Dollar regained some strength in early US session, after a volatile week marked by high-profile events, including the US presidential election and Fed’s rate decision. The greenback’s pullback from its post-election spike now appears to be more of a consolidation rather than reversal of its bullish momentum. However, Dollar bulls may need to wait until next week’s US CPI report to see if inflation data can provide the next catalyst for a decisive move.

Commodity currencies continue to top the weekly performance charts for now. However, there is uncertainty about whether they can maintain these gains as the trading week concludes, as Aussie appears to be leading a reversal.

Euro is currently the weakest performer of the week, with Swiss Franc also under pressure while Sterling is mixed. Yen also positions in the middle with help from today’s strong rebound.

In Europe, at the time of writing, FTSE is down -0.62%. DAX is down -0.66%. CAC Is down -0.81%. UK 10-year yield is down -0.0490 at 4.455. Germany 10-year yield is down -0.046 at 2.402. Earlier in Asia, Nikkei rose 0.30%. Hong Kong HSI fell -1.07%. China Shanghai SSE fell -0.53%. Singapore Strait Times rose 1.39%. Japan 10-year yield fell -0.0006 to 1.006.

Canada’s unemployment rate unchanged at 6.5%, wages growth picks up

Canada’s employment data for October revealed modest job growth, with 15k increase in jobs, falling short of the anticipated 33k. Employment rate slipped by -0.1% to 60.6%, marking its sixth consecutive monthly decline, while the unemployment rate remained steady at 6.5%. Labor force participation also declined, slipping by -0.1% to 64.8%, indicating a contraction in the active workforce.

On the positive side, total hours worked rose by 0.3% over the month and were up 1.6% yoy. Additionally, wage growth picked up, with average hourly wages rising 4.9% yoy, increase from September’s 4.6% yoy rise. This uptick in wages could signal pickup pressure on labor costs, potentially impacting inflation.

BoE’s Pill emphasizes focus on long-term inflation amid temporary budget impact

In a briefing today, BoE Chief Economist Huw Pill emphasized that while the recent budget is expected to give inflation a temporary boost, the primary focus will remain on underlying, longer-term inflationary pressures.

Pill is more more concerned with structural inflation trends than short-term fluctuations triggered by fiscal policies.

“To a large extent, we will have to look through and interpret in a way that allows us to have a good sight of these underlying and more persistent components of inflation that really have to be the focus of what’s driving our policy decisions,” Pill said

According to BoE estimates, the budget is expected to add about 0.5% to inflation at its peak, which is anticipated to occur within the next two years. Governor Andrew Bailey expressed that this increase is unlikely to significantly alter BoE’s anticipated path of interest rate cuts.

EUR/USD Mid-Day Outlook

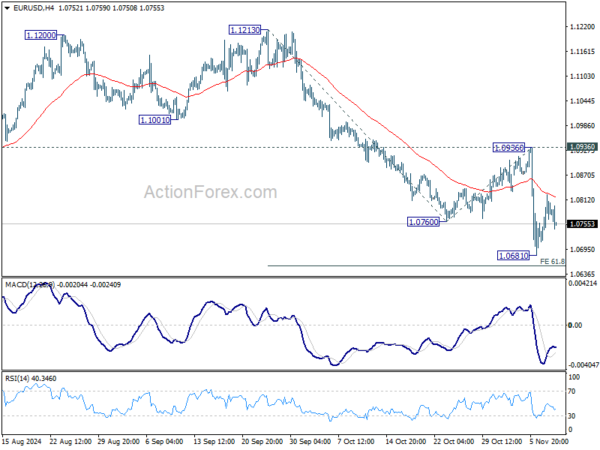

Daily Pivots: (S1) 1.0736; (P) 1.0780; (R1) 1.0848; More…

EUR/USD retreats after initial rejection by 55 4H EMA. Intraday bias remains neutral and more consolidations could still be seen above 1..0681 temporary low. But further decline is expected as long as 1.0936 resistance holds. On the downside, sustained break of 61.8% projection of 1.1213 to 1.0760 from 1.0936 at 1.0656 will pave the way to 100% projection at 1.0483.

In the bigger picture, price actions from 1.1274 (2023 high) are seen as a consolidation pattern to up trend from 0.9534 (2022 low), with fall from 1.1213 as the third leg. Downside should be contained by 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404, to bring up trend resumption at a later stage.