Here is what you need to know on Friday, May 28:

It was AMC day on US stock markets on Thursday as the cinema operator totally took control of the volume profile, outdoing every mega-cap and growth stock in the process. AMC rose over 35% as retail and perhaps some other operators stoked the fizzle that was last seen in January. Ford continued its impressive run post Wednesday’s investor day but mostly it was the small-cap names that stole the day. The Russell 2000 was Thursday’s indices winner moving over one percent higher while the S&P 500 and Dow flatlined and the Nasdaq fell.

Friday looks to be taking the same playbook and running with it as AMC surges again in the premarket and futures move higher. President Biden has the chequebook out again as he is mulling over a $5 trillion spending plan over the next decade, boosting the American Jobs Plan and the American Families Plan.

The dollar is stronger versus the euro at 1.2140, yields are steady, Gold is lower at $1889, Oil is up at $67.50 and Bitcoin is sliding, back to $36,500.

European markets are higher, the FTSE is flat, EuroStoxx +0.4% and the Dax +0.6%.

US futures are also higher Dow +0.4%, S&P +0.3% and Nasdaq +0.2%.

Wall Street top news

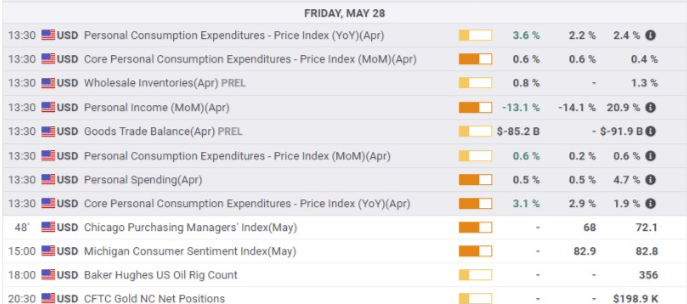

US Consumer spending +0.5% monthly, in line with expectations.

Japan extends state of emergency as Olympics beckon!

Microsoft says Solar Winds hacking group is back, targetting government agencies, think tanks and consultancies.

AMC shares surge again in premarket, up 10%, go apes.

Boeing (BA) reports of delays to the delivery of the 787 Dreamliner due to FAA information requests.

Ollie (OLLI) grabs a bargain as the shares rally 10% post-earnings release.

Veeva Systems (VEEV) rises 5% in premarket after posting earnings after the close on Thursday.

HP reports EPS and revenue beat estimates but shares drop.

DELL reported EPS of $2.13 versus the $1.61 forecast.

BOX just beat EPS by a penny, $0.18 versus $0.17 expected.

Costco (COST) EPS $2.75 versus $2.35 estimate.

GAP reported EPS of $0.48 versus -$0.05 estimate, those analysts are good huh!

Salesforce (CRM) posted strong earnings after the close on Thursday, shares up 5% premarket.

Emergent Bio (EBS) WSJ reports that FDA is close to allowing vaccines to be released from Emergent’s plant.

ULTA Beauty reports earnings after the close on Thursday, shares up 5% premarket.

Beyond Meat (BYND) Bank of America calls it a new meme stock to watch and Raymond James raises price target, share pop 5%.

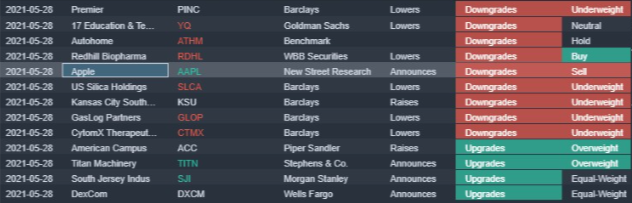

Up, downs, movers and groovers

Premarket movers

Source: Benzinga

Economic releases

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.