Yen is drawing significant attention again today as it plummeted past the crucial 160 mark against Dollar, and hit its lowest level in over 37 years. Market participants are vigilantly watching for any signs of intervention from Japanese authorities, yet no action has been taken so far. It should be emphasized again that the tone from Japanese officials appears less urgent compared to the rhetoric when Yen last approached this level in April. The focus is now on whether Yen will continue to decline towards the next potential intervention point at 165.

Last week, the US Treasury added Japan to its foreign exchange monitoring list, alongside China, Vietnam, Taiwan, Malaysia, Singapore, and Germany. This inclusion has sparked speculation that it may complicate Japan’s efforts to intervene in the currency market. However, it is essential to note that the US is generally less concerned about Japan propping up Yen’s value compared to the cases of capping its appreciation or even pushing it down.

Overall in the currency markets, Australian Dollar remains the strongest performer of the day, buoyed by stronger-than-expected CPI data, which has heightened expectations of an August rate hike by RBA. Nevertheless, the second-placed Dollar is gaining some traction and could threaten Aussie’s first place. Canadian Dollar is also performing well as the third strongest, maintaining its strength following robust CPI data.

Conversely, New Zealand Dollar is the second weakest currency today, largely due to its decline against Australian Dollar. Swiss Franc is also weak, trailing just behind Yen and Kiwi. Meanwhile, Euro and British Pound are positioned in the middle of the performance spectrum, but Euro appears more susceptible to further declines due to ongoing political risks in France.

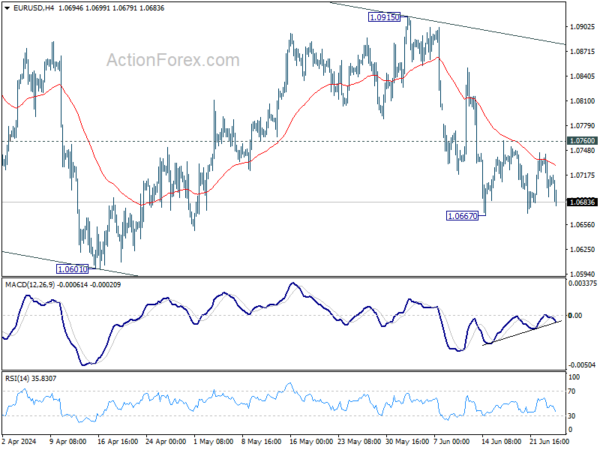

Technically, it should be about time EUR/USD completes its near term consolidations. Break of 1.0667 support will resume the fall from 1.0915, as another leg in the larger pattern from 1.1138. Next target will be 1.0601 support and below.

In Europe, at the time of writing, FTSE is down -0.37%. DAX is down -0.43%. CAC is down -1.01%. UK 10-year yield is up 0.0432 at 4.125. Germany 10-year yield is up 0.0284 at 2.440. Earlier in Asia, Nikkei rose 1.26%. Hong Kong HSI rose 0.09%. China Shanghai SSE rose 0.76%. Singapore Strait Times rose 0.16%. Japan 10-year JGB yield rose 0.0241 to 1.025.

In Europe, at the time of writing, FTSE is down -0.37%. DAX is down -0.43%. CAC is down -1.01%. UK 10-year yield is up 0.0432 at 4.125. Germany 10-year yield is up 0.0284 at 2.440. Earlier in Asia, Nikkei rose 1.26%. Hong Kong HSI rose 0.09%. China Shanghai SSE rose 0.76%. Singapore Strait Times rose 0.16%. Japan 10-year JGB yield rose 0.0241 to 1.025.

ECB’s Panetta: Must manage risks beyond baseline scenarios

Speaking today, ECB Governing Council member Fabio Panetta noted that the current macroeconomic conditions support “normalization of the monetary stance.” He added that ECB initiated this process recently and, under the “baseline scenario,” intends to continue it “gradually and smoothly.”

However, Panetta cautioned that the inflation and growth projections represent only one of many possible outcomes. He stressed that monetary policy must also manage “risks and tail scenarios,” not just baseline forecasts. The prevailing political and geopolitical risks, he said, necessitate “awareness, flexibility, and state-contingent action plans.”

Panetta’s comments come just days before French voters head to the polls for the first round of parliamentary elections. He highlighted the potential economic implications of political turnover, explaining that it inherently brings policy uncertainty. This uncertainty affects households and investors as they try to predict how new governments will handle critical economic and political decisions.

