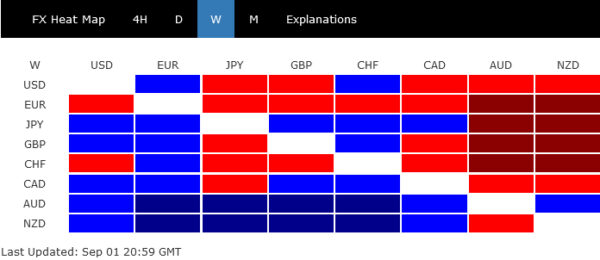

In a week marked by high volatility, Dollar proved resilient, closing within its established range against other major currencies after intra-week selloff. This performance quells, at least for now, fears of bearish reversal for the greenback. Indeed, sentiment has shifted to favor near-term upside for Dollar, which is likely to maintain its strength at least until Fed releases new economic projections later this month.

Contrastingly, Euro emerged as the week’s weakest performer amid rising expectations that ECB will hit the pause button on interest rate changes this month. Weakness in Euro has also dragged down Swiss Franc, which ended as the week’s second-worst performer. British Pound lingered not far behind, showing vulnerability against the resilient Dollar.

Australian Dollar was the best performer of the week, buoyed by improving sentiment towards China’s economy. However, this rally appears to be in corrective mode only, lacking decisive momentum needed to confirm a sustained uptrend. Consequently, renewed wave of selling could emerge at any moment, particularly if optimism about China’s economic outlook starts to wane. Following closely behind was New Zealand Dollar, which also enjoyed a strong week. Yen ended mixed as the pull back in major benchmark yields didn’t last long.

Dollar’s volatile week ends on a high note

Dollar faced significant volatility last week, flirting with the risk of a near-term bearish reversal before making a sharp U-turn on Friday. This renewed bullishness keeps the prospect for more upside in the greenback alive, albeit not without hurdles.

The eagerly watched non-farm payroll data gave investors a balanced view of the US economy: the labor market showed just enough loosening to deter immediate Fed rate action, but not so much as to raise concerns about a recession. Supplementing this positive outlook, recovering ISM manufacturing data offered a glimmer of hope that the worst may be over for that sector.

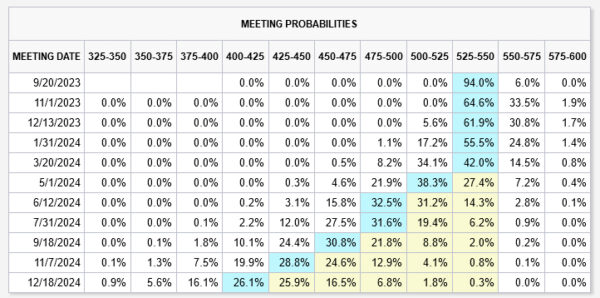

Market expectations for Fed to maintain its current rate held steady, with Fed fund futures now pricing in 94% chance of a hold this month. The likelihood of another rate hike this year has dipped to below 36%. There’s a 65% probability being priced in for a rate cut by May of next year—a projection that appears overly optimistic given that overall economic growth is outpacing the trend and inflation is well above Fed’s target.

All eyes will now be on Fed’s new set of economic projections and dot plot, scheduled for release on September 20. These could potentially recalibrate market expectations and pricing metrics significantly.

On the technical front, Dollar Index successfully defended its near-term support at 102.84, bouncing to close the week at 104.23. Near term bullishness is maintained for extending the rally from 99.57 through 104.44. But loss of upside momentum, as seen in D MACD, could limited upside at 38.2% retracement of 114.77 to 99.57 at 105.37.

Should the index break 102.84 support level, it would signify that the recent rebound has run its course. Conversely, sustained break of 105.37 could argue that Dollar Index is on track to reverse the downtrend from 2022 high of 114.77, altering the broader market narrative.

Euro stumbles as ECB pause gains traction amid recession risks

Euro emerged as the week’s worst-performing currency, reflecting growing market sentiment that ECB may hold off on policy changes in its upcoming meeting. Money markets are currently pricing in more than 70% chance that ECB will stay put on September 14, a stark contrast to last week when odds of a rate hike stood at 60%.

Starkly contrasting the US, economic landscape in Eurozone is becoming increasingly fraught, caught between the dual pressures of recession and inflation. Recent PMI data offered little comfort, particularly with disconcerting trends emerging from Germany, the “sick man of Europe”. ECB Executive Board member Isabel Schnabel, traditionally a hawkish voice, has also turned cautious in her recent speech, signaling downside risks to economic growth and refraining from taking a firm stance on the September meeting. Inflation data for August further complicated the picture; while the flash CPI remained stable at 5.5%, core CPI eased to 5.3%.

Minutes from ECB’s July meeting offered no clarity either, painting a divided stance among the central bank’s members. While some argued for a rate hike in September, should inflation not recede as expected, others countered that new ECB staff projections could show a downward revision in the inflation path, rendering another rate hike unwarranted.

