Dollar’s selloff picks up momentum in early US session after PCE inflation slowed more than expected in October, while core PCE also declined. The data give a nod to Fed Chair Jerome Powell’s comment that smaller rate hikes could start in December. Yen is the better performer as supported by extended pull back in US and European benchmark yields. But Euro and Sterling are clearly advancing with more conviction. Commodity currencies are also firm but lag behind.

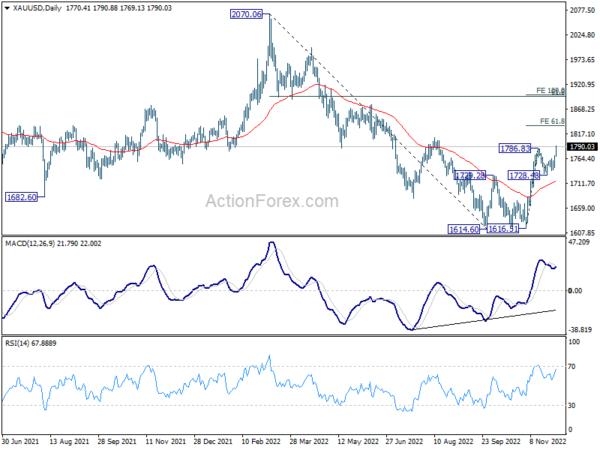

Technically, EUR/USD is breaking 1.0496 while GBP/USD has taken out 1.2152 resistance, confirming resumption of recent rally. Similarly, Gold has also taken out 1786.83 resistance to resume the rise from 1616.51. Next target is 61.8% projection of 1616.51 to 1786.83 from 1728.43 at 1833.73. It’s a bit early to judge, but there is prospect of extending the rise to 1900 handle, which is close to another cluster fibonacci level.

In Europe, at the time of writing, FTSE is up 0.16%. DAX is up 1.01%. CAC is up 0.46%. Germany 10-year yield is down -0.1074 at 1.827. Earlier in Asia, Nikkei rose 0.92%. Hong Kong HSI rose 0.75%. China Shanghai SSE rose 0.45%. Singapore Strait Times rose 0.07%. Japan 10-year JGB yield rose 0.0006 to 0.251.

US PCE slowed to 6.0% yoy in Oct, core PCE down to 5.0% yoy

US personal income rose 0.7% mom to USD 155.3B in October, above expectation of 0.4% mom. Personal spending rose 0.8% mom to USD 147.9B, matched expectations.

For the month, PCE price index rose 0.3% mom, below expectation of 0.5% mom. PCE core (excluding food and energy) rose 0.2% mom, below expectation of 0.4% mom.

From the same month ago, PCE price index slowed from 6.3% yoy to 6.0% yoy, below expectation of 6.0% yoy. PCE core price index slowed from 5.2% yoy to 5.0% yoy, matched expectations. Prices for goods rose 7.2% yoy and prices for services rose 5.4% yoy. Food prices rose 11.6% yoy and energy prices rose 18.4% yoy.

US initial jobless claims dropped back to 225k

US initial jobless claims dropped -16k to 225k in the week ending November 26, below expectation of 245k. Four-week moving average of initial claims rose 2k to 229k.

Continuing claims rose 57k to 1608k in the week ending November 19. Four-week moving average of continuing claims rose 30k to 1539k.

Eurozone PMI manufacturing finalized at 47.1, welcome moderation in downturn intensity

Eurozone PMI Manufacturing was finalized at 47.1in November, up from October’s 46.4. Looking at some member countries, Ireland PMI Manufacturing was at 48.7 (30 mth-low), Italy at 48.4, Greece at 48.4, France at 48., Austria at 46.6, Germany at 46.2, the Netherlands at 46.0 (29-mth low), and Spain at 45.7. All were in contraction.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said: “The PMI signals some welcome moderation in the intensity of the eurozone manufacturing downturn in November, which will support hopes that the region many not be facing a winter downturn as severe as previously anticipated by many. However, the survey’s production index continuing to run at one of the lowest levels recorded over the past decade. At these levels the survey is indicative of a marked annualised rate of contraction of approximately 4%. While official manufacturing data have been more buoyant – and more volatile – in recent months, such weak PMI readings have always been followed by commensurate steep declines in the official statistics.”

