Trading in the forex markets remain mixed and non-committal. Yen’s pull back appeared to have run its course already, and recover broadly today. Euro and Swiss Franc are now on the firmer side. On the other hand, Dollar is weak together with Aussie and Sterling. Canadian and New Zealand Dollar are mixed. Meanwhile, European stock indexes and US futures are trading higher but it’s unsure if the rebound could persist. Gold is also struggling in range.

In Europe, at the time of writing, FTSE is up 0.01%. DAX is up 0.58%. CAC is up 0.49%. Germany 10-year yield is down -0.002 at 2.496. Earlier in Asia, Nikkei dropped -0.94%. Hong Kong HSI dropped -0.79%. China Shanghai SSE dropped -0.44%. Singapore Strait Times dropped -0.54%. Japan 10-year JGB yield dropped -0.0096 to 0.448.

US initial jobless claims rose to 225k, matched expectations

US initial jobless claims rose 9k to 225k in the week ending December 24, matched expectations. Four-week moving average of initial claims dropped -250 to 221k.

Continuing claims rose 41k to 1710k in the week ending December 17. Four-week moving average of continuing claims rose 25k to 1680k.

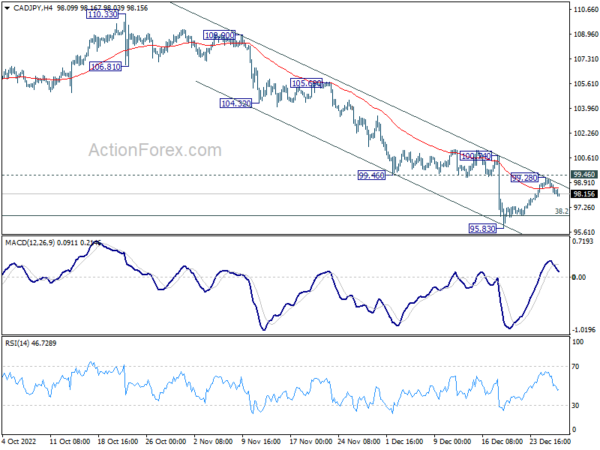

CAD/JPY rejected by channel resistance, heading back to 95.83

CAD/JPY is one of the top moves today, following Yen’s recovery, as well as weakness in oil prices. Recovery from 95.83 might have completed at 99.28, after rejection by near term falling channel and 99.46 support turned resistance. Deeper decline is now in favor back to retest 95.83 low first. Firm break there will resume whole fall from 110.33.

Nevertheless, break of 99.28 will now be a sign of stronger rebound ahead. Further rally would likely be seen through 110.24 resistance to 55 day EMA (now at 103.32) instead.

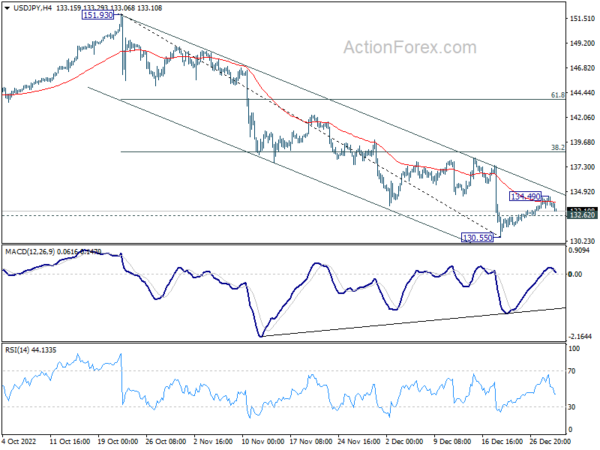

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 132.90; (P) 133.25; (R1) 133.86; More…

USD/JPY’s recovery lost momentum after hitting 134.49 and intraday bias is turned neutral first. On the upside, above 134.49 should resume the rebound through near term channel resistance, towards 38.2% retracement of 151.93 to 130.55 at 138.71 first. On the downside, however, break of 132.62 minor support will bring retest of 130.55 instead.

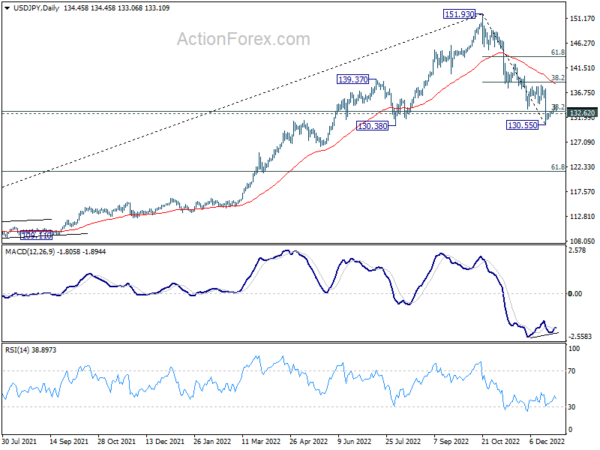

In the bigger picture, price actions from 151.93 medium term could be just a corrective pattern to up trend from 102.58 (2021 low). Strong support from 38.2% retracement of 102.58 to 151.93 at 133.07 and 55 week EMA (now at 131.76) will set the range for such corrective pattern. However, sustained break of 55 week EMA will pave the way to 61.8% retracement at 121.43.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Nov | 4.80% | 5.00% | 5.10% | |

| 13:30 | USD | Initial Jobless Claims (Dec 23) | 225K | 225K | 216K | |

| 15:30 | USD | Natural Gas Storage | -198B | -87B | ||

| 16:00 | USD | Crude Oil Inventories | -1.2M | -5.9M |