Dollar bounces in early US session, buoyed by unexpectedly low initial jobless claims data, which also lifts US 10-year yield. One of the key themes emerging this week is recalibration of market expectations regarding rate cut by Fed in March, with the probability now down to around 56%. Today’s job data is likely another factor supporting this shift in market expectations.

In the broader currency market, Sterling and Euro are maintaining their positions as the second and third strongest currencies for the week, trailing Dollar. Market participants are also scaling back their expectations for rate cuts by BoE and ECB. ECB’s meeting minutes from December indicate that the central bank might wait for a clear turnaround in wage growth before adjusting interest rates.

Meanwhile, Japanese Yen remains at the lower end of the weekly performance chart, accompanied by Australian and New Zealand Dollars. The Canadian Dollar and Swiss Franc are showing mixed performances. Yen, in particular, is awaiting Japan’s CPI data, set to be released in the upcoming Asian session, which could be pivotal in determining its short-term trajectory.

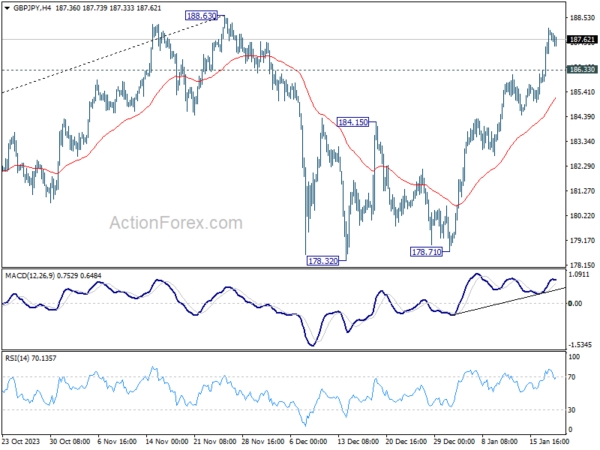

From a technical analysis standpoint, GBP/JPY currency pair is one to watch closely for the remainder of the week, especially with the impending release of Japan’s CPI and UK’s retail sales tomorrow. It’s Further rally is expected as long as 186.33 minor support holds, to retest 188.63 high first. Decisive break there will resume larger up trend to 190 psychological level next.

In Europe, at the time of writing, FTSE is up 0.15%. DAX is up 0.74%. CAC is up 1.07%. UK 10-year yield is down -0.0306 at 3.952. Germany 10-year yield is up 0.0148 at 2.330. Earlier in Asia, Nikkei fell -0.03%. Hong Kong HSI rose 0.75%. China Shanghai SSE rose 0.43%. Singapore Strait Times fell -0.08%. Japan 10-year JGB yield rose 0.0461 to 0.655.

US initial jobless claims fell to 187k, lowest since Sep 2022

US initial jobless claims fell -16k to 187k in the week ending January 13, below expectation of 207k, marking the lowest level since September 24, 2022. Four-week moving average of initial claims fell -5k to 203k.

Continuing claims fell -26k to 1806k in the week ending January 6. Four-week moving average of continuing claims fell -14k to 1848k.

ECB minutes reveal growing confidence in inflation control, but clear wage turnaround awaited

ECB’s meeting minutes for the December 13-14 session indicate that officials believe monetary policy is “working as intended”, with disinflationary processes “proceeding well and probably more strongly than had been anticipated”. The decline in November’s inflation was described as “encouraging” and “broad-based,” encompassing core inflation components, which bolstered confidence in bringing inflation back to target in a timely manner.

One significant observation was that services inflation had begun to ease, suggesting that inflationary pressures across various components were diminishing. This trend was attributed in part to weak demand influenced by monetary policy measures.

However, ECB officials highlighted the uncertainty surrounding future wage dynamics, noting that “convincing evidence of a sustained turnaround in wages had yet to emerge.” This is a crucial factor for ECB, as a more definitive shift in wage trends is necessary to ensure confidence in inflation’s return to the 2% target.

In their decision-making, ECB officials chose to keep the three key interest rates unchanged, emphasizing the importance of their data-dependent approach. This approach focuses on the three elements of ECB’s reaction function, providing a structured framework for monetary policy decision-making and communication. The meeting minutes underscored that this approach is central to the Governing Council’s meeting-by-meeting orientation, allowing for the flexibility required in the current economic context.

Australia’s employment drops by 65.1K in Dec, following two months of robust growth

Australia had an unexpected contraction in employment in December, with a decrease of -65.1k jobs, significantly deviating from expectation of 15.4k. This decline was marked by a substantial drop in full-time employment by -106.6k, which was only partially offset by 41.4k increase in part-time jobs.

Despite this downturn in job creation, unemployment rate remained steady at 3.9%, aligning with expectations. Participation rate declined -0.4% to 66.8%. Additionally, there was -0.5% mom decrease in the total monthly hours worked.

