Tiff Macklem, the Governor of the Bank of Canada (BoC), elaborates on the BoC’s choice to maintain the interest rate at 5% following the March policy gathering and addresses inquiries from the media.

Highlights from the Bank of Canada Press Conference

We have out eyes on commercial real estate, exposure in Canada spreads more broadly.

Shelter price inflation is weighing on our decisions.

We most likely won’t get to 2% inflation this year.

Canadian Overnight Repo Rate Average pressures not a sign of needing to end QT early.

Labour market adjustment to higher rates has been relatively smooth.

We have been surprised over last couple of quarters by the strength of the US economy.

We are comfortable with our measures of core inflation.

I am looking for consistency across inflation indicators.

There was clear consensus inside governing council that rates needed to stay at 5%.

I can’t put timing of rate cuts on a calendar.

We’re not going to be lowering rates at the pace we raised them.

This section below was published at 14:45 GMT to cover the Bank of Canada policy announcements and the market reaction

As anticipated, the Bank of Canada (BoC) decided to maintain its key rate at 5.0%, matching its decision at the January 24 gathering. In its policy statement, the BoC reiterated that it needs to see further progress in core consumer prices at a time when it deems premature any attempt to loosen the current restrictive stance.

BoC policy statement takeaways:

The Bank of Canada maintains its stance that it is premature to consider reducing interest rates.

The bank emphasizes the need for continued patience and asserts that higher rates require more time to demonstrate their effectiveness.

The BoC underscores that it is premature to relax the restrictive policies that have brought about the current economic conditions.

It adds that since the January rate announcement, there have been no significant surprises, with economic growth remaining sluggish and inflation further moderating.

The bank anticipates gradual and uneven progress in curbing inflation, with lingering upside risks. It requires sustained easing in core inflation before considering any adjustments.

The statement mentioned that inflation is projected to hover around 3% until the middle of 2024 before moderating in the latter half of the year. Despite elevated shelter price inflation and ongoing underlying price pressures, domestic inflation could persist longer than anticipated.

Finally, the BoC argued that the Canadian labour market has shown signs of improvement, moving towards a better balance.

Later in the session, Governor Tiff Macklem will hold his usual press conference (15:30 GMT).

Market reaction to BoC interest rate decision

The Canadian Dollar appreciates to multi-day highs vs. the Greenback in the wake of the bank’s decision, dragging USD/CAD to the area of multi-session lows near 1.3520.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the .

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.30% | -0.17% | -0.44% | -0.76% | -0.41% | -0.53% | -0.06% | |

| EUR | 0.28% | 0.12% | -0.18% | -0.45% | -0.10% | -0.22% | 0.22% | |

| GBP | 0.16% | -0.13% | -0.30% | -0.58% | -0.23% | -0.35% | 0.09% | |

| CAD | 0.47% | 0.20% | 0.29% | -0.29% | 0.06% | -0.05% | 0.41% | |

| AUD | 0.72% | 0.44% | 0.55% | 0.28% | 0.32% | 0.20% | 0.66% | |

| JPY | 0.38% | 0.08% | 0.20% | -0.06% | -0.37% | -0.14% | 0.30% | |

| NZD | 0.51% | 0.23% | 0.34% | 0.05% | -0.23% | 0.12% | 0.50% | |

| CHF | 0.08% | -0.22% | -0.10% | -0.36% | -0.64% | -0.34% | -0.44% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

This section below was published as a preview of the Bank of Canada’s interest rate decision at 14:45 GMT.

- The Bank of Canada (BoC) is expected to keep its rates unchanged.

- The Canadian Dollar has met a tough resistance at around 1.3600.

- Canadian inflation remains sticky, although on a downward path.

There is widespread expectation that the Bank of Canada (BoC) will keep its policy rate steady at 5.0% for the fifth consecutive time during its upcoming policy meeting on Wednesday. The Canadian Dollar (CAD) has experienced significant depreciation against the US Dollar (USD) since the start of the new year, following a sharp rise from its November lows around 1.3900. This week, USD/CAD has maintained a consolidative theme in the upper end of the range, in line with the rest of the FX universe.

