Dollar tumbles in US session after another huge non-farm payroll miss. On the other hand, Canadian Dollar surges notably after solid employment data. As for the week, the Loonie is now in a pole position to end as the strongest. Yen is still the worst performing, but we’d see if Dollar would over take its position before ending the week.

In Europe, at the time of writing, FTSE is up 0.16%. DAX is up 0.03%. CAC is down -0.18%. Germany 10-year yield is up 0.010 at -0.172. Earlier in Asia, Nikkei rose 1.34%. Hong Kong HSI rose 0.55%. China Shanghai SSE rose 0.67%. Singapore Strait Times rose 0.38%. Japan 10-year JGB yield rose 0.0101 to 0.088.

US non-farm payroll grew 194k in Sep, well below expectation

US non-farm payroll employment grew 194k only in September, well below expectation of 500k. Total employment is still down by -5.0m, or -3.3% from its pre-pandemic level in February 2020. Unemployment rate dropped notably from 5.2% to 4.8%, better than expectation of 5.1%. Labor force participation rate was little changed at 61.6%. Average hourly earnings rose 0.6% mom versus expectation of 0.5% mom.

Canada employment grew 157k in Sep, regained pre-pandemic level

Canada employment grew 157k, or 0.8% mom in September, well above expectation of 61.2k. Employment regained pre-pandemic level in February 2020. Jobs in services-producing sector surpassed pre-COVID level but was still down -3.2% in goods-producing sector. Unemployment rate dropped from 7.1% to 6.9%, matched expectations. Labor force participation rate was at 65.5, also matched pre-pandemic levels.

China Caixin PMI services rose to 53.4, PMI composite rose to 51.4

China Caixin PMI Services rose to 53.4 in September, up from August’s 46.7, above expectation of 49.3. PMI Composite rose to 51.4, up from 47.2 in August.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Both market supply and demand recovered, and improvement in the services sector was stronger than in the manufacturing sector. Impacted by the pandemic, overseas demand was weak. Employment was stable overall. Prices gauges remained high, indicating strong inflationary pressure.”

Elsewhere

Japan labor cash earnings rose 0.7% yoy in August, versus expectation of 0.3% yoy. Household spending dropped -3.0% yoy, versus expectation of -1.5% yoy. Current account surplus narrowed to JPY 1.04T.

Germany trade surplus narrowed to EUR 13.0B in August, below expectation of EUR 15.7B.

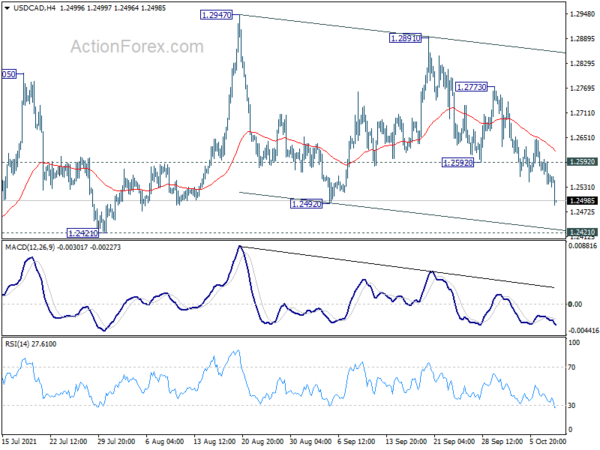

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.2527; (P) 1.2564; (R1) 1.2586; More…

USD/CAD’s decline continues today and breaches 1.2492 support. Current decline is seen as the third leg of the pattern from 1.2947, and intraday bias stays on the downside for the moment. Overall, with 1.2421 support intact, rise from 1.2005 should still be in progress for another rise through 1.2947 at a later stage. On the upside, break of 1.2592 will turn bias back to the upside for 1.2773 resistance first. However, sustained break of 1.2421 will argue that larger rise from 1.2005 has completed and turn near term outlook bearish.

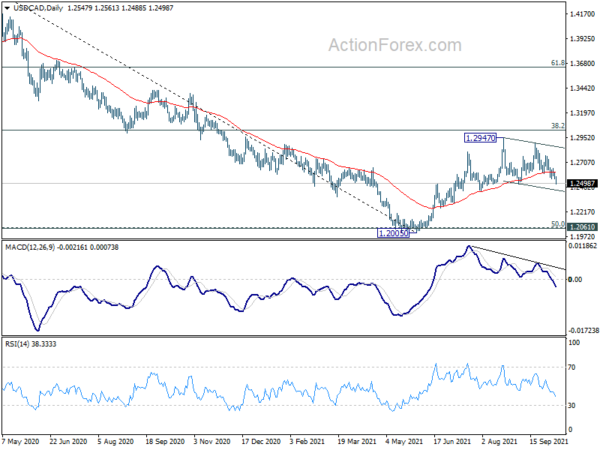

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). It should have completed after hitting 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048. Sustained break of 38.2% retracement of 1.4667 to 1.2005 at 1.3022 will pave the way to 61.8% retracement at 1.3650 and above. Overall, medium term outlook remains neutral at worst with 1.2048/61 support zone intact.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Aug | 0.70% | 0.30% | 0.60% | |

| 23:30 | JPY | Overall Household Spending Y/Y Aug | -3.00% | -1.50% | 0.70% | |

| 23:50 | JPY | Current Account (JPY) Aug | 1.04T | 1.15T | 1.41T | |

| 01:45 | CNY | Caixin Services PMI Sep | 53.4 | 49.3 | 46.7 | |

| 05:00 | JPY | Eco Watchers Survey: Current Sep | 42.1 | 43.4 | 34.7 | |

| 06:00 | EUR | Germany Trade Balance (EUR) Aug | 13.0B | 15.7B | 17.9B | |

| 11:00 | GBP | BoE Quarterly Bulletin | ||||

| 12:30 | USD | Nonfarm Payrolls Sep | 194K | 500K | 235K | 366K |

| 12:30 | USD | Unemployment Rate Sep | 4.80% | 5.10% | 5.20% | |

| 12:30 | USD | Average Hourly Earnings M/M Sep | 0.60% | 0.40% | 0.60% | 0.40% |

| 12:30 | CAD | Net Change in Employment Sep | 157.1K | 61.2K | 90.2K | |

| 12:30 | CAD | Unemployment Rate Sep | 6.90% | 6.90% | 7.10% | |

| 14:00 | USD | Wholesale Inventories Aug F | 1.20% | 1.20% |