Dollar is facing renewed pressure against European majors in early US trading sessions due to faster-than-expected declines in headline inflation. However, it continues to hold strong against Japanese Yen, which remains the worst performer for both the day and the week. Yen is continuing the post-BoJ selloff, with no signs of stopping as of yet. Euro is weaker compared to British Pound the Swiss Franc after mixed GDP data, while the Australian and Canadian dollars are not faring much better.

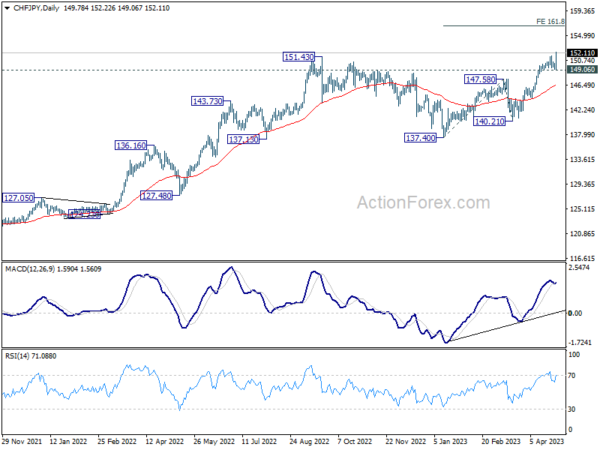

On the technical side, CHF/JPY broke through 151.43 high convincingly today, a resumption of the long-term uptrend. Near-term outlook will remain bullish as long as 149.06 support level holds. The cross could now enter acceleration phase, targeting 161.8% projection of 137.40 to 147.58 from 140.21 at 156.68.

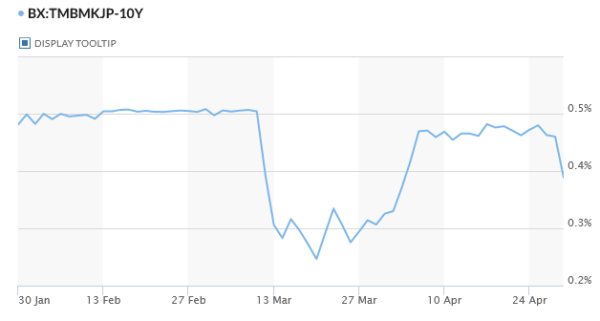

In Europe at the time of writing, FTSE is up 0.13%. DAX is up 0.20%. CAC is down -0.42%. Germany 10-year yield is down -0.1117 at 2.350. Earlier in Asia, Nikkei surged 1.40%. Hong Kong HSI rose 0.27%. China Shanghai SSE rose 1.14%. Singapore Strait Times dropped -0.35%. Japan 10-year JGB yield tumbled sharply by -0.0713 to 0.389.

US PCE inflation slowed to 4.2% yoy, core PCE slightly down to 4.6% yoy

US personal income rose 0.3% mom or USD 67.9B in March, above expectation of 0.2% mom. The increase in income primarily reflected increases in compensation, personal income receipts on assets, and rental income of persons that were partly offset by decreases in proprietors’ income and personal current transfer receipts

Personal spending rose less than 0.1% mom or USD 8.2B, better than expectation of -0.1% mom contraction. The increase reflected a USD 44.9 billion increase in spending for services that was partly offset by a USD 36.7 billion decrease in spending for goods

For the month PCE price index increased 0.1% mom. Excluding food and energy, PCE price index increased 0.3% mom. Prices for goods decreased -0.2% mom and prices for services increased 0.2%. Food prices decreased -0.2% and energy prices decreased -3.7% mom.

From the same month one year ago, PCE price index March slowed from 5.1% yoy to 4.2% yoy, below expectation of 4.6% yoy. Excluding food and energy, PCE price index ticked down from 4.7% yoy to 4.6% yoy, above expectation of 4.6% yoy. Prices for goods increased 1.6 yoy and prices for services increased 5.5% yoy. Food prices increased 8.0% yoy and energy prices decreased 9.8% yoy.

Canada GDP grew 0.1% mom in Feb, but down -0.1% in Mar

Canada GDP grew 0.1% mom in February, below expectation of 0.2% mom. Both services-producing industries and goods-producing industries edged up 0.1%. Overall, 12 of 20 subsectors increased.

Advance information indicates that real GDP edged down -0.1% in March. This advance information indicates a 0.6% increase in real GDP by industry in the first quarter of 2023.

Eurozone GDP rose 0.1% qoq in Q1, EU up 0.3 qoq

Eurozone GDP grew 0.1% qoq in Q1, matched expectations. EU GDP rose 0.3% qoq. Germany GDP stalled in Q1 (price, seasonally and calendar adjusted), below expectation of 0.1% qoq growth. France’s Q1 GDP growth came in at a modest 0.2% qoq, slightly outperforming market expectations of 0.1% qoq.