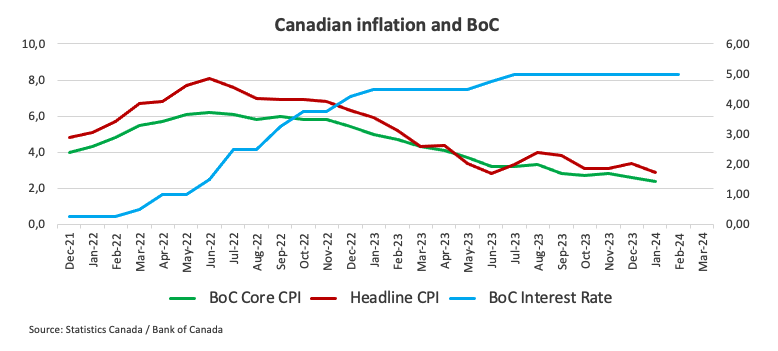

Headline inflation, tracked by the Consumer Price Index (CPI), kept its downtrend in the first month of the year even as the BOC’s Core CPI showed signs of sticky price pressures. In this context, the central bank is predicted to deliver a prudent approach, highlighting the need to assess further incoming data as well as their sustainability before deciding on any move on rates, namely the start of the easing cycle. This last view matches that of most of the bank’s G10 peers (the Federal Reserve, ECB, Bank of England, and Reserve Bank of Australia).

A hint of caution looms

Since its January gathering, the BoC is expected to maintain a conservative outlook on GDP growth. Back to that meeting, the bank anticipated a growth rate of 0.8% this year and 2.4% in 2025, aligning with their previous forecast released in October.

Regarding inflation, Governor Tiff Macklem said at his press conference in January that the surge in shelter prices is the primary driver of inflation exceeding the target, adding that the journey towards achieving 2% inflation is expected to be gradual with lingering risks. He argued that the policy interest rate of 5% is deemed necessary to further subdue inflationary pressures, while the focus of discussions regarding future policy is shifting from whether monetary policy is sufficiently restrictive to how long the current stance should be maintained.

From the latest news, fifteen out of twenty economists warned that there is a higher likelihood of the first rate cut by the Bank of Canada occurring later than initially predicted rather than sooner. Additionally, nineteen out of thirty-one economists anticipate that the Bank of Canada will reduce the overnight rate from 5.00% to 4.75% in June.

According to analysts at TD Securities: “We look for the BoC to stick to the recent script as it holds the overnight rate at 5.00% and continues to seek more evidence that inflation is on track for a sustained return to 2%. We look for the overall message to remain one of cautious optimism, and while the January CPI report skews risks towards a more dovish outcome, we do not expect the Bank will overreact to a single data point.”

When will the BoC release its monetary policy decision and how could it affect USD/CAD?

The Bank of Canada will announce its policy decision at 14:45 GMT on Wednesday, followed by the usual press conference by Governor Macklem at 15:30 GMT.

Banning surprises, any anticipated effect on the Canadian currency is expected to be minimal, if any. A cautious decision to maintain current conditions might lead to a short-term, reflexive decline in USD/CAD, although its duration and magnitude are unlikely to be significant. It’s worth noting that much of the upward movement in the spot rate so far this year is attributed to the dynamics of the USD.

According to Pablo Piovano, Senior Analyst at FXStreet.com, “the gradual uptrend in USD/CAD in place since the beginning of the year appears reinforced by the recent surpass of the key 200-day SMA at 1.3479. However, this trend has so far met quite a decent barrier at the 1.3600 neighbourhood. A sustainable break above this region could motivate the pair to set sails to the November 2023 peak of 1.3898 (November 1).”

Piovano adds: “If sellers regain the upper hand, the 55-day SMA at 1.3428 should offer temporary contention prior to the weekly low of 1.3358 (January 31). Extra weakness from here could open the door to a move to the December 2023 bottom of 1.3177 (December 27).”

Economic Indicator

Canada BoC Press Conference

After Bank of Canada (BoC) meetings and the release of the Monetary Policy Report, the BoC Governor and Senior Deputy Governor hold a press conference at which they field questions from the media. The press conference has two parts – first a prepared statement is read out, then the conference is open to questions from the press. Hawkish comments tend to boost the Canadian Dollar (CAD), while a dovish message tends to weaken it.