What does option positioning tell us

Bank of America Global Research tracks how option investors have traded so far in 2021.

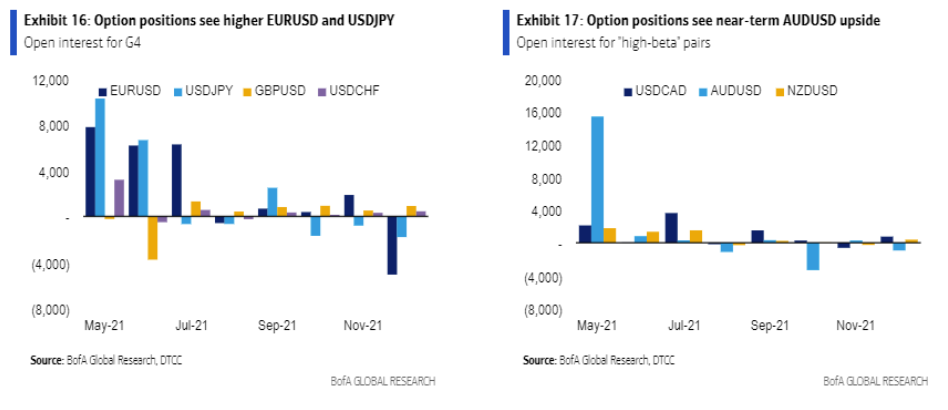

“G4: near-term bullish EUR, bearish JPY and CHF

From

May to July, option investors have significantly more amount of

unexpired calls than puts in EURUSD, their conviction in near-term

strength for EUR (Exhibit 16). In contrast, option investors are positioned for more USDJPY and USDCHF calls than puts this month,” BofA notes.

“G10 “high-beta” pairs: bullish AUD and NZD, moderately bearish CAD

Near-term open interest remain constructive for AUD and NZD (Exhibit 17),

as shown by the amount of unexpired calls versus puts for AUD and NZD

against USD. On the other hand, unexpired contracts are moderately

bearish CAD,” BofA adds.

For bank trade ideas, check out eFX Plus.