David Taylor, ABS head of labour statistics, noted combined strong growth of 117k in October and November, and the fall in large contraction in December, “reflected changes in the timing of employment growth in the last few months of 2023, compared with earlier years.”

Over the past twelve months, employment grew an average of 32k. Also, both the unemployment and underemployment rates remained relatively low and the participation rate and employment-to-population ratio relatively high. Taylor noted that suggests “the labour market remains tight.”

Japan’s core machinery orders decline -4.9% mom in Nov

Japan’s core private-sector machinery orders fell notably by -4.9% mom in November, significantly below expectation of -0.8% mom. This decline marks the first downturn in three months and points to a potential slowdown in business investment. On a year-on-year basis, core machinery orders decreased -4.0% yoy, falling short of the anticipated 0.2% yoy increase.

The Japanese government has maintained its assessment that machinery orders have “stalled” for 13 consecutive months. This continued stagnation in machinery orders is particularly concerning as they are often regarded as a leading indicator of capital spending over the next six to nine months. The implication is that businesses might be exercising caution in their investment decisions, possibly due to uncertainty in the economic outlook or other external factors impacting their spending plans.

Breaking down the orders by sector, manufacturing industry saw substantial reduction in orders, with -7.8% mom drop. Service sector also recorded a slip in orders, down -0.4% mom.

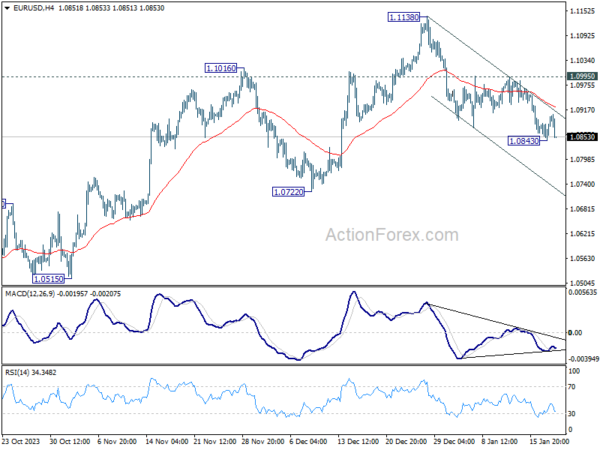

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0857; (P) 1.0870; (R1) 1.0896; More…

Intraday bias in EUR/USD remains neutral first and outlook stays bearish with 1.0995 resistance intact. break of 1.0843 will resume the fall from 1.1138 to 1.0722 support. Sustained break there will argue that whole rise from 1.0447 has completed, and target this low.

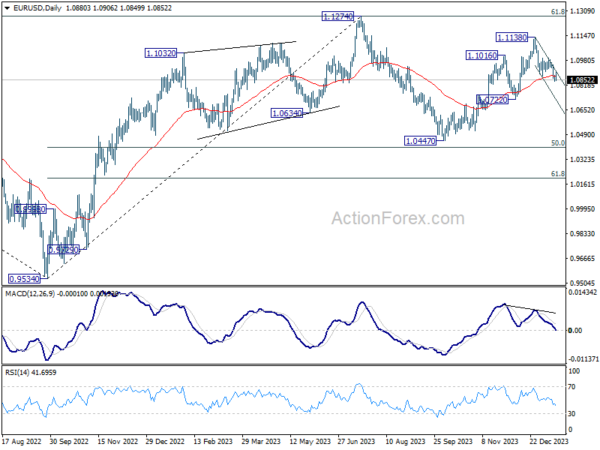

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machinery Orders M/M Nov | -4.90% | -0.80% | 0.70% | |

| 00:00 | AUD | Consumer Inflation Expectations Jan | 4.50% | 4.50% | ||

| 00:01 | GBP | RICS Housing Price Balance Dec | -30% | -43% | -41% | |

| 00:30 | AUD | Employment Change Dec | -65.1K | 15.4K | 61.5K | 72.6K |

| 00:30 | AUD | Unemployment Rate Dec | 3.90% | 3.90% | 3.90% | |

| 04:30 | JPY | Industrial Production M/M Nov F | -0.90% | -0.90% | -0.90% | |

| 09:00 | EUR | Eurozone Current Account (EUR) Nov | 24.6B | 30.9B | 33.8B | 32.3B |

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 13:30 | USD | Initial Jobless Claims (Jan 12) | 187K | 207K | 202K | 203K |

| 13:30 | USD | Housing Starts Dec | 1.46M | 1.43M | 1.56M | |

| 13:30 | USD | Building Permits Dec | 1.50M | 1.47M | 1.47M | |

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Jan | -10.6 | -6.9 | -10.5 | |

| 15:30 | USD | Natural Gas Storage | -166B | -140B | ||

| 16:00 | USD | Crude Oil Inventories | -0.6M | 1.3M |