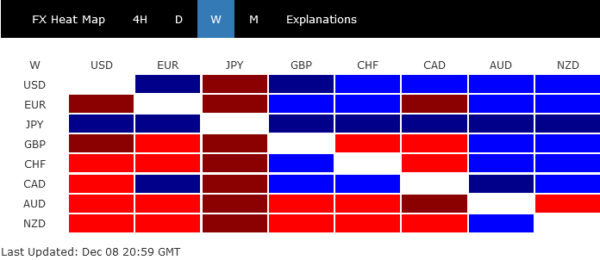

The global financial markets last week were primarily influenced by three pivotal themes: Yen’s dramatic rise, Dollar’s strength following robust US employment data, and repercussions of Moody’s downgrading China’s rating outlook.

The most striking was the Yen’s significant surge, driven by intensified speculation about an impending exit from negative interest rates by BoJ. The anticipation of this policy change propelled Yen as the strongest currency, simultaneously impacting Japan’s bond yields and stock market, with Nikkei facing a significant downturn.

Dollar secured its position as the second strongest currency, buoyed by robust employment and upbeat consumer sentiment data. The solid labor market report led traders to reconsider their expectations for an early rate cut by Fed.

Contrasting with strengths of Yen and Dollar, both Australian and New Zealand Dollars emerged as the weakest performers. Their downturn was primarily driven by deteriorating risk sentiment in Asia, especially following Moody’s decision to downgrade China’s rating outlook. Meanwhile, RBA’s decision to hold rates steady failed to provide any significant impetus to Aussie.

Elsewhere in the currency markets, Canadian Dollar ended as the third strongest, benefiting from Dollar’s rally and also influenced by BoC’s decision to keep interest rates unchanged without adopting a dovish tone. European majors displayed mixed performance. Sterling was on the weaker side, while Euro showed relative strength compared to its European counterpart.

Fed rate cut expectation shifts; Capping stock rallies, lifting Dollar

In a week marked by significant economic data that reflected a sense of resilience in the slowly cooling US economy, major US stock indexes marked their sixth consecutive week of gains. This continued upward trend comes amidst steadfast expectations that Fed will hold interest rates unchanged in its upcoming December meeting, with the current tightening cycle completed already. However, stocks’ rallies are being tempered as markets reassess their expectations for rate cuts in the next year, a factor also contributing to strengthening of Dollar and recovery in 10-year yield.

Non-farm payroll report released on Friday provided a glimpse into the robustness of the US job market. The report exceeded expectations with a headline job growth of 199k, while unemployment rate fell unexpectedly to 3.7%. Furthermore, wages continued to grow at a strong pace of 0.4% mom. These figures suggest that the US job market remains tight, with ongoing robust wage growth indicating that inflationary pressures might persist longer than some market analysts had anticipated.

Subsequent to the payroll data, University of Michigan survey revealed a significant downward adjustment in inflation expectations. One-year inflation rate outlook dropped to 3.1%, a substantial decrease from 4.5% in November, marking the lowest level since March 2021. This decline in short-term inflation expectations was mirrored in the longer-term outlook, which also fell from 3.2% to 2.8%. In parallel, consumer sentiment index experienced a marked improvement, climbing more than 8 points to 69.4, tying for the best level since July.

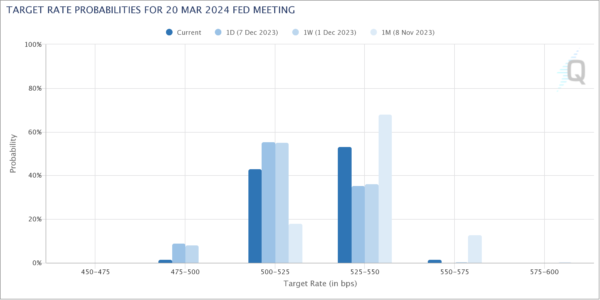

Despite these positive indicators, the market still heavily anticipates Fed to maintain steady interest rates, with a 97.1% chance at its final policy meeting of the year. However, the likelihood of a rate cut in March has reduced, with expectations falling to 44% from 55% just last week. This shift in expectations is also evident in the swaps market, where traders have scaled back their bets on the extent of Fed rate cuts next year, pricing in about 110 basis points of easing, a reduction from previous forecasts of over 120 basis points.

In stock market performance, DOW registered a slight increase of 0.01%, while S&P 500 and NASDAQ Composite recorded gains of 0.2% and 0.7%, respectively.

Near term outlook in S&P 500 stays bullish as long as 4537.24 support holds. However, loss of upside momentum is clear in D MACD. Whether there is enough momentum to challenge 4818.62 high is in question. The future course of the index will largely depend on how economic and market conditions evolve in early 2024.

