The January/February highs between 1.2669 and 1.2880 were broken earlier, but price has moved back below

The USDCAD continued its run higher today with the pair breaking above its 2021 highs between 1.2869 and 1.2880 (from January and February).

The break saw increase momentum and the pair moving up to the next target area between 1.2926 and 1.29578 (see yellow area and red numbered circles). The high price reached 1.29483 – between that area – where sellers entered and start to push the price back to the downside.

That move has now broken below the old swing highs for the year, which has tilted the short term bias a more in the favor of the sellers as long as the price can remain below those levels.

The pair is still higher on the day, but traders continue to eat away at the gains.

Drilling to the hourly chart, the 38.2% retracement of the move up from Wednesday’s corrective low comes in at 1.2814. The Asian session low bottomed near that level. That would be the next target on the downside if momentum continues (and is really the minimum target IF the sellers are to be taken more seriously. Absent that, and the retracement is a plain vanilla one.

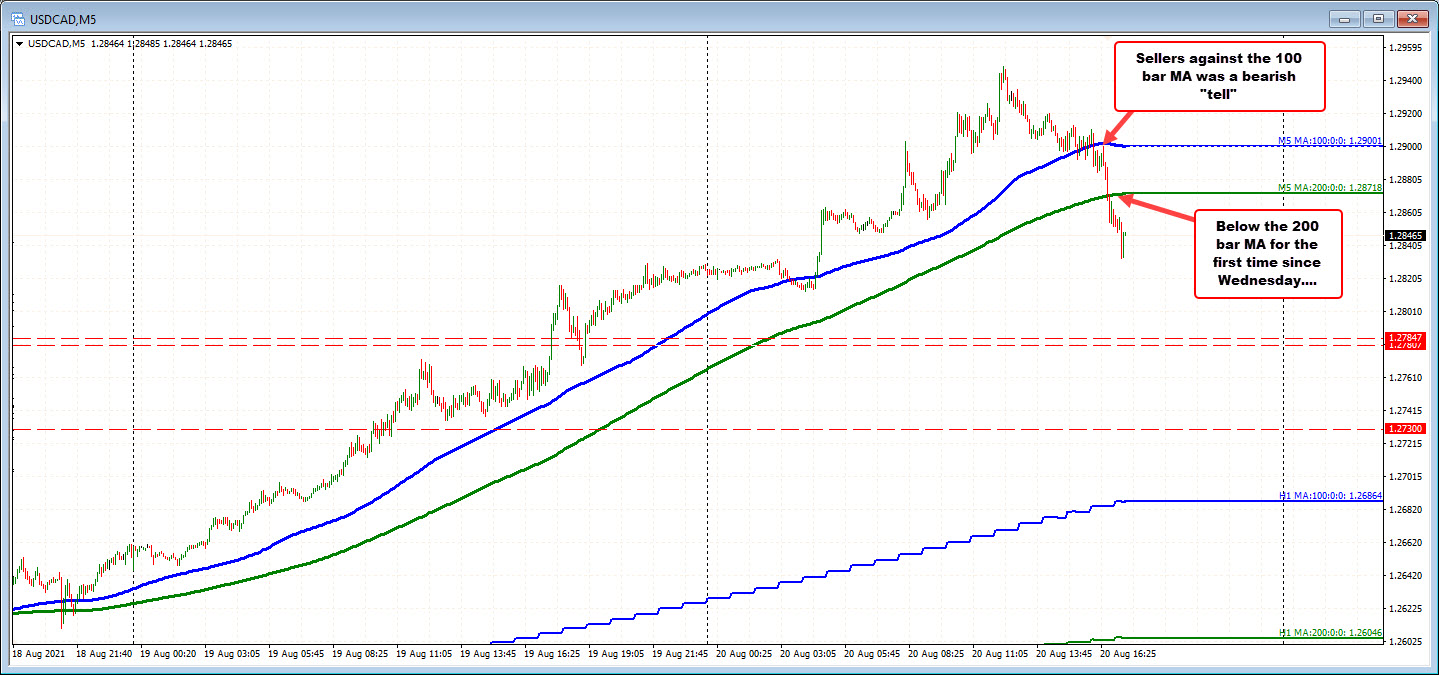

Drilling further to the 5-minute chart below, the pair fell below its 100 bar moving average, and then retested that moving average before moving lower (see blue line in the chart below). The pair has subsequently moved below its 200 bar moving average currently at 1.28718. That is a close risk/bias defining level in the short term intraday. Stay below is more bearish.

Crude oil is still down $0.58 at $63.04. The contract is working on its seventh straight day to the downside which has helped to weaken the loonie (trended the USDCAD pair).