- The AUD/JPY saw a late break higher in Friday’s broad-market sentiment recovery.

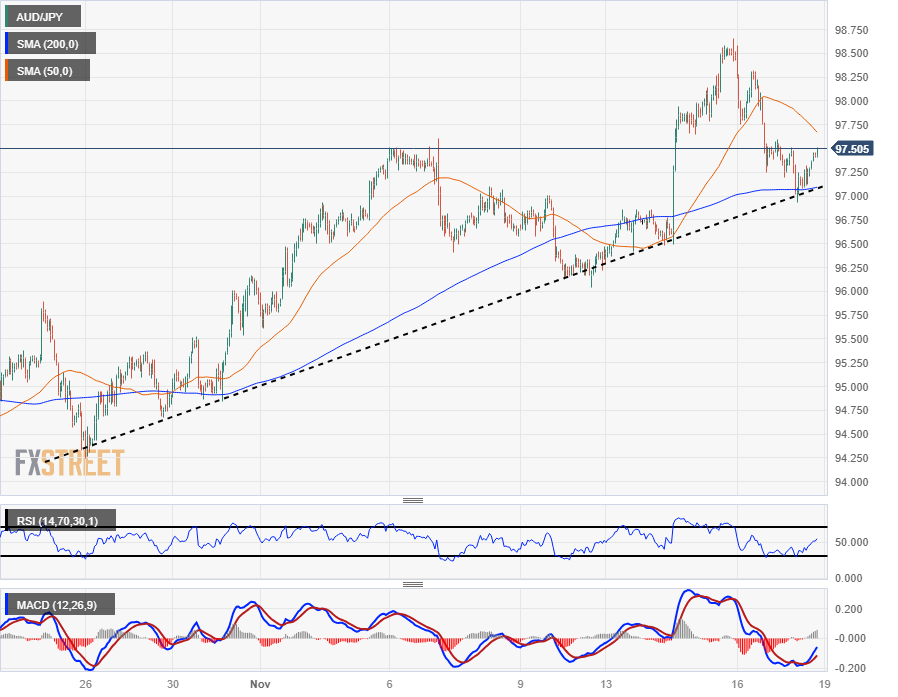

- The Aussie is catching a bounce from the 200-hour SMA and a rising trendline.

- The technicals are leaning bullish with more upside on the cards, but headwinds remain.

The AUD/JPY snuck over the 97.50 level just ahead of the Friday closing bell, trying to claw back some of the midweek’s losses after the pair tumbled from a Wednesday peak of 98.66.

The AUD/JPY closed out the trading week with some gains, up nearly 1.2% from Monday’s opening bids near 96.40, but the back half of the week was marred by a 1.75% decline that only saw a minor paring back in late Friday trading.

With the Aussie (AUD) bouncing off a technical confluence of the 200-hour Simple Moving Average (SMA) and a rising trendline drawn from late October’s swing low into 94.25, the pair is set for a bullish continuation as long as broad-market fundamentals keep risk appetite on the high side.

Daily candlesticks are flashing warning signs that the current bullish push could be running out of gas.

The AUD/JPY is at risk of getting pulled back towards the 50-day SMA near 95.50, and long-term technical support is far below current price action at the 200-day SMA rising from 93.00.

November’s rise out of October’s consolidation phase could face a near-term bearish breakdown, with the last swing low into the 96.00 handle acting as the immediate support level for bears to beat.

AUD/JPY Hourly Chart

AUD/JPY Daily Chart