Movements in the currency markets today are somewhat mixed today. Commodity currencies are generally underperforming, led by a sharp decline in Australian Dollar. Investor sentiment in Asia was dampened by the lack of detailed stimulus measures from China, following the much-anticipated post-holiday announcement. This disappointment was starkly reflected in Hong Kong’s stock markets, which saw a massive -9.41% drop with record-breaking trading volume.

Swiss Franc, however, sits at the bottom of the currency performance chart despite the absence of any immediate fundamental drivers. A plausible explanation is tied to ECB’s top hawks signaling another 25bps rate cut at the next meeting. With this expectation already priced into Euro, pressure may now be shifting to SNB to respond with a larger rate cut in December to weaken the Franc.

Sterling leads the currency gains today, followed by Japanese Yen. Yen continues its rebound, boosted by Japan’s verbal intervention efforts as USD/JPY inched closer to 150 level earlier in the week. Meanwhile, Dollar remains mixed, with traders eyeing Thursday’s US CPI release for further direction.

New Zealand Dollar will be in focus in the upcoming Asian session, with RBNZ widely expected to deliver a 50bps rate cut to 4.75%. In addition to weakening economy, a major reason for this pre-emptive move is risks that Q3 inflation, due next week, might undershoot the 2% target. Technically, NZD/USD is now pressing an important near term support at 0.6105. Decisive break there should confirm that rise from 0.5840 has already completed at 0.6378. Deeper decline should then be seen back to 0.5771/5849 support zone.

In Europe, at the time of writing, FTSE is down -1.01%. DAX is down -0.17%. CAC is down -0.61%. UK 10-year yield is down -0.004 at 4.213. Germany 10-year yield is up 0.001 at 2.260. Earlier in Asia, Nikkei fell -1.00%. Hong Kong HSI fell -9.41%. China Shanghai SSE rose 4.59%. Singapore Strait Times fell -0.65%. Japan 10-year JGB yield rose 0.0004 to 0.926.

Fed’s Kugler: Inflation progress key, but focus on employment also needed

In a speech today, Fed Governor Adriana Kugler expressed her support on “shifting attention to the maximum-employment side” of the dual mandate, while maintaining focus on fighting inflation.

While labor market “remains resilient”, Kugler emphasized, the important of “avoiding an undesirable slowdown in employment growth and economic expansion.”

Regarding future rate decisions, Kugler noted that, “If progress on inflation continues as I expect, I will support additional cuts in the federal funds rate to move toward a more neutral policy stance over time.”

However, she remained cautious, suggesting that if downside risks to employment rise, Fed may need to “more quickly” in easing policy to a neutral stance.

Fed’s Williams: September’s half-point cut not the norm

In an interview with the Financial Times, New York Fed President John Williams described the latest “dot plot” projections, which show expectations for two quarter-point rate cuts at the remaining meetings this year, as a “very good base case.” He emphasized, however, that these cuts would depend on economic data, rather than following a “preset course.”

Williams also noted that the larger half-point rate cut in September was not “the rule of how we act in the future”. Instead, he explained that the focus for policymakers is to eventually move interest rates toward a neutral setting, one that neither stimulates nor restricts demand.

ECB’s Nagel open to rate cut at upcoming meeting

ECB Governing Council member and Bundesbank President Joachim Nagel, one of the central bank’s leading hawks, signaled today that he is “open” to considering another interest rate cut at the next meeting.

Nagel acknowledged the “very encouraging” inflation data, while has recently dropped below ECB’s 2% target for the first time since 2021. But also highlighted that the persistent strength in core inflation suggests the ECB’s inflation battle is not yet over.

Separately, Governing Council member Martins Kazaks pointed out that recent economic data support the case for an interest rate cut in October. Though he’s still concerned with the high uncertainty globally due to “wars, conflicts, and the United States presidential elections.”

Another Governing Council member Bostjan Vasle acknowledged the option for a rate cut. But he stressed that such a decision would not necessarily signal another cut in December, adding that “the markets aren’t dictating our moves.”

ECB’s Elderson warns of materializing growth risks

In an interview with Slovenia’s Delo newspaper, ECB Executive Board member Frank Elderson highlighted growing risks to economic growth across the Eurozone, noting that “a number of recent indicators suggest that risks of lower economic growth are already materializing.”

Elderson emphasized that ECB remains data-driven, and officials will approach the upcoming October 16-17 meeting “with an open mind.” He reiterated the importance of a genuine and open discussion among members, stressing that no decisions will be made in advance of reviewing the full range of economic data.

RBA minutes: Inflation vigilance remains key focus

Minutes from RBA’s September meeting revealed the consensus to keep the cash rate unchanged, as members felt there had been no significant changes since the previous meeting to justify a shift in policy.

Members discussed scenarios that could lead to policy being “held restrictive for a prolonged period or tightened further”. One scenario involved stronger-than-expected “consumption growth”, driven by rising household disposable income. Another involved more “constrained” than expected “aggregate supply” outlook. Financial conditions could turn out to be “insufficiently restrictive”.

Conversely, they acknowledged scenarios where policy could become less restrictive, such as the economy proved to be “significantly weaker than expected”. Or, “inflation proved less persistent than assumed”, even without significant economic weakness.

The board reiterated their vigilance to “upside risks to inflation” and emphasized that policy will remain sufficiently restrictive until inflation is clearly moving toward target. They reiterated that future rate changes could not be “ruled in or ruled out” based on current data, leaving the door open for adjustments if necessary.

