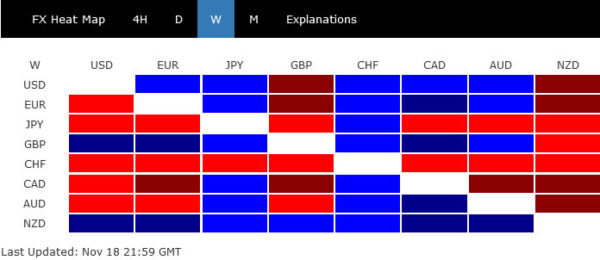

The post-CPI selloff in Dollar and rally in US stocks faded last week, after Fed officials talked down the significance of just one data point. While the greenback still lacked momentum for sustainable recovery, selloff has at least slowed. The greenback ended the week mixed together with Euro.

On the one hand New Zealand Dollar was the best performer, as traders look forward to a jumbo 75bps hike by RBNZ. Sterling followed as second, with no disastrous response to the UK government’s new budget. Swiss Franc and Yen were the weakest ones while Canadian dollar followed, as weighed down by falling oil prices.

Looking ahead, there is prospect of finally a stronger rebound in Dollar, considering the risk of a near term pull back in stocks, and recovery in yields. Also, retreat in gold price and extended decline in oil could give the greenback a helping hand.

DOW losing upside momentum as Fed hawks returned

Rally in the US stock markets started to lost momentum after a chorus of Fed officials emphasized not to over interpret just one month of inflation data. Tightening is set to continue, and interest rates will stay at “sufficiently restrictive” levels until inflation shows sign of returning to target sustainably. So what is “sufficiently restrictive”? According to St. Louis Fed President James Bullard, rates could be anywhere between 5%-7%.

DOW closed the week nearly flat after engaging in sideway trading in very tight range. It’s starting to lose upside momentum slightly as seen in daily MACD. While further rise cannot be ruled out, upside is likely to be limited by 34281.36 resistance on first attempt to bring a pull back. That could start to happen in the coming week or two.

But overall, near term bullish outlook will remain in favor as long as 31727.05 support holds. That is, corrective pattern from 36952.65 has completed with three waves down to 28600.94. Firm break of 3481.36 will pave the way to retest 36952.65. That might happen in the early part of next year.

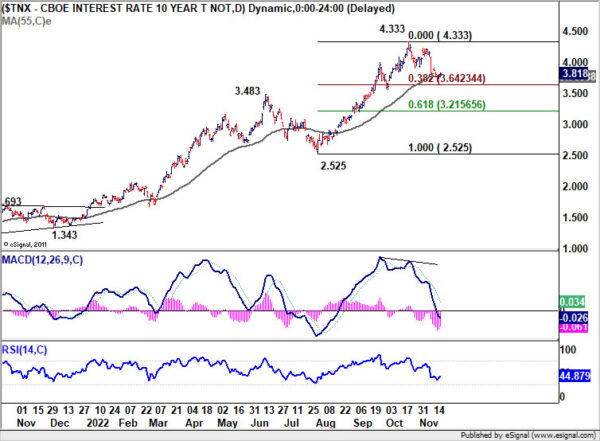

10-year yield drawing support from 55 day EMA

10-year yield stabilized after a brief dip to 3.692 and closed the week nearly flat too. Outlook is unchanged that it’s merely in a correction to rise from 2.525. Strong support is expected from current zone of 55 day EMA (now at 3.768) and 38.2% retracement of 2.525 to 4.333 at 3.642 to bring rebound.

There is little prospect for TNX to break through 4.333 high in the near term. That is, range trading between 3.642/4.333 is envisaged.

Rebound in Dollar index to happen any time

Dollar index closed the week slightly higher after initial dip to 105.34. DXY is now close to an important support zone at 104.63, 38.2% retracement of 89.20 to 114.77 at 105.00, and 55 week EMA at 103.91. So a rebound could happen any time. Break above last week’s high at 107.27 could trigger buying back towards 55 day EMA (109.73).

The overall conditions for DXY to rebound should there if DOW does start the pull back as mentioned above, while 10-year yield also recovers.

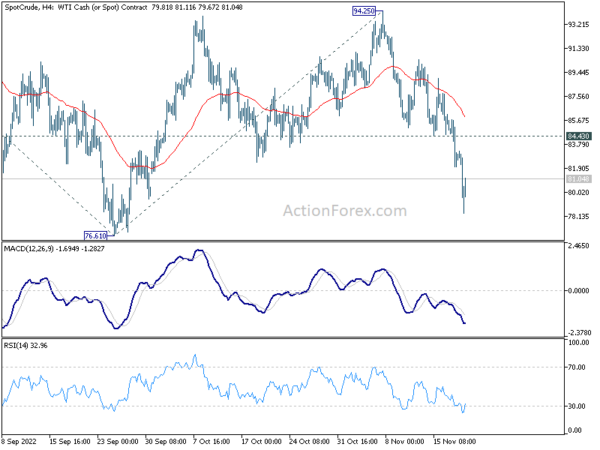

WTI oil ready for down trend resumption

Development in oil prices could be used as a gauge to confirm overall risk sentiment. WTI oil logged a second weekly decline as weighed down by concern over China. While there were steps in easing the strict zero-COVID policy, skyrocketing infections could eventually force the government to reinstate tough lockdown measures. After all, unlike almost all other countries in the world, the vaccination status in China is a big unknown.

