- USD/INR stands on slippery ground near multi-day low, drops for fifth consecutive day.

- Risk-on mood weighs on the US dollar, downbeat options market also weigh on the quote.

- SBI report anticipates slower fall in Indian GDP, covid infections in India ease of late.

- Market sentiment favor bears, risk catalysts are the key to follow.

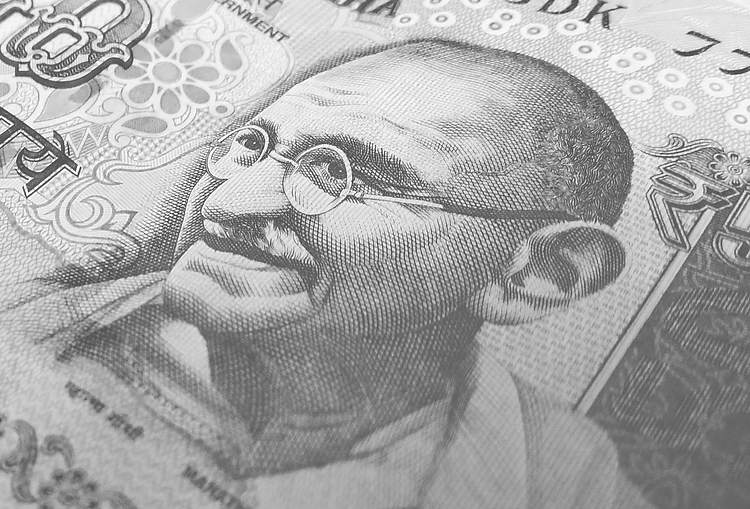

USD/INR takes offers around 72.65, down 0.21% intraday, amid the initial Indian trading session on Wednesday. The Indian rupee (INR) pair cheers the broad US dollar weakness, amid risk-on mood, to test the lowest levels since March 29.

Following multiple attempts from the US Federal Reserve (Fed) policymakers, market players seemed to have convinced of reflation fears as transitory and not resulting in any tapering. The same joins the US removal of China’s Xiaomi from the blacklist and readiness to ease restrictions on the Russian oil pipeline to portray the upbeat market sentiment.

Amid these plays, S&P 500 Futures print mild gains despite the Wall Street benchmark’s downplay whereas the US 10-year Treasury yields snap a four-day losing streak. However, the US dollar index (DXY) remains heavy near the early January lows by the press time.

Other than the market optimism and the USD weakness, hopes of a lesser economic loss due to the pandemic to the Indian economy, per the State Bank of India (SBI) report, shared by Accord Fintech, per Reuters, also drag the USD/INR prices to the south. “According to the report, going by the estimate of 1.3 percent GDP growth, India would still be the fifth-fastest-growing country among 25 nations that have released their GDP numbers so far. It said one likely consequence of any upward revision in FY21 estimates is a concomitant decline in FY22 GDP estimates. Its estimates now indicate that there might be nominal GDP loss of up to Rs 6 lakh crore during Q1 FY22 as compared to a loss of Rs 11 lakh crore in Q1 FY21,” said the report.

It’s worth mentioning that the latest easing of the coronavirus (COVID-19) infections in India as well as a three-day fall in the USD/INR risk reversal, suggesting a more bearish move, add to the sellers’ strength.

Looking forward, Fedspeak and the risk catalysts remain as the key near-term directives to follow for fresh impulse. However, the USD/INR prices seem to have been oversold for the short term and are near to the key support, which in turn may offer a magnified reaction in case of the US dollar rebound.

Technical analysis

Unless bouncing back beyond the 73.30 immediate hurdle, USD/INR is vulnerable to drop towards an ascending trend line from December 2019, near 72.50.