Here is what you need to know on Friday, October 1:

Equity markets remain cautious despite another slew of losses for the main indices on Thursday to close out September and the quarter. Normally a dead cat bounce would be in evidence at this stage, but even that seems a tough act now as European markets remain shaky. Just with perfect timing, it seems everyone is now long the equity market, with the latest Bank of America survey showing household holding of equities has reached a 70-year high. Have we all become stock market gurus or lemmings heading for the cliff?

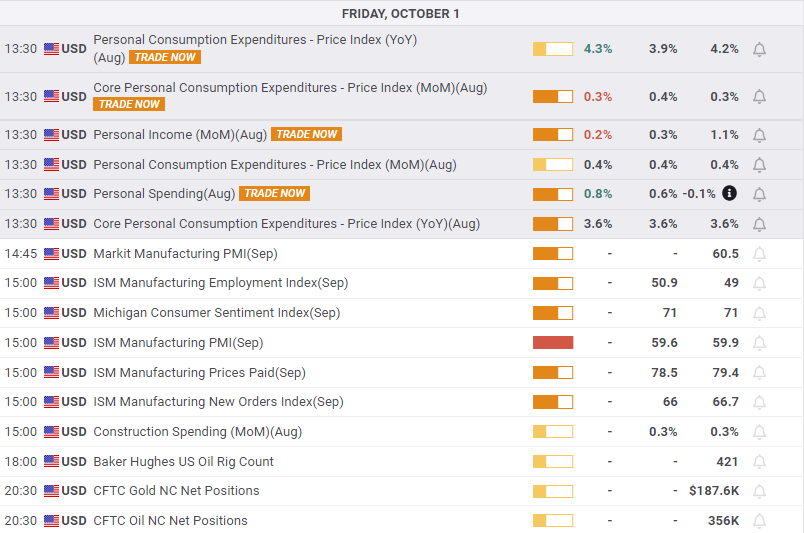

Inflation remains the watchword as yields head higher again after the latest PCE data shows it running above the norm. The US 10-year has just popped back above 1.5% and futures have fallen after the release.

The dollar is seeing some profit-taking at 1.1602 now versus the euro, Oil is at $74.41, and Bitcoin is surging to $47,400 after Fed chair Powell says there are no plans to ban it.

See forex today

European markets are mixed: FTSE -0.3%, Eurostoxx +0.1% and Dax -0.1%.

US futures are higher: S&P +0.2%, Dow +0.2% and Nasdaq flat.

Wall Street (SPY) top news

US PCE +0.4% versus +0.3% expected.

President Biden signs a funding bill, so the government shutdown avoided, but debt ceiling still beckons.

President Biden’s infrastructure bill is still deadlocked.

Merck (MRK) announces oral covid drug cuts risk of hospitalization and death by up to 50% and will seek emergency FDA approval.

Lordstown Motors (RIDE) to sell its Ohio plant to Foxconn for $230 million.

Novavax (NVAX), Moderna (MRNA), BioNTech (BNTX), and Pfizer (PFE) are all down premarket, likely on Merck oral drug news above.

XPeng (XPEV): record September deliveries, shares up 4% premarket.

NIO shares up 3% premarket on strong delivery numbers.

Li Auto (LI) delivery data is also strong, stock up 2% premarket.

Zoom Video (ZM) and Five9 (FIVN) deal is cancelled by mutual consent.

Five9 (FIVN) upgraded by Barclays and Wells Fargo, up 1.5% premarket.

Exxon (XOM) says higher oil and gas prices could increase Q3 earnings by $1.5 billion.

Jefferies (JEF) results well ahead with a strong performance in investment banking.

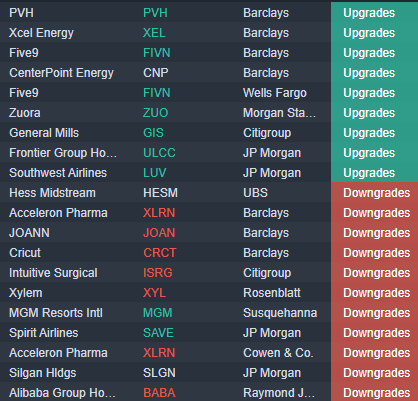

Upgrades, downgrades and premarket movers

Source: Benzinga Pro