ECB’s Rehn considers two more rate cuts this year as reasonable

In an interview today, ECB Governing Council member Olli Rehn indicated that market data suggests the likelihood of two additional rate cuts, bringing the rate to 3.25% by the end of the year. He also noted that the terminal rate for this easing cycle is expected to fall between 2.25% and 2.50%. Rehn described these projections as “reasonable expectations.”

Despite recent economic data overshooting expectations, Rehn affirmed that “disinflationary process is going on,” although it may be bumpy. He added that ECB would maintain its course and “continue rate cuts” to ensure this process remains on track.

Rehn further elaborated that current interest rates are still in “restrictive territory,” underscoring ECB’s work to ensuring that the “disinflationary process will continue.” He stressed that the central bank’s primary goal is to control inflation, but also highlighted its broader responsibilities.

“Without compromising our primary objective,” Rehn said, “we also have a responsibility to support full employment, sustainable development, and balanced growth.”

German Gfk consumer sentiment fells to -21.8, interruption of uptrend

Germany’s Gfk Consumer Sentiment for July fell from -21.0 to -21.8, below expectation of -20.0. In June, economic expectations fell from 9.8 to 2.5. Income expectations fell from 12.5 to 8.2. Willingness to buy fell from -12.3 to -13.0. Willingness to save jumped again from 5.0 to 8.2.

“The interruption of the recent upward trend in consumer sentiment shows that the road out of the sluggish consumption will be difficult and there can always be setbacks,” explains Rolf Buerkl, consumer expert at NIM.

Australia CPI jumps to 4%, trimmed mean rises to 4.4%

Australia’s monthly CPI accelerated from 3.6% yoy to 4.0% yoy in May, well above expectation of a fall to 3.5% yoy. The last time it was higher was last November, when it was sitting at 4.3%.

CPI excluding volatile items and holiday travel ticked down from 4.1% yoy to 4.0% yoy. Annual Trimmed Mean CPI, on the other hand, surged from 4.1% yoy to 4.4% yoy.

The most significant contributors to the annual rise to May were Housing (+5.2%), Food and non-alcoholic beverages (+3.3%), Transport (+4.9%), and Alcohol and tobacco (+6.7%).

RBA’s Kent stresses vigilance amid mixed data and uncertainty over neutral rate

RBA Assistant Governor Christopher Kent, in a speech today, emphasized that recent economic data have been “mixed,” reinforcing the need for RBA to “remain vigilant to upside risks to inflation.” Kent reiterated that, regarding the path of interest rates, RBA is “not ruling anything in or out.”

Kent noted that the recent median estimate among market economists suggested that the cash rate was around 1 percentage point above the nominal neutral rate. This indicates that current monetary policy is restrictive.

However, he acknowledged the significant uncertainty surrounding estimates of the neutral rate, making it unclear how restrictive monetary policy truly is.

Additionally, Kent mentioned that RBA’s own models suggest that the neutral rate has increased since the pandemic, aligning with trends observed in other economies.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 159.33; (P) 159.55; (R1) 159.90; More…

Intraday bias in USD/JPY is back on the upside as recent rally resumed through 159.92 temporary top after brief consolidations. Decisive break of 100% projection of 151.86 to 157.70 from 154.53 at 160.37 will confirm long term up trend resumption, and pave the way to 161.8% projection at 163.97. On the downside, below 159.18 minor support will turn intraday bias neutral against first. But outlook will stay bullish as long as 157.70 resistance turned support holds.

In the bigger picture, there is no sign of long term trend reversal yet. Further rally is expected as long as 150.87 resistance turned support holds. Decisive break of 160.02 will target 100% projection of 127.20 to 151.89 from 140.25 at 164.94.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | AUD | Westpac Leading Index M/M May | 0.00% | 0.00% | ||

| 01:30 | AUD | Monthly CPI Y/Y May | 4.00% | 3.50% | 3.60% | |

| 06:00 | EUR | Germany GfK Consumer Confidence Jul | -21.8 | -20 | -20.9 | -21 |

| 08:00 | CHF | UBS Economic Expectations Jun | 17.5 | 18.2 | ||

| 14:00 | USD | New Home Sales M/M May | 650K | 634K | ||

| 14:30 | USD | Crude Oil Inventories | -2.6M | -2.5M |