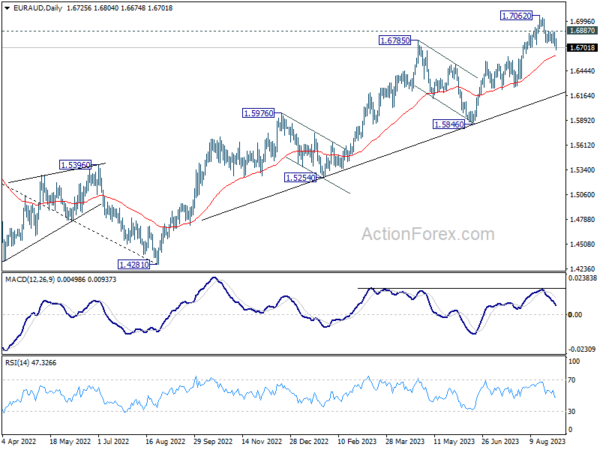

EUR/AUD was the top mover last week, closing down -0.93%. For now, the fall form 1.7062 is still seen as a near term correction only. While deeper decline is in favor as long as 1.6887 resistance holds, strong support could be seen from 55 D EMA (now at 1.6612) to contain downside to complete the fall. However, sustained break of the EMA will raise the change that the cross is in a larger scale correction, and prompt deeper fall to medium term trend line support (now at 1.6177).

Australian dollar rides higher on Chinese policy moves

Talking about Australian Dollar, it ended as the strongest one for the week, buoyed by a series of encouraging developments from China and a rebound in copper prices. However, Aussie’s recent upswing appears more of a corrective move than a sustainable rally, suggesting downside risk remains for an extension of its recent downtrend.

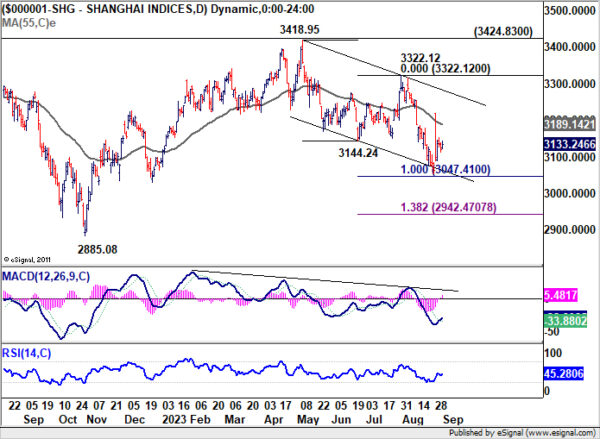

China began the week by slashing stamp duty on stock trading by half, aimed at revitalizing its capital markets and bolstering investor sentiment. This was followed by a significant 200 basis point cut in the foreign exchange reserve requirement ratio by the People’s Bank of China on Friday, reducing it from 6% to 4% in a bid to alleviate downward pressure on the Yuan. In between, official PMI Manufacturing data for August showed a marginal rise, while Caixin PMI Manufacturing Index advanced turned back into expansion.

Though these developments led Shanghai SSE to close higher, the lackluster upside momentum just mixed up the near term outlook, rather than turning it bullish. On the one hand, fall from 3148.95 could have completed as a three-wave correction, slightly ahead of 100% projection of 3418.95 to 3144.24 from 3322.12 at 3047.41. However, sustained break above 55 D EMA (now at 3819.14) is needed to instill greater confidence. Conversely, firm break below 3047.31 could resume the descent to 138.2% projection level at 2924.47.

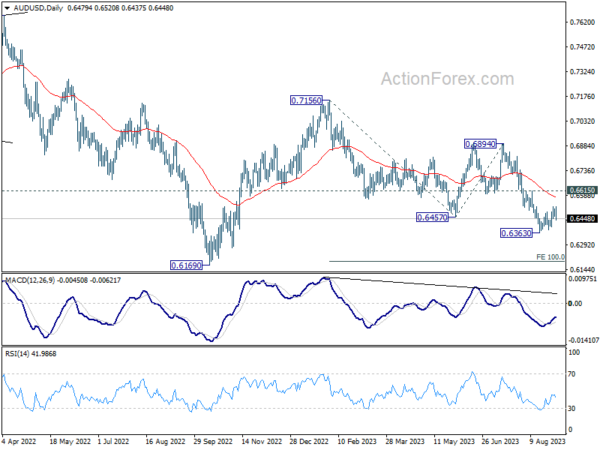

As for AUD/USD, the structure of the recovery from 0.6363 is corrective looking. Upside is capped below falling 55 D EMA (now at 0.6573). Near term outlook is staying bearish for another fall through 0.6363, to resume the whole decline from 0.7156, to 1% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195.