Last week’s decline suggests that WTI’s corrective rebound from 76.61 has completed with three waves up to 94.25. Immediate focus is now on 76.61 low. Firm break there will resume whole down trend from 131.82 high. Next target will be 61.8% projection of 124.12 to 76.61 from 94.25 at 64.88.

While it’s indeed too early to tell whether the down trend would really hit the above mentioned target, a break through 76.61 should come in tandem with pull back in stocks, and a stronger recovery in Dollar.

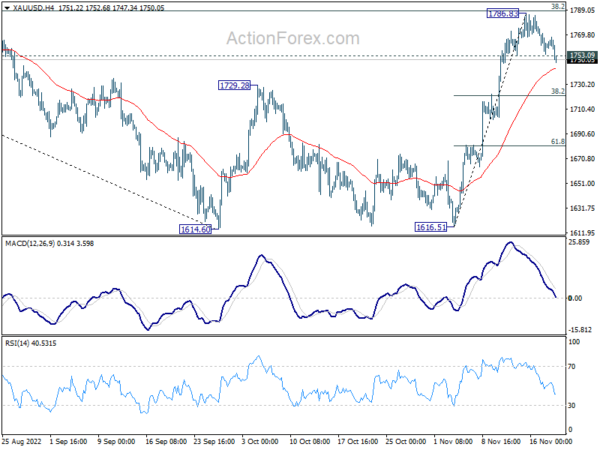

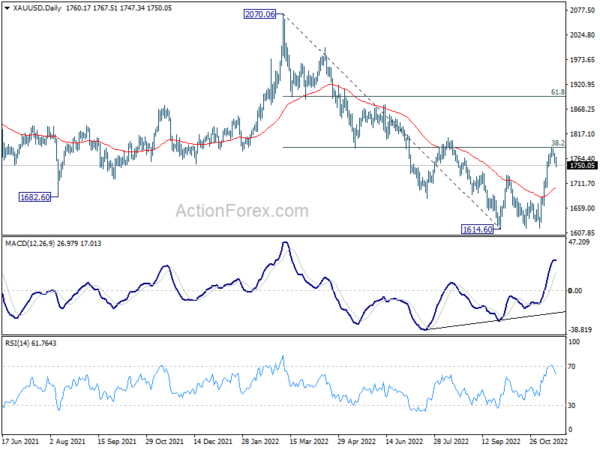

Gold topped in short term, starting pull back

Taking about the prospect of a rebound in Dollar, Gold’s pull back is also worth a note. The break of 1753.09 minor support last week indicates short term topping at 1786.83. That came just ahead of 38.2% retracement of 2070.06 to 1614.60 at 1788.58.

Deeper decline is in favor in Gold in the short term. Firm break of 4 hour 55 EMA (now at 1742.44) would pave the way to 38.2% retracement of 1616.51 to 1786.83 at 1721.76, or even further to 55 day EMA (now at 1702.80). If that happens, such pull back should be accompanied by a stronger rebound in Dollar in general.