Dollar Index saw notable volatility last week, primarily influenced by the steep selloff in USD/JPY and a counteracting pullback in EUR/USD. For now, further rally is expected as long as 103.06 minor support holds, to 55 D EMA (now at 104.56). But DXY could start to struggle above there due to conflicting dynamics exerted by Yen and Euro.

Also, if price actions from 102.46 represent the second leg of the corrective pattern from 107.34, then the road is expected to be extra bumpy, as a corrective move inside a corrective pattern.

BoJ speculation stirs markets: Yen up, Nikkei down

BoJ’s potentially looming shift away from its long-standing negative interest rate policy was one of the dominant themes in the global financial markets last week, causing significant ripples. This speculation, intensified after statements from BoJ officials, led to substantial strengthening of Yen and an upswing in 10-year JGB yield. Conversely, these developments triggered a notable decline in Japan’s benchmark stock index, Nikkei.

BoJ Governor Kazuo Ueda’s comments to the parliament about the increasing complexity in policy management in the coming months added fuel to the market speculation. He also brought attention to various potential targets for interest rates once the BoJ decides to move away from negative short-term borrowing costs.

Preceding Ueda’s comments, Deputy Governor Ryozo Himino’s remarks were perceived by the market as a precursor to policy normalization. Himino suggested that the potential first rate hike since 2007 may not be as damaging to the economy as some market analysts had feared.

A Bloomberg poll of economists underscored the shift sentiment, with a two-third majority anticipating BoJ to discard its negative rate policy by April 2024. About half of these economists expect this change in April, while a smaller group of 15% foresees it occurring as early as January.

Given the planned release of new economic forecasts by BoJ in both January and April, March meeting is viewed as an unlikely timing for such a crucial policy adjustment. Meanwhile, BoJ is expected to wait for the outcome of Spring wage negotiations, further solidifying April as the more probable time for the policy shift.

The looming question for BoJ observers is whether the December 18-19 meeting will be used by Ueda and his board to signal imminent policy normalization or if such indications will be postponed until January.

The steep decline in Nikkei last week, followed by strong break of 55 D EMA (now at 32566.02), suggests that rise from 30538.28 has completed at 33853.46 already. A more important question is whether the whole up trend 24681.74 has completed its five-wave run too, after breaching 33772.89.

In either case, risk will now stay on the downside if Nikkei cannot regain 55 D EMA firmly within a short period of time. Deeper fall could then be seen to 30538.28 support, which is close to 38.2% retracement of 24681.74 to 33853.46 at 30349.86.

Moody’s downgrade of China’s outlook triggers turbulence in HK stocks

Another significant development in the Asian financial markets occurred when Moody’s downgraded China’s A1 debt rating outlook from “stable” to “negative.” This downgrade reflects concerns about the financial burden of bailing out local governments and state firms, as well as managing the ongoing property crisis.

Following this, Moody’s took further action by adjusting outlook for eight Chinese banks, including the nation’s four largest lenders – Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, and China Construction Bank Corporation – from “stable” to “negative.” Additionally, Moody’s lowered Hong Kong’s outlook from stable to negative, acknowledging the close political, institutional, economic, and financial ties between Hong Kong and mainland China.

In the wake of these developments, Hong Kong’s HSI extended its downtrend from 22700.85, reaching a new low for the year. Near term outlook will stay bearish as long as 17068.26 resistance holds. Next target is 100% projection of 22700.85 to 18044.85 from 20361.02 at 15705.02.

Medium-term fate of HSI is closely linked to whether Shanghai SSE can defend its key long-term support at 2863.64 amid the current decline. It is still premature to make a definitive assessment, but decisive break of 2863.64 would resume SSE’s down trend from 3731.68 to 100% projection of 3731.68 to 2863.64 from 3418.95 at 2550.91.

