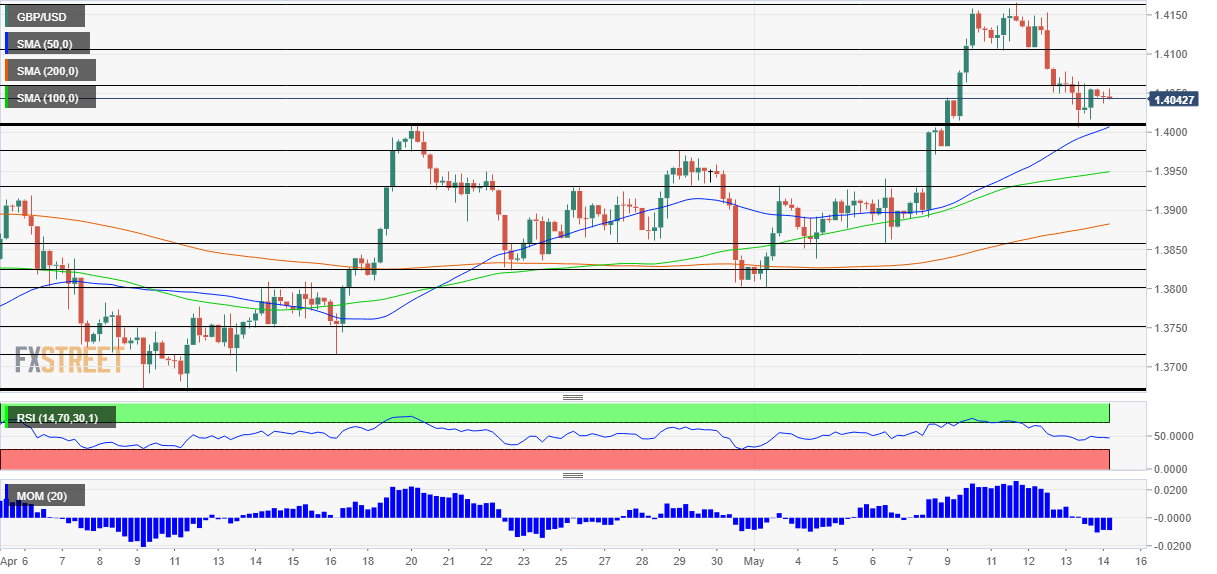

GBP/USD Forecast: Virus variant concerns and the American shopper may push cable below 1.40

GBP/USD has been attempting recovery as markets swing back to positive ground. The danger from variants to Britain’s reopening and US consumption data could push the pair lower. Friday’s four-hour chart is showing that 1.40 is a critical separator of ranges. Call off the reopening? Prime Minister Boris Johnson has come short of suggesting a reversal in policy but he has expressed concerns about the rapid spread of the Indian variant in the UK. Read more…

GBP/USD Weekly Forecast: Cable ready for next climb, with help from UK data, the Fed

Will the Fed be forced to tighten its policy prematurely? The raging debate has been shaking and eventually benefiting the dollar, especially after robust inflation figures, with more volatility expected in response to the bank’s minutes. Sterling has received support from the UK reopening and GDP, with a long list of figures now due. Read more…

GBP/USD analysis: Finds support

The decline of the GBP/USD did not reach the support of the 200-hour simple moving average on Thursday. Instead, the rate found support in the 1.4005/1.4015 zone, which had provided both resistance and support on Monday. On Friday morning, the GBP/USD had recovered to the 1.4070 level, where it encountered the 55-hour simple moving average. The 55-hour SMA could provide resistance to the currency exchange rate. Read more…