Swiss KOF dropped to 96.4, the economy cannot find its footing

Swiss KOF Economic Barometer dropped from 99.2 to 96.4 in April, dipping slightly lower under its medium-term average value. KOF said, “at the moment, the Swiss economy cannot really find its footing.”

The majority of the indicator bundles are affected by the softening. In particular, the indicators for manufacturing, services, hospitality and private consumption. In contrast, the outlook for foreign demand is stable and that for financial and insurance services is brightening.

BoJ stands pat, to take 1-1.5 yrs to review monetary policy

BoJ keeps monetary policy unchanged as widely expected, by unanimous vote. Under the yield curve control, short-term policy interest rate is held at -0.10%. 10-year JGB yield will be kept at around 0% with bond purchases without upper limit. 10-year JGB yield will continue to be allowed to fluctuate in range of around plus and minus 0.50% from 0% level.

The central bank maintained the pledge to continue with Quantitative and Qualitative Monetary Easing with Yield Curve Control for “as long as it is necessary” for meeting inflation target in a “stable manner”. It “will not hesitate to take additional easing measures if necessary”. BoJ will conduct a “broad-perspective review of monetary policy”, with a planned time frame of around 12 to 18 months.

In the new economic projections, while core inflation forecasts were upgraded, it’s not expected to sustain at the 2% level throughout the horizon.

- Real GDP forecasts (versus January estimates):

- Fiscal 2023 at 1.4% (down from 1.7%).

- Fiscal 2024 at 1.2% (up from 1.1%).

- Fiscal 2025 at 1.0% (new)

- CPI Core forecasts (versus January estimates):

- Fiscal 2023 at 1.8% (up from 1.6%).

- Fiscal 2024 at 2.0% (up from 1.8%).

- Fiscal 2025 at 1.6% (new).

- CPI Core-Core forecasts (versus January estimates):

- Fiscal 2023 at 2.5% (up from 1.8%).

- Fiscal 2024 at 1.7% (up from 1.6%).

- Fiscal 2025 at 1.8% (new).

Japan industrial production rose 0.8% mom, with signs of moderate pick up

Japan’s industrial production expanded for the second consecutive month, recording a 0.8% mom growth in March, surpassing the expected 0.4% mom increase. The growth was driven by output in eight sectors, led by motor vehicles, while declines were observed in seven sectors, including electronic components and devices.

The Ministry of Economy, Trade and Industry upgraded its basic assessment for the month, stating that industrial production was “showing signs of moderately picking up” as parts supply shortages continued to ease. This is a marked improvement from the previous month’s assessment of “weakening.” The ministry also projects a further 4.1% growth in industrial production for April and a -2.0% decline in May.

Other economic indicators released include 7.2% yoy increase in retail sales for March, surpassing expectations of 6.5% yoy. However, unemployment rate rose for the second month in a row, reaching 2.8%, above expectation of 2.5%.

April, Tokyo core CPI, which excludes fresh food, accelerated from 3.2% to 3.5% yoy, exceeding expectations of 3.2% yoy. Core-core CPI, which excludes fresh food and fuel costs, accelerated from 3.4% to 3.8% year-on-year, marking the highest rate since April 1982.

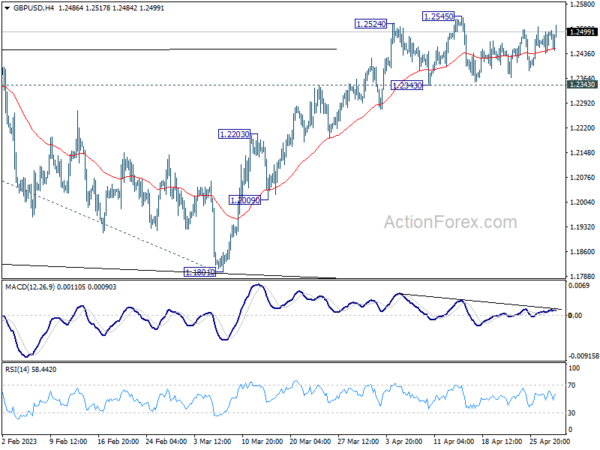

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2456; (P) 1.2479; (R1) 1.2520; More…

GBP/USD extends the near term choppy recovery but stays below 1.2545 resistance. Intraday bias remains neutral at this point. Outlook remains bullish with 1.2343 support intact. On the upside, above 1.2545 will target 1.2759 fibonacci level first. Firm break there will target 61.8% projection of 1.0351 to 1.2445 from 1.1801 at 1.3095. However, considering bearish divergence condition in 4H MACD, firm break of 1.2343 will confirm short term topping, and turn bias back to the downside for deeper pullback.