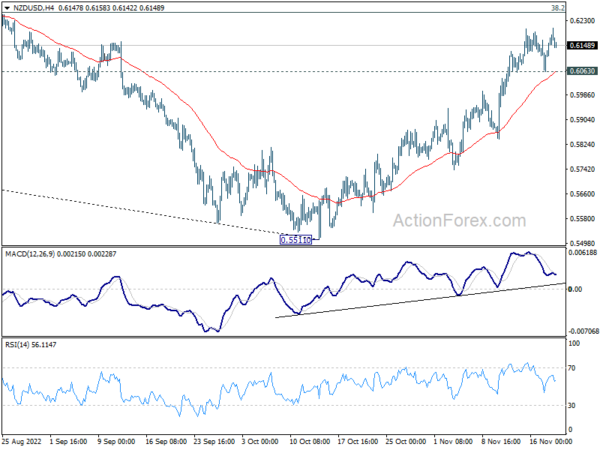

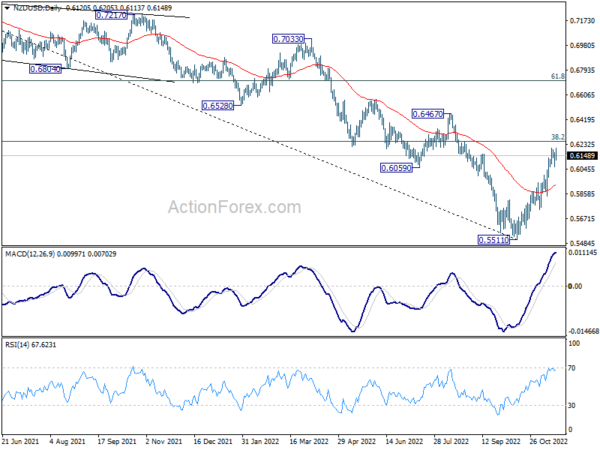

NZD/USD lost momentum ahead of 0.6257 fibonacci level

New Zealand Dollar ended as the strongest one last week, ahead of a jumbo 75bps rate hike by RBNZ in the coming Wednesday. Nevertheless, NZD/USD is clearly losing momentum ahead of 38.2% retracement of 0.7463 (2021 high) to 0.5511 at 0.6257.

Rejection by 0.6257, followed by break of 0.6063 minor support, will argue that a short term top is formed. Deeper retreat could then be seen back to 55 day EMA (now at 0.5927). If that happens, it would be another sign that Dollar’s rebound is underway.

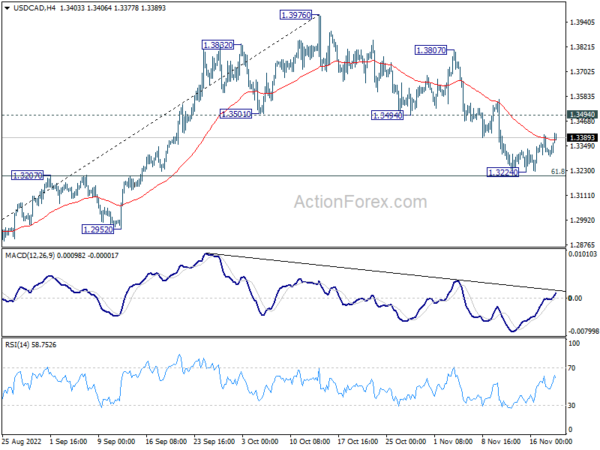

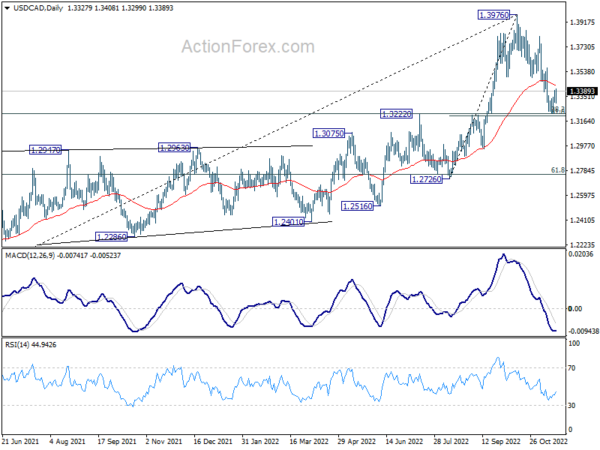

USD/CAD Weekly Outlook

USD/CAD recover ahead of 1.3207 cluster support (61.8% retracement of 1.2726 to 1.3976 at 1.3204) last week. But upside is limited well below 1.3494 support turned resistance. Initial bias remains neutral this week first. On the upside, firm break of 1.3494 will indicate that correction from 1.3976 has completed at 1.3224. Intraday bias will be turned back to the upside for 1.3807/3976 resistance zone. However, on the downside, sustained break of 1.3204/7 will carry larger bearish implication and target 1.2952 support next.

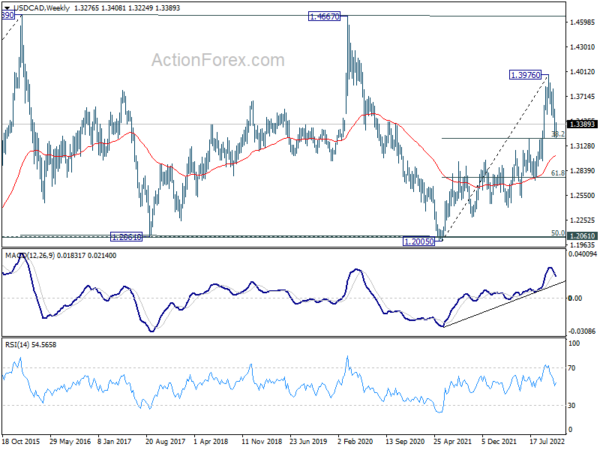

In the bigger picture, as long as 1.3222 cluster support (38.2% retracement of 1.2005 to 1.3976 at 1.3223) holds, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 high at a later stage. . However, firm break of 1.3222/3 will indicate that the trend might have reversed. Deeper fall would be seen to next cluster support at 1.2726 (61.8% retracement at 1.2758).

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern only, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as long as 1.2061 support holds, which is close to 50% retracement of 0.9406 to 1.4689 at 1.2048.