UK PMI manufacturing finalized at 46.5, further contraction, outlook darkened

UK PMI Manufacturing was finalized at 46.5 in November, up from October’s 46.2. S&P Global said intermediate goods remained the weakest performing sector. Business sentiment dipped to the lowest since April 2020. Input price inflation eased to three-month low.

Rob Dobson, Director at S&P Global Market Intelligence, said: “November saw a further contraction of the UK manufacturing sector, as weak demand, declining export sales, high energy prices and component shortages all hit industry hard. The outlook for the sector also darkened, as confidence among manufacturers fell to its lowest level since April 2020. … The trend in new export business was especially weak, as Brexit issues and supply chain stresses exacerbated the effects of a weakening global economic backdrop, leading to lower sales from the US, the EU and China.”

Swiss CPI unchanged at 3.0% yoy in Nov

Swiss CPI was unchanged at 3.0% yoy in November, above expectation of 2.6% yoy. Core CPI (excluding fresh and seasonal products, energy and fuel) rose from 1.8% yoy to 1.9% yoy. Domestic product inflation rose from 1.7% yoy to 1.7% yoy. But Imported product inflation slowed from 6.9% yoy to 6.3% yoy.

FSO said: “The stability of the index compared with the previous month is the result of opposing trends that offset each other overall. Prices for housing rentals, gas and fuels increased, as did those for foreign and Swiss red wine. In contrast, prices for heating oil, fruiting vegetables and hotel accommodation decreased.”

Also released, retail sales dropped -2.5% yoy in October, worse than expectation of 3.3% yoy rise.

BoJ Noguchi: Must maintain monetary easing

BoJ board member Asahi Noguchi said the central bank must continue to maintain monetary easing, keep interest rates at low levels now as achievement of 2% inflation target remains uncertain.

“While not as much as other countries, Japan’s consumer prices have risen sharply. This increase is driven mostly by rising imported goods prices,” he said. “What’s more important in deciding monetary policy is trend inflation based on domestic macro-economic factors, which remains at low levels.”

Inflation is likely to fall back below 2% once these cost-push factors dissipate.

China Caixin PMI Manufacturing rose to 49.4 in Nov, pandemic continued to take a toll

China Caixin PMI Manufacturing rose from 49.2 to 49.4 in November, above expectation of 48.6. Caixin said that Covid-19 restrictions continued to constrain output. New orders fell, albeit at softest rate in four months. Supply chain delays worsened.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the pandemic continued to take a toll on the economy. Output contracted, total demand was under pressure, overseas demand remained weak, employment deteriorated, logistics was sluggish, and manufacturers faced growing operating pressure. As the measure for suppliers’ delivery times is negatively correlated to the PMI, the fall in the measure partially offset the drop in the PMI, leading the decline in November manufacturing activity to be underestimated.”

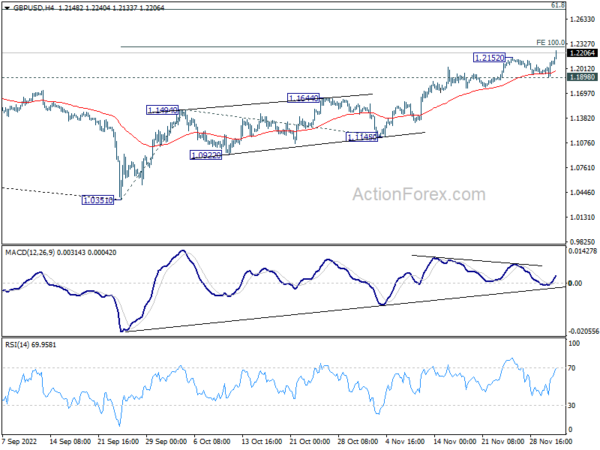

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1944; (P) 1.2015; (R1) 1.2130; More…

