The NASDAQ and S&P closed higher for the 2nd consecutive day. Admittedly the S&P index only rose marginally (0.02%) yesterday, but it still was a victory in the win column. Today, the gain was a little more respectable at 0.59%.

The final numbers for the major indices are showing:

- Dow industrial average +116.07 points or 0.35% at 33666.35

- S&P index up 25.17 points or 0.59% at 4299.69

- NASDAQ index of 108.42 points or 0.83% at 13201.27

Although higher, the broader indices are still on pace for their worst month in 2023 (since December)

- Dow industrial average is down -3.04%. Its worst month since May

- S&P index is down -4.61%. Its worst month since December

- NASDAQ index is down -5.94%. Also its worst month since December.

Yields in the US are closing near their lows which help to support prices:

- 2 year yield 5.060%, -8.1 basis points

- 5 year yield 4.624%, -8.1 basis points

- 10 year yield 4.578% -4.7 basis points

- 30 year yield 4.706% -2.7 basis points

The 2 – 10 year spread is trading at -48.5 basis points. The yield curve is still 50 basis points negative, but in 2023 it was as low as -109 basis points.

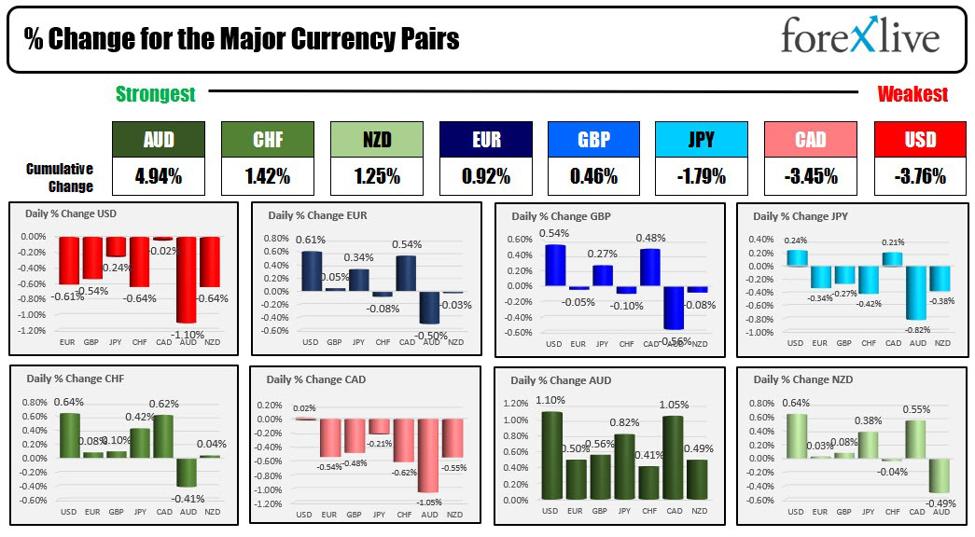

In the Forex market, the AUD is the strongest while the USD is the weakest.

The strongest to the weakest of the major currencies

Nike earnings after the close came in mixed.

- Revenues $12.94 billion versus $12.98 billion, a little light on revenues but not by much

- Earnings-per-share came in much better than expected at $0.94 vs. $0.75 est.

Nike shares are currently up about 1.87% in after hours trading. Shares for the company is down -23.4% this year.