Surge in oil prices could cloud global disinflation path

Last week saw oil prices surging to their highest levels in 10 months, creating a complex scenario for global disinflation efforts and complicating central bank policies. The development has triggered a sense of unease in the markets and could potentially disrupt the delicate balancing act central banks are performing amid inflationary pressures and economic uncertainties.

Several factors are contributing to this rally in oil prices. Most notably, Saudi Arabia is expected to extend its voluntary oil production cut of 1 million barrels per day into October. This move is in addition to production cuts already instituted by OPEC+. The cuts could even potentially last through the end of 2023. Meanwhile, in US, oil stockpiles have fallen by 10.6 million barrels to their lowest levels since December of last year.

From a technical perspective, WTI crude oil prices have broken through 84.91 resistance, confirming resumption of the rally that began at 63.67. Strong support from rising 55 D EMA is clearly a bullish sign. Next target is 61.8% projection of 66.94 to 84.91 from 77.95 at 89.05. This is close to 38.2% retracement of 131.82 to 63.67 at 89.70.

Market participants should keep an eye on 90 level as strong resistance is anticipated to cap upside and possibly complete the current uptrend. However, any powerful move through 90 could suggest underlying drastic developments and unsettle the markets.

EUR/USD Weekly Outlook

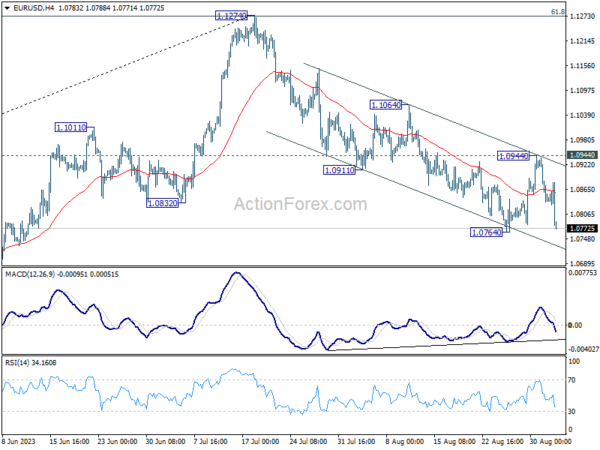

EUR/USD’s rebounded to 1.0944 last week, but was rejected by 55 D EMA (now at 1.0924) and fell sharply since then. The development keeps near term outlook bearish. Immediate focus is now on 1.0764 support this week, firm break there will resume whole decline from 1.1274 to 1.0609/34 cluster support next. Meanwhile, further decline will be in favor as long as 1.0944 resistance holds, in case of recovery.

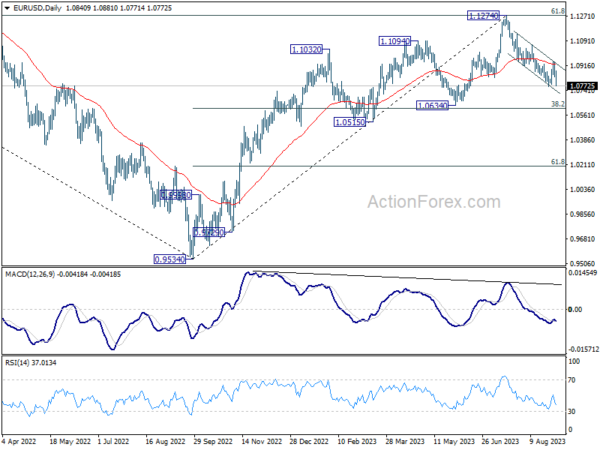

In the bigger picture, fall from 1.1274 medium term top is seen as a correction to up trend from 0.9534 (2022 low). Deeper decline would be seen to 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609). Strong support could be seen there, at least on first attempt, to bring rebound. Yet, medium term outlook will be neutral for now, as long as 1.1274 resistance holds.

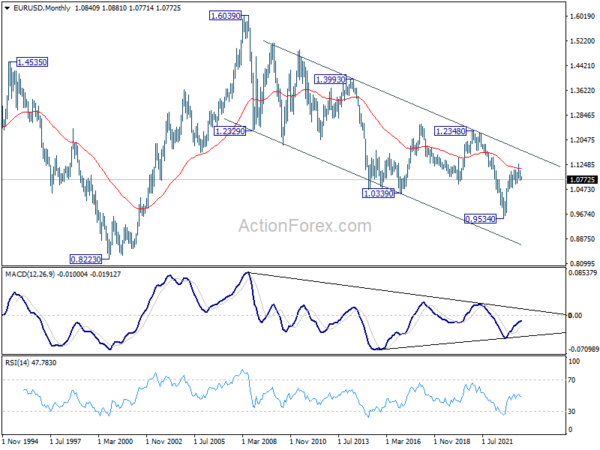

In the long term picture, focus stays on 55 M EMA (now at 1.1124). Rejection by this EMA will revive long term bearishness. However, sustained break above here will be affirm the case of long term bullish reversal and target 1.2348 resistance for confirmation.