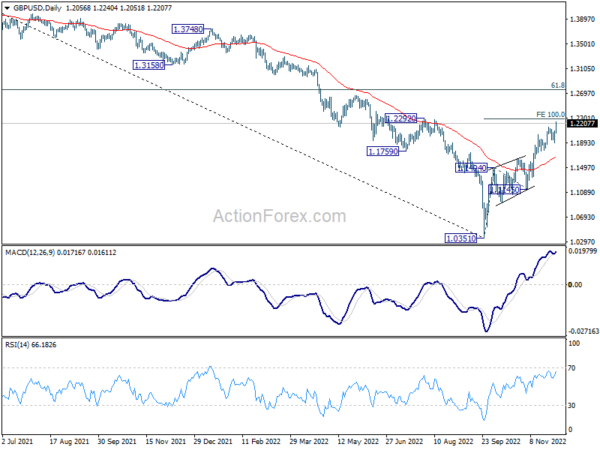

GBP/USD’s rally resumed by breaking 1.2152 and intraday bias is back on the upside. Current rise from 1.0351 should target 100% projection of 1.0351 to 1.1494 from 1.1145 at 1.2288 first. Sustained break there will pave the way to 1.2759 medium term fibonacci level. On the downside, break of 1.1898 minor support is needed to indicate short term topping, otherwise, further rally will remain in favor in case of retreat.

In the bigger picture, rise from 1.0351 medium term bottom is at least correcting whole down trend from 1.4248 (2021 high). Further rise is expected as long as 1.1145 support holds. Next target is 61.8% retracement of 1.4248 to 1.0351 at 1.2759. Sustained break there will pave the way back to 1.4248.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Mfg Index Nov | 44.7 | 49.6 | ||

| 00:30 | AUD | Private Capital Expenditure Q3 | -0.60% | 1.20% | -0.30% | |

| 00:30 | JPY | Manufacturing PMI Nov F | 49 | 49.4 | 49.4 | |

| 01:45 | CNY | Caixin Manufacturing PMI Nov | 49.4 | 48.6 | 49.2 | |

| 05:00 | JPY | Consumer Confidence Nov | 28.6 | 30.2 | 29.9 | |

| 07:00 | EUR | Germany Retail Sales M/M Oct | -2.80% | -0.60% | 0.90% | |

| 07:30 | CHF | Real Retail Sales Y/Y Oct | -2.50% | 3.30% | 3.20% | 2.60% |

| 07:30 | CHF | CPI M/M Nov | 0.00% | 0.20% | 0.10% | |

| 07:30 | CHF | CPI Y/Y Nov | 3.00% | 2.60% | 3.00% | |

| 08:30 | CHF | Manufacturing PMI Nov | 53.9 | 53 | 54.9 | |

| 08:45 | EUR | Italy Manufacturing PMI Nov | 48.4 | 47.3 | 46.5 | |

| 08:50 | EUR | France Manufacturing PMI Nov F | 48.3 | 49.1 | 49.1 | |

| 08:55 | EUR | Germany Manufacturing PMI Nov F | 46.2 | 46.7 | 46.7 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Nov F | 47.1 | 47.3 | 47.3 | |

| 09:30 | GBP | Manufacturing PMI Nov F | 46.5 | 46.2 | 46.2 | |

| 10:00 | EUR | Eurozone Unemployment Rate Oct | 6.50% | 6.60% | 6.60% | |

| 12:30 | USD | Challenger Job Cuts Y/Y Nov | 416.50% | 48.30% | ||

| 13:30 | CAD | Labor Productivity Q/Q Q3 | 0.60% | 0.30% | 0.20% | 0.10% |

| 13:30 | USD | Personal Income M/M Oct | 0.70% | 0.40% | 0.40% | |

| 13:30 | USD | Personal Spending Oct | 0.80% | 0.80% | 0.60% | |

| 13:30 | USD | PCE Price Index M/M Oct | 0.30% | 0.50% | 0.30% | |

| 13:30 | USD | PCE Price Index Y/Y Oct | 6.00% | 6.20% | 6.20% | 6.30% |

| 13:30 | USD | Core PCE Price Index M/M Oct | 0.20% | 0.40% | 0.50% | |

| 13:30 | USD | Core PCE Price Index Y/Y Oct | 5.00% | 5.00% | 5.10% | 5.20% |

| 13:30 | USD | Initial Jobless Claims (Nov 25) | 225K | 245K | 240K | 241K |

| 14:30 | CAD | Manufacturing PMI Nov | 50 | 48.8 | ||

| 14:45 | USD | Manufacturing PMI Nov F | 47.6 | 47.6 | ||

| 15:00 | USD | ISM Manufacturing PMI Nov | 50.5 | 50.2 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Nov | 47.3 | 46.6 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Nov | 50 | |||

| 15:00 | USD | Construction Spending M/M Oct | -0.10% | 0.20% | ||

| 15:30 | USD | Natural Gas Storage | -82B | -80B |