- Apple stock continues to head for all-time highs.

- AAPL broke the key resistance level at $137.

- Apple’s mega tech FAANG peer-group GOOGL, FB and AMZN have already set record highs.

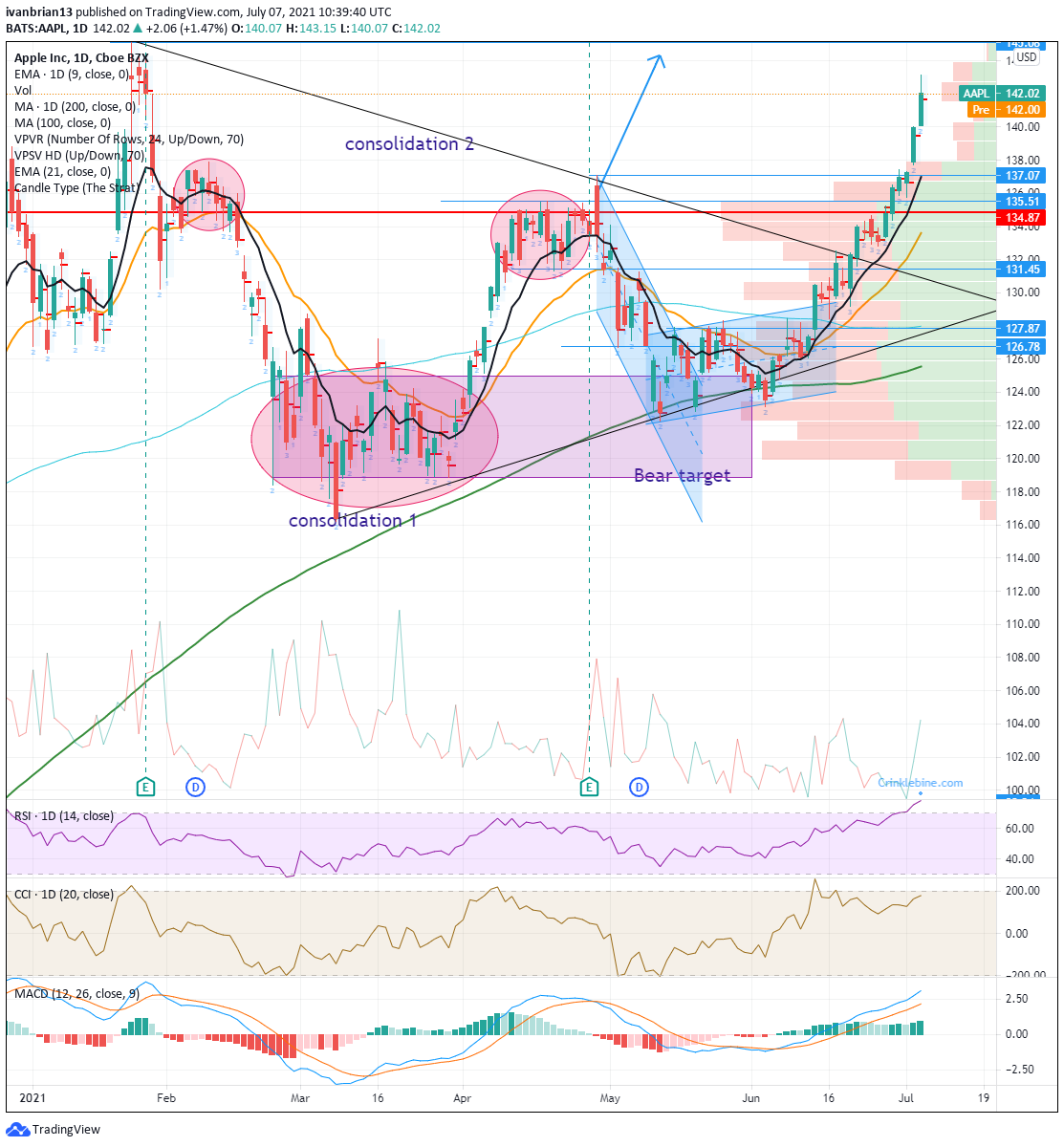

Apple stock continues to trend very strongly toward making fresh all-time highs. Tuesday saw the mega tech leader add another 1.47% to a steady rise and AAPL stock closed only $3 away from fresh record highs. The shares closed at $142.02 with the previous all time high from January 25 at $145.09.

Apple shares are now up nearly 13% in the last month, lucky for some, especially those who are long. But despite this Apple still has to break all-time highs while Facebook (FB), Alphabet (GOOGL) and Amazon (AMZN) have all recently powered to new all time highs. The chart below compares the mega tech names in question. Apple is catching up but there is no reason why it should be lagging. The last results were stellar, beating analyst’s estimates by over 40% and Apple also added that it was increasing its dividend and stock buyback program. As we can see from below since the results period at the end of April when all of FB, AAPL, AMZN and GOOGL released strong results Apple has underperformed Facebook by a huge margin, FB is up 17% since Q1 results, Apple is up 6%. GOOGL is up over 10% on the period. All of these mega tech names released results strongly ahead of Wall Street estimates. As mentioned Apple beat estimates by 42%, GOOGL and AMZN beat estimates by over 60% while Facebook matched Apple with a 40% beat. Apple though also increased its buy-back and dividend program. But still, it has lagged. Well not for long as the trend is clearly headed higher.

Apple stock forecast

Now that the last big resistance at $137 before all-time highs has been taken out it paves the way for an easier ascent for AAPL stock. The volume profile has dropped off significantly above this $137 level. The trend has gained strength above $135 and then again above $137. This is exactly what should happen given the volume profile drops off each time above these resistance levels. Now there is very little volume and price resistance to stop AAPL from breaking record highs above $145.09. The one worrying aspect is the Relative Strength Index (RSI) has moved into overbought territory. So this needs to be watched, but as we have previously mentioned it does not mean a stock price must drop. The RSI is based on the speed of movement so the price can rise more slowly or sideways and the RSI will move back to neutral, the price does not have to fall for the RSI to retreat. But apart from this, the trend remains very strong and the risk-reward continues to favour a move to new all-time highs.

1. The trend is clearly strong, with 6 green days in a row.

2. Apple peer group is also making record highs, AMZN, FB, and GOOGL and Apple needs to play catch up.

3. The Nasdaq and S&P remain bullish with a matching strong trend in place.

4. The volume profile is thin at current levels meaning resistance is not strong.

Ok so that’s four reasons, you got one for free! $137 remains key support now for the short term push higher. This is the previous strong resistance and also now where the 9-day moving average sits. A break and the trend is in doubt. This is where I would have my stop if I was long but every trader is different but please do have some risk management plan in place.

-637612501086250245.png)

-637612504502165240.png)