Here is what you need to know on Monday, October 4:

No Time to Die is kicking up a storm in the UK and is due to do the same for the US when it is out on Thursday so AMC apes get ready for some strong audience numbers if the UK experience is anything to go by. The equity market does feel like it’s time to die though, despite a modest dead cat bounce on Friday. Things again look bleak on Monday (they always do!) if European markets are anything to go by. President Biden’s much touted infrastructure deal is struggling for support just when many of the beneficiary stocks could do with a boost. Lawmakers also have to avoid the US failing to meet its debt burden which kinda overshadows Evergrande’s worries. But then the US is unlikely to default whereas Evergrande might have some sort of controlled restructuring.

The dollar meanwhile continues to take a breather following last weeks yield induced run, at 1.1640 now versus the euro. Gold is at $1754 and Oil at $76. Bitcoin is lower at $47,700 while the US 10-Year yield is also lower at 1.48%. VIX is up 6% to 22.58.

See forex today

European markets are lower: FTSE -0.4%, Dax -0.1% and Eurostoxx -0.7%.

US futures are lower: S&P -0.3%, Dow -0.3% and Nasdaq -0.4%.

Wall Street (SPY) top news

The US to resume tariff exclusion procedure for Chinese imports.

UK wants to renegotiate the exit agreement with the EU, specifically over Northern Ireland.

UK admits a UK-US trade agreement could be 10 years away.

German electricity wholesale price reaches a record high.

Tesla (TSLA) up in premarket by 2% on strong delivery numbers, see here.

Evergrande raising up to $5 billion cash from asset sales.

Facebook (FB) whistleblower gives negative interview to CBS 60 minutes.

BioNTech (BNTX), Pfizer (PFE) Moderna (MRNA) Novavax (NVAX) are still down after Merck’s (MRK) covid pill results on Friday.

Merck (MRK) up 4% in premarket on SVB price target rise and continued follow thorough from Friday.

Guardent Health (GH) Bloomberg reports company not buying NeoGenomics.

General Motors (GM), up 3% premarket. Company announces strategic supplier agreement with Wolfspeed for silicon carbide.

NetApp (NTAP) to acquire Cloudchekcer.

Delta (DAL) reinstates Q3 revenue forecasts.

Southwest (LUV) Barclays upgraded it.

Proctor and Gamble (PG) Deutsche Bank ups price target.

Hasbro (HAS) Stifel lowers price target.

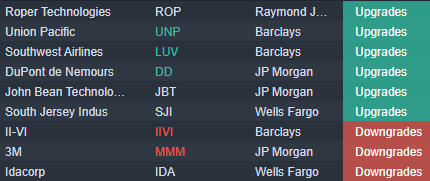

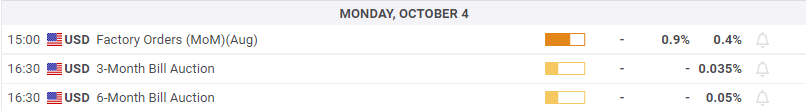

Upgrades, downgrades and premarket movers

Source: Benzinga Pro