Following return of risk-on sentiment, commodity currencies are currently the best performers for the week. On the other hand, Swiss Franc and Yen are trading broadly lower, followed by Euro and Dollar. The economic calendar is very light today and main focus will be on BoC policy decision. At the same time, we’ll see if the strong stock market rally could continue to push major US indexes back to record highs.

Technically, the rebounds in Yen crosses are relatively disappointing so far, considering the strong rise in stocks. We’ll continue to keep an eye on 113.94 minor resistance in USD/JPY, 128.77 minor resistance in EUR/JPY and 152.35 resistance in GBP/JPY to gauge if they’re in a bullish turnaround.

In Asia, at the time of writing, Nikkei is up 1.19%. Hong Kong HSI is down -0.10%. China Shanghai SSE is up 0.73%. Singapore Strait Times is down -0.23%. Japan 10-year JGB yield is down -0.0011 at 0.054. Overnight, DOW rose 1.40%. S&P 500 rose 2.07%. NASDAQ rose 3.03%. 10-year yield rose 0.046 to 1.480.

BoJ Amamiya: No need to adjust large-scale monetary easing at present

BoJ Deputy Governor Masayoshi Amamiya said in a speech that Japan’s inflation rate is still “far below the price stability target of 2 percent”. CPI is projected to be just around 1% even in fiscal 2023, the end of the current projection period. Therefore, BoJ will “persistently continue with powerful monetary easing” under the current QQE with yield curve control.

While central banks in US and Europe have recently started adjusting their monetary policy, the situation is different in Japan. Amamiya said, “given the price developments in Japan I have described, I think it makes sense that the Bank does not actually need to adjust its large-scale monetary easing at present”.

Also from Japan, GDP dropped -0.9% qoq in Q3, revised down from prior estimate of -0.8% qoq. GDP deflator dropped -1.2% yoy. Current account surplus widened to JPY 1.03T in October.

CAD/JPY in strong rebound as BoC in focus

With a light economic calendar, main focus will be on BoC monetary policy decision today. No change is expected as the central has just stopped asset purchases back in October. Also, at that statement, BoC had pushed forward the timing for the first rate hike to “sometime in the middle quarters of 2022”, compared with previous estimate of “the second half of 2022”. Given the uncertainty surrounding Omicron, the central bank will more likely keep the rhetoric unchanged than not.

Some previews on BoC:

Canadian Dollar is in strong rebound this week, partly on return of risk-on sentiment, in tandem with rebound in oil prices. CAD/JPY’s pull back from 93.00 could have completed at 87.68, after hitting 61.8% retracement of 84.65 to 93.00 at 87.83.

Sustained trading above 55 day EMA (now at 89.78) will affirm this case and pave the way for retesting 93.00 high next. Also, given that CAD/JPY has defended medium term trend line support and 55 week EMA very well, the whole up trend from 73.80 could be ready to resume through 93.00 in this case.

Nevertheless, another fall and sustained trading below 87.83 will turn focus back to 84.65 key medium term structural support.

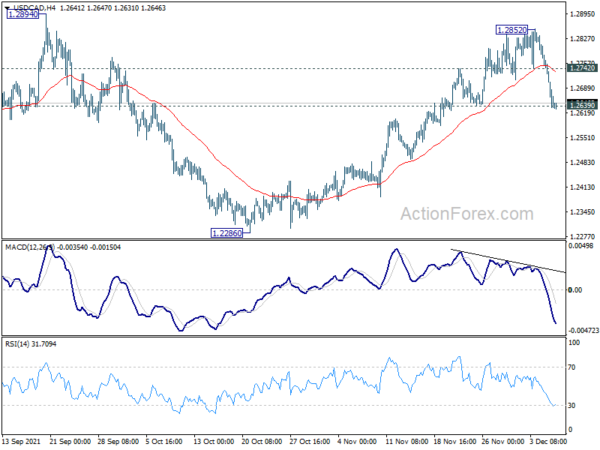

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2594; (P) 1.2681; (R1) 1.2726; More…

Immediate focus is now on 1.2639 in USD/CAD with the steep fall from 1.2852. Firm break there will argue that rebound from 1.2286 might be finished at 1.2852. Deeper fall would be seen back to 55 day EMA (now at 1.2592). Sustained break there will bring deeper fall to 1.2286 support. Nevertheless, rebound from the current level and break of 1.2742 minor resistance will retain near term bullishness and bring retest of 1.2852.

In the bigger picture, medium term outlook is neutral for now. The pair drew support from 1.2061 cluster and rebounded. Yet, upside was limited below 38.2% retracement of 1.4667 to 1.2005 at 1.3022. On the upside, firm break of 1.3022 should affirm the case of medium term bullish reversal. However, break of 1.2286 will turn focus back to 1.2005 low again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q Q3 | -0.90% | -0.80% | -0.80% | |

| 23:50 | JPY | GDP Deflator Y/Y Q3 | -1.20 | -1.10% | -1.10% | |

| 23:50 | JPY | Current Account (JPY) Oct | 1.03T | 0.98T | 0.76T | |

| 5:00 | JPY | Eco Watchers Survey: Current Nov | 56.3 | 57.8 | 55.5 | |

| 15:00 | CAD | BoC Interest Rate Decision | 0.25% | 0.25% | ||

| 15:30 | USD | Crude Oil Inventories | -0.9M |