Shares of MongoDB rose as much as 22% in extended trading Thursday after the database software maker issued blowout fiscal first-quarter earnings and lifted its full-year guidance.

Earnings: 56 cents per share, adjusted, vs. 19 cents per share as expected by analysts, according to Refinitiv.

related investing news

Revenue: $368 million, vs. $347 million as expected by analysts, according to Refinitiv.

MongoDB’s revenue increased 29% year over year in the quarter that ended April 30, according to a statement. The net loss for the quarter came out to $54 million, or 77 cents per share, compared with $77 million, or $1.14 per share, in the year-ago quarter, even as the company increased spending on sales and marketing and research and development.

The company added 2,300 customers in the quarter, reaching a total of 43,100 people, which was above the StreetAccount consensus of 42,430 people.

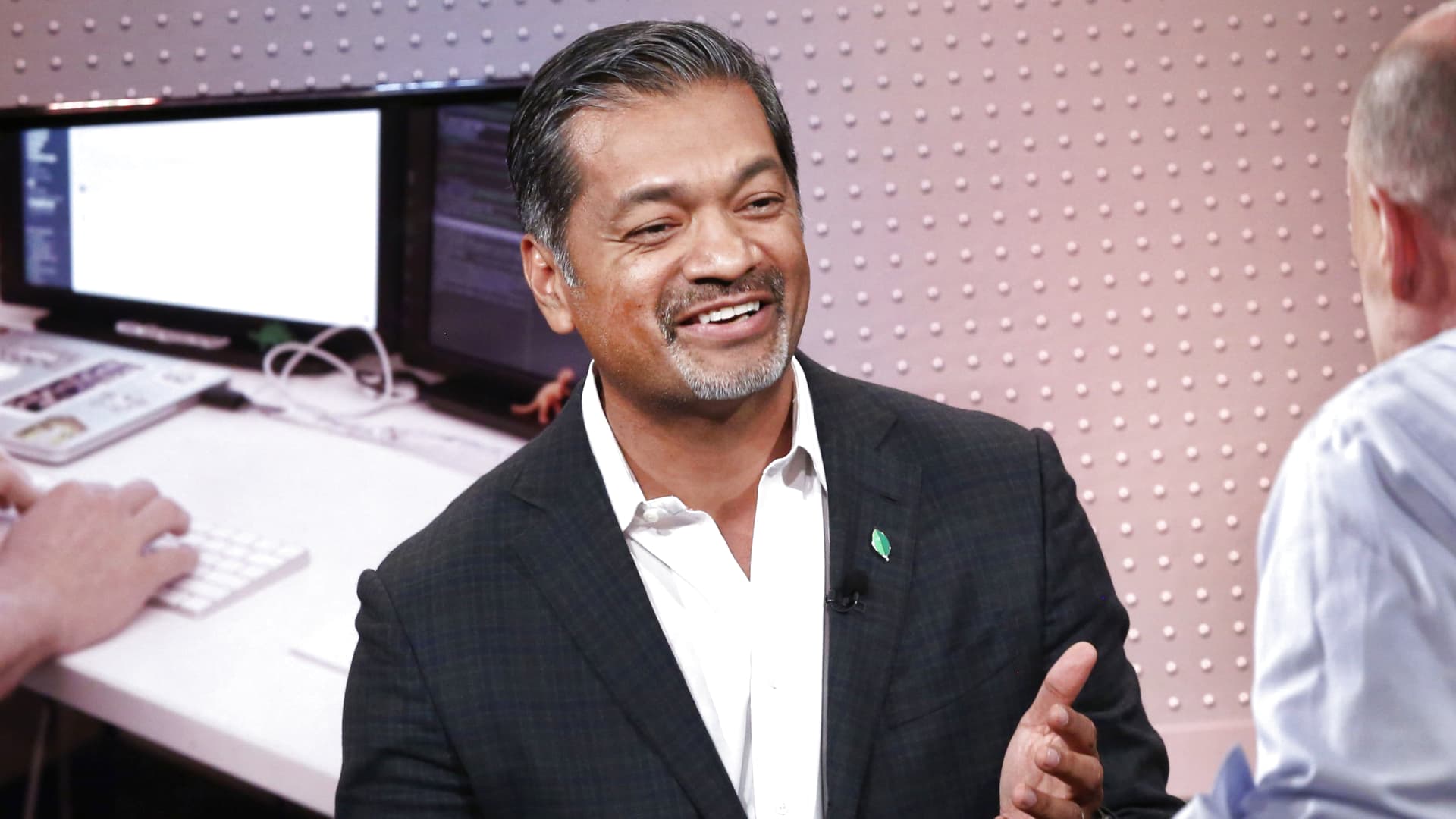

China Mobile moved a service for sharing billing information with customers from Oracle to MongoDB, leading to an 80% performance increase and reducing the number of underlying servers from 50 to 12, CEO Dev Ittycheria said on a conference call with analysts.

Innovation remains a priority inside organizations, Ittycheria said. But he also said, “it’s clear customers continue to scrutinize their technology investments and must decide which technologies are a must-have, versus merely nice to have.”

During the quarter, MongoDB extended its partnership with Alibaba through 2027. The arrangement has “led to an 8x growth in consumption” since its launch in 2019, MongoDB said in the statement.

With respect to guidance, management called for fiscal second-quarter earnings of 43 cents to 46 cents per share on $388 million to $392 million in revenue. Analysts surveyed by Refinitiv had been looking for 14 cents in adjusted earnings per share and $362 million in revenue.

MongoDB raised its fiscal 2024 forecast for both revenue and income. The guidance calls for $1.42 to $1.56 in adjusted earnings per share on $1.522 billion to $1.542 billion in revenue, which would imply 19.5% growth. In March, MongoDB had said it was anticipating full-year adjusted earnings per share of 96 cents to $1.10 on revenue of $1.48 billion to $1.51 billion. Analysts had been looking for adjusted earnings of $1.03 per share and $1.51 billion in revenue.

Before the after-hours move, MongoDB stock was up 49% so far this year, compared with a gain of about 10% for the S&P 500 index.

WATCH: Three Stock Lunch: MongoDB, American Airlines and Dollar General