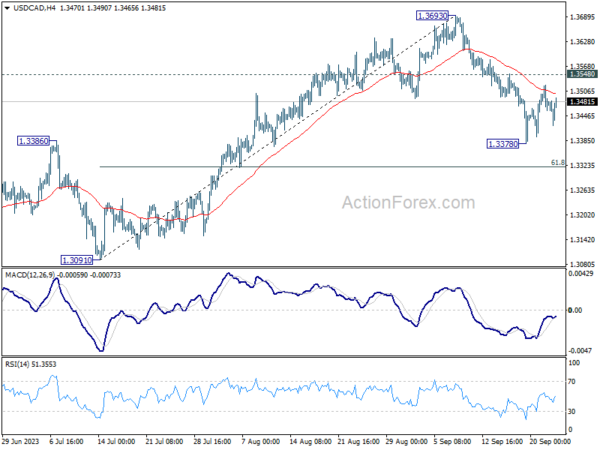

USD/CAD’s deep decline last week argues that rise from 1.3091 might have completed at 1.3693 already. Fall from there is probably another leg in the corrective pattern from 1.3976 high. Initial bias stays neutral this week for consolidation above 1.3378 temporary low. But risk stays on the downside as long as 1.3548 resistance holds. Below 1.3378 will target 61.8% retracement of 1.3091 to 1.3693 at 1.3321.

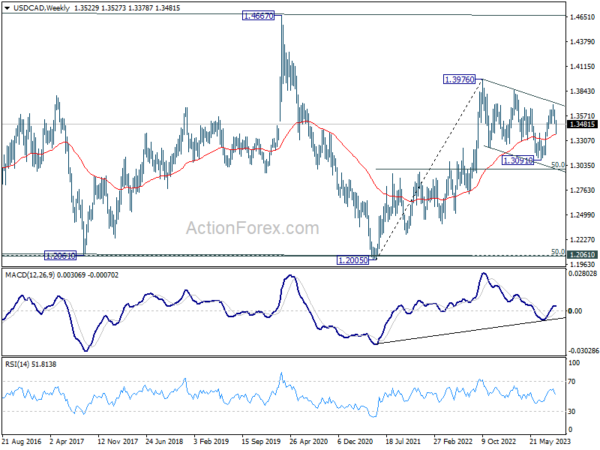

In the bigger picture, price actions from 1.3976 are viewed as a corrective pattern to the up trend from 1.2005 (2021 low). Deeper decline could be seen as the pattern is now extending. But downside should be contained by 50% retracement of 1.2005 to 1.3796 at 1.2991. Rise from 1.2005 is still expected to resume after the correction completes.

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern only, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as 55 M EMA (now at 1.3082) holds.