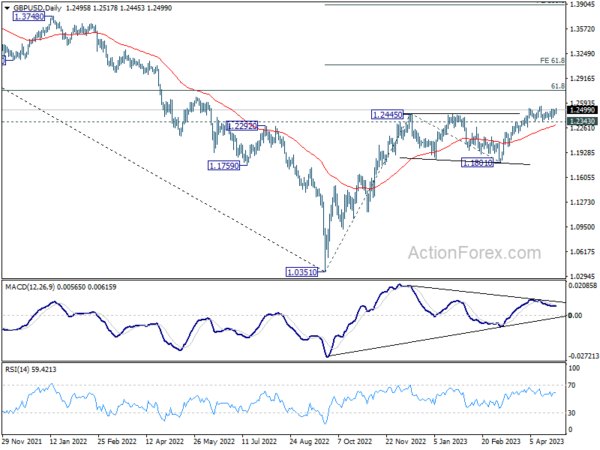

In the bigger picture, the rise from 1.0351 medium term term bottom (2022 low) is in progress for 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759. Sustained break there will add to the case of long term bullish trend reversal. Further break of 61.8% projection of 1.0351 to 1.2445 from 1.1801 at 1.3095 could prompt upside acceleration to 100% projection at 1.3895. For now, this will remain the favored case as long as 1.1801 support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Apr | 3.50% | 3.20% | 3.20% | |

| 23:50 | JPY | Industrial Production M/M Mar P | 0.80% | 0.40% | 4.60% | |

| 23:50 | JPY | Retail Trade Y/Y Mar | 7.20% | 6.50% | 6.60% | 7.30% |

| 23:30 | JPY | Unemployment Rate Mar | 2.80% | 2.50% | 2.60% | |

| 01:30 | AUD | Private Sector Credit M/M Mar | 0.30% | 0.30% | 0.30% | |

| 01:30 | AUD | PPI Q/Q Q1 | 1.00% | 1.50% | 0.70% | |

| 01:30 | AUD | PPI Y/Y Q1 | 5.20% | 5.80% | 5.80% | |

| 04:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 05:00 | JPY | Housing Starts Y/Y Mar | -3.20% | -3.70% | -0.30% | |

| 05:30 | EUR | France GDP Q/Q Q1 P | 0.20% | 0.10% | 0.10% | |

| 06:00 | EUR | Germany Import Price Index M/M Mar | -1.10% | -0.90% | -2.40% | |

| 06:30 | CHF | Real Retail Sales Y/Y Mar | -1.90% | 0.40% | 0.30% | -0.50% |

| 07:00 | CHF | KOF Leading Indicator Apr | 96.4 | 98 | 98.2 | 99.2 |

| 07:55 | EUR | Germany Unemployment Change Mar | 24K | 10K | 16K | |

| 07:55 | EUR | Germany Unemployment Rate Mar | 5.60% | 5.60% | 5.60% | |

| 08:00 | EUR | Germany GDP Q/Q Q1 P | 0.00% | 0.10% | -0.40% | |

| 08:00 | EUR | Italy GDP Q/Q Q1 P | 0.50% | 0.20% | -0.10% | |

| 09:00 | EUR | Eurozone GDP Q/Q Q1 P | 0.10% | 0.10% | 0.00% | |

| 12:00 | EUR | Germany CPI M/M Apr P | 0.40% | 0.60% | 0.80% | |

| 12:00 | EUR | Germany CPI Y/Y Apr P | 7.20% | 7.30% | 7.40% | |

| 12:30 | CAD | GDP M/M Feb | 0.10% | 0.20% | 0.50% | |

| 12:30 | USD | Personal Income M/M Mar | 0.30% | 0.20% | 0.30% | |

| 12:30 | USD | Personal Spending Mar | 0.00% | -0.10% | 0.20% | 0.10% |

| 12:30 | USD | PCE Price Index M/M Mar | 0.10% | 0.30% | 0.30% | |

| 12:30 | USD | PCE Price Index Y/Y Mar | 4.20% | 4.60% | 5.00% | 5.10% |

| 12:30 | USD | Core PCE Price Index M/M Mar | 0.30% | 0.30% | 0.30% | |

| 12:30 | USD | Core PCE Price Index Y/Y Mar | 4.60% | 4.50% | 4.60% | 4.70% |

| 12:30 | USD | Employment Cost Index Q1 | 1.20% | 1.10% | 1.00% | |

| 13:45 | USD | Chicago PMI Apr | 43.7 | 43.8 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Apr F | 63.5 | 63.5 |