AUD/JPY and NZD/JPY as biggest losers of the week

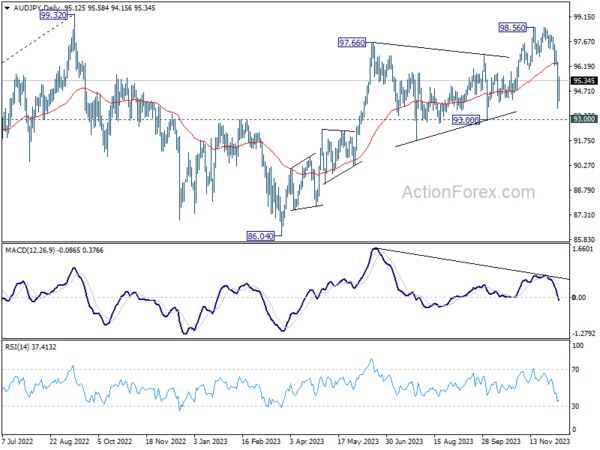

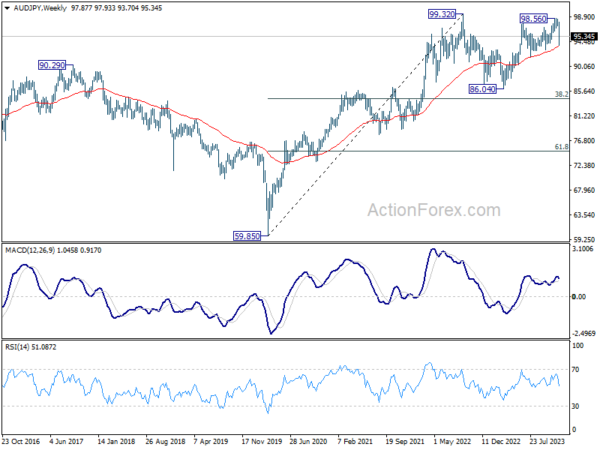

AUD/JPY and NZD/JPY were the biggest movers last week, loosing -2.8% and -2.7% respectively. That’s a combined results of Yen’s surge on BoJ speculations, pressures on Aussie and Kiwi due to China’s problems.

AUD/JPY’s steep decline last week suggests that whole rise from 86.04 has completed at 98.56 already. Deeper fall is in favor as long as 55 D EMA (now at 96.29) holds. Break of 93.00 support will confirm this bearish case and target 86.04 support again.

Also, the fall from 98.56 is tentatively seen as the third leg of the consolidation pattern from 99.32 (2022 high). If this is correction, fall from 98.56 has the potential to extend through 86.04 to 38.2% retracement of 59.85 (2020 low) to 99.32 at 84.24 before completion.

NZD/JPY’s outlook is clearly more bullish than AUD/JPY. Yet the sharp fall form 91.50 and bearish divergence condition in D MACD raising the chance that a medium term top was already formed. Short term focus is now on 86.75 support. Strong bounce from there will keep the medium term up trend intact, and bring another rise through 91.50 at a later stage.

However, decisive break of 86.75 will argue that it’s already correcting whole up trend from 59.49 (2020 low), and bring deeper decline to 80.42 support.

USD/JPY Weekly Outlook

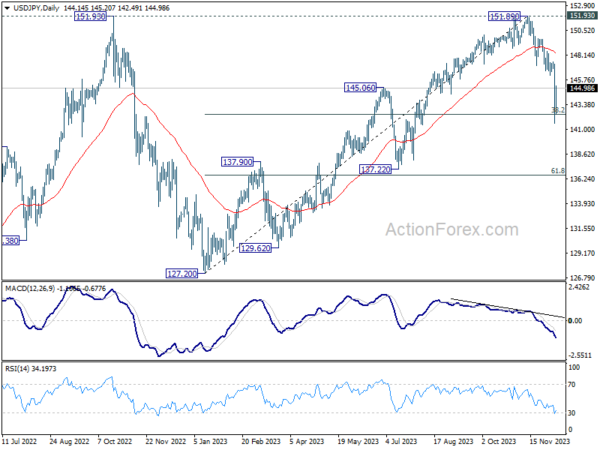

USD/JPY’s fall from 151.89 accelerated to as low as 141.59 last week, but recovered after drawing support from 142.45 fibonacci level. Initial bias remains neutral this week for consolidations first. But recovery should be limited below 147.14 support turned resistance to bring another fall. On the downside, break of 141.59 and sustained trading below 142.45 fibonacci level will pave the way to next fibonacci level at 136.63.

In the bigger picture, current fall from 151.89 is seen as the third leg of the corrective pattern from 151.93 (2022 high). Deeper decline would be seen through 38.2% retracement of 127.20 to 151.89 at 142.45 to 61.8% retracement at 136.63. This will now remain the favored as long as 147.14 support turned resistance holds.

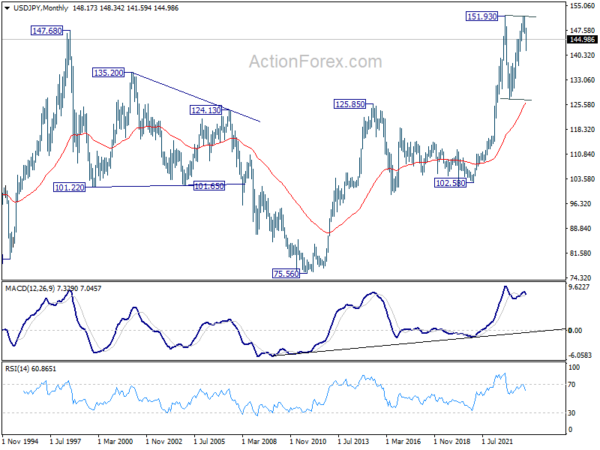

In the long term picture, as long as 125.85 resistance turned support holds (2015 high), up trend from 75.56 (2011 low) is still in favor to continue through 151.93 (2022 high) at a later stage.