Australian Westpac consumer sentiment hits 2.5-year high as rate hike fears ease

Australia’s Westpac Consumer Sentiment surged by 6.2% yoy in October to 89.8, marking the highest reading since RBA began its tightening cycle two and a half years ago.

Westpac noted that consumer sentiment has been buoyed by interest rate cuts overseas and improving inflation conditions domestically. “Consumers are no longer fearful that the RBA could take interest rates higher,” Westpac commented.

In particular, the Mortgage Rate Expectations Index, which tracks expectations for variable mortgage rates over the next 12 months, saw a significant drop of -14.1% mom to 106.4. The index has now declined by one-third since July, as households feel less pressure from future rate increases.

Westpac anticipates that RBA’s cash rate target will remain unchanged for the rest of the year. While Q3 CPI data, due on October 30, is expected to show inflation tracking lower, it may not be enough for RBA to “shift to an explicit easing bias” at the November meeting. However, Westpac believes the Board could begin easing its “hawkish hold” and adopt a more neutral policy stance as inflation pressures show signs of abating.

Australia’s NAB business confidence improves to -2, inflation pressures still high despite easing costs

Australia’s NAB Business Confidence improved in September, rising from -5 to -2. Business conditions also increased from 4 to 7, with key components such as trading conditions rising from 8 to 12, profitability up from 2 to 5, and employment conditions also climbing from 1 to 5.

A key positive development was the continued easing in input cost pressures. Labour cost growth slowed to 1.7% in quarterly equivalent terms, down from 1.8% in August. Purchase cost growth eased to 1.2%, from 1.6%.

NAB’s Head of Australian Economics, Gareth Spence, noted that while business conditions have been trending lower over the past 24 months due to slower economic growth, capacity utilization remains significantly above its long-run average.

Spence remarked, “This remains an important dynamic for the RBA where, despite slow growth, inflation remains too high, suggesting that the balance of supply and demand in the economy is yet to fully normalize.”

Japan’s real wages fall -0.6% yoy in Aug as inflation outpaces wage growth

Japan’s real wages declined by -0.6% yoy in August, marking the first drop in three months. Nominal wages rose for the 32nd consecutive month, increasing by 3.0% yoy, slightly missed market expectations of 3.1% .

The wage growth was not enough to offset inflationary pressures. The CPI used to calculate real wages, which includes fresh food prices but excludes owners’ equivalent rent, surged by 3.5% yoy in August, the highest increase since October 2023.

On a positive note, base wages (excluding bonuses and overtime) saw a significant 3.0% yoy increase, the largest rise in nearly 32 years. Overtime pay grew by 2.6% yoy. However, these gains were still outpaced by inflation.

In other data, household spending fell -1.9% yoy in August, but the decline was less severe than the market’s expected drop of -2.6%.

USD/CHF Mid-Day Outlook

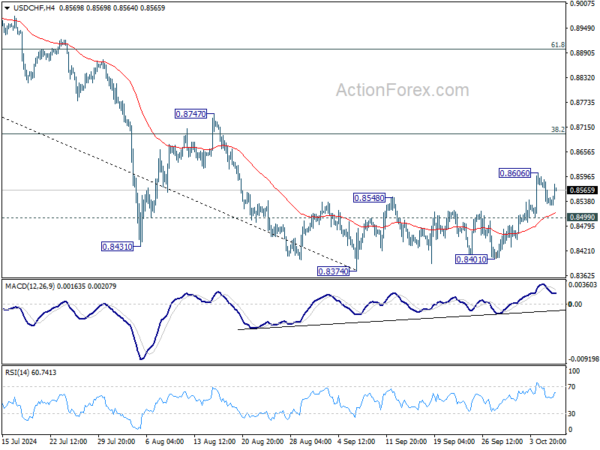

Daily Pivots: (S1) 0.8520; (P) 0.8559; (R1) 0.8584; More…

USD/CHF recovered today but stays below 0.8606 temporary top. Intraday bias remains neutral at this point. Further rise is in favor as long as 0.8499 minor support holds. Above 0.8606 will target 38.2% retracement of 0.9223 to 0.8374 at 0.8698. Sustained break there will argue that fall from 0.9223 has completed after defending 0.8332 low. Next target will be 61.8% retracement at 0.8899. On the downside, break of 0.8499 will turn bias back to the downside for retesting 0.8374 low instead.

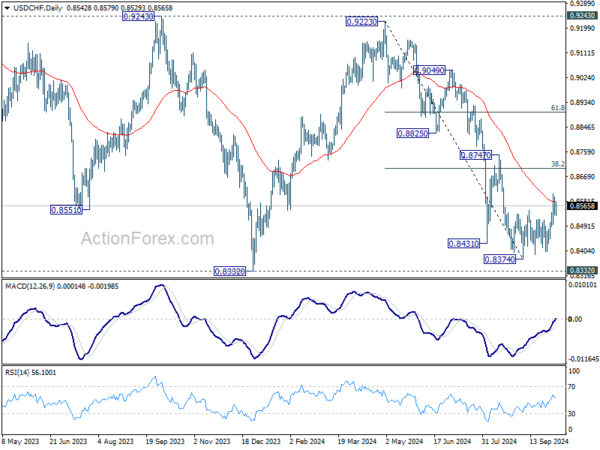

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern, with fall from 0.9223 as the second leg. Strong support could be seen from 0.8332 to bring rebound. Yet, overall outlook will continue to stay bearish as long as 0.9243 resistance holds. Firm break of 0.8332, however, will resume larger down trend from 1